APAC Windows And Doors Market to witness remarkable growth opportunities over 2018-2024, proliferating infrastructure investments to drive the regional demand

Publisher : Fractovia | Published Date : 2018-08-03Request Sample

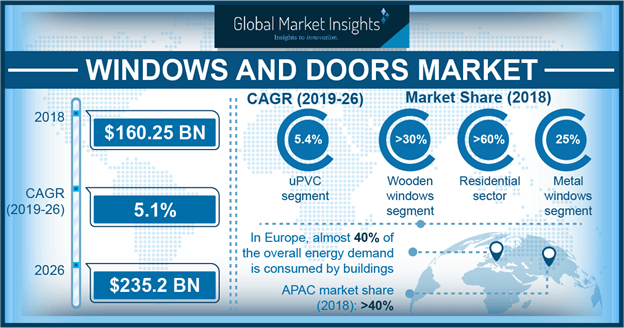

Globally, the windows and doors market has experienced tremendous impulsion owing to the increased spending on infrastructure construction and rising disposable income of the working class. With the world population charting an upward movement in growth, the large number of residential and commercial projects expected to be undertaken will imminently boost the construction sector. Subsequently, the windows & doors market is slated to gain immense profits from the evolving infrastructure industry where the need for improved privacy and security has brought out notable changes in the product specifications. Product enhancements, combined with the economic growth and industrial expansion within developing countries propelled the windows and doors market valuation to above USD 190 billion in 2017.

U.S. Window and Door Market, By Material, 2017 & 2024, (Million Units)

According to data available on infrastructure schemes, industrial construction projects in Asia-Pacific (APAC) worth over USD 1.1 trillion were in the pipeline at the end of 2016, demonstrating the enormous earning potential for the windows & doors market in the region. India, China and Indonesia accounted for the largest shares, and the projects included residential schemes, water treatment facilities, manufacturing plants, software centers, among various others. APAC comprises of industrially developed nations, emerging economies and also less developed countries that will eventually contribute heavily towards the windows and doors industry. The regional progress is characterized by greater integration with global marketplace in terms of goods, services and investments, which in turn has supplemented growth of the commercial segment and instigated infrastructure development.

Being a major industry hub, China has a number of advanced cities that are also constantly upgrading in terms of infrastructure and technology. Todtown, a mixed-use development project in Shanghai’s Minhang District is an example of the windows & doors market proliferating from a concentrated scheme. Todtown will be featuring 1,000 residential units, 1.5mil sq.ft. of office space, 1.3mil sq.ft. of shopping mall, another 580,000 sq.ft. of retail space and a 52,000 sq.ft. cultural center, while incorporating a host of green technologies. The project will present an opportunity to utilize efficient energy-saving materials, doors and windows along with integrated security features. Construction projects of similar scales will bolster the windows and doors market all over the region, especially in developing economies.

Global events have usually affected large scale construction projects aimed at catering to international visitors, tourists and working professionals, inadvertently supporting the windows & doors market. For instance, in its attempt to provide ample residential, commercial and lodging space before the 2020 Summer Olympics, Tokyo, the event’s host, has initiated a slew of development projects around the city. Reportedly, at least 45 new sky scrapers are slated to be built by 2020, which would be a 50 percent increase on the number of high-rise structures in a span of 3 years. The 2020 plan is part of a multi-billion dollar project involving redevelopment several stations within Tokyo, and the entire project is planned to be completed by 2027. As evident, large-scale infrastructure schemes necessary to meet the rising demand for residential and commercial spaces will fuel the APAC windows and doors market, predicted to record a sale of more than 750 million units by 2024.

With the windows and doors industry traditionally consisting of wood or other depreciative materials, the worldwide increase in renovation or redevelopment plans include replacing old doors and windows, which are vital in regulating energy consumption. Replacements are particularly essential for maintaining the energy-efficiency of the overall building, as studies indicate that cracks and openings around the doors or windows can affect heating bills by up to 10 percent. Replacement windows and doors made from vinyl or uPVC are durable and strong, require almost no maintenance and are resistant to dents, scratches, stains and mold. They can be insulated to deliver improved energy saving, besides allowing installation of effective security systems and burglar-proof glass within the frames.

All in all, energy-efficiency and security in combination with additional features like flame-retardant natural properties, corrosion and temperature resistance and cost effective manufacturing will spur the booming uPVC windows and doors industry. The need for innovative and stronger infrastructure components to meet strict quality regulations and support the increasing industrial and residential demand will dive the industry competition. Estimated to record a CAGR of 3.5 percent from 2018 to 2024, the windows and doors market comprises of a vast number of industry players like PDS, Jeld Wen, Anderson Corporation, EcoView, ATIS Group, SGM Windows and many others.