uPVC window and door frame market to garner appreciable valuation over 2016-2024, surging demand for energy-efficient products to characterize the industry landscape

Publisher : Fractovia | Published Date : 2017-10-04Request Sample

Masonite’s present-day acquisition of AFWP manifests one of the many commendable strategies adopted by prominent window and door frame market players to consolidate their footing in this business sphere. Masonite International Corporation boasts of a long, continued corporate bond with A&F Wood Products, Inc., given that they have been, for a considerably long while, supplying window and door products to the latter, which has, in a way, helped AFWP predominate window and door frame industry. The Michigan-based firm, renowned for manufacturing metal doors, wood doors, wood frames, customized frames, and other components and providing the same to hardware distributors, has indeed taken a significant step by extending its already powerful ties with Masonite, through this acquisition deal. Now, through this agreement, AFWP would be able to complement Masonite’s thriving architectural manufacturing business, while obtaining reciprocal benefits including a widespread consumer base, thereby further strengthening its position in window and door frame market, which accounted for a valuation of close to USD 80 billion in 2015.

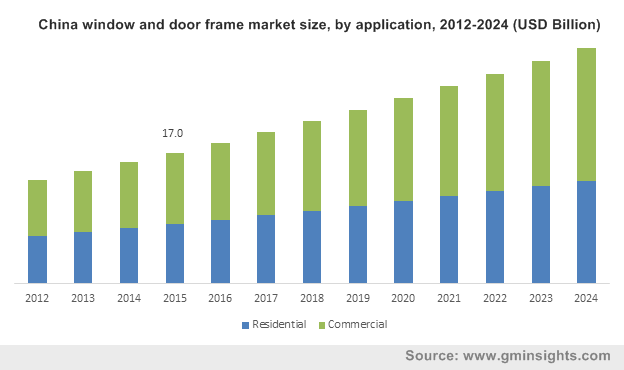

China window and door frame market size, by application, 2012-2024 (USD Billion)

Having held a reputation as one of the most significant verticals of the construction and architecture spaces since long, window and door frame industry stands to accrue valuable gains in the forthcoming years, subject to a plethora of reasons, prominent among them being, the rising global population demanding comfortable housing facilities, increasing governmental efforts toward infrastructural development, and the rising private and public expenditure on construction and renovation activities. Of late, it has been observed that lack of constructible land has led home designers and real estate developers to come up with alternative, feasible construction plans that not only provide safety and reliability, but are also artistic and aesthetic, as is remnant of the lofty standards of living that are commonplace across major geographies. In consequence, this has led to manufacturers adopting unique material for developing customized hardware components, which has caused quite a considerable stir in window and door frame market.

Why uPVC has been gaining precedence in window and door frame industry

While the traditional material utilized for frames borders along metal and wood, of late, window and door frame market has been witnessing the introduction of cutting-edge material such unplasticized polyvinyl chloride (uPVC). This material has apparently created a storm in window and door frame industry, primarily subject to the fact that uPVC is endowed with beneficial features such as thermal insulation, light weight, minimal maintenance, and recyclability. The fact that uPVC possesses minimal expansion and contraction properties makes it ideal to be used for frames, as it provides the much-needed durability and glass holding capacity. In addition, it delivers high-grade thermal insulation that makes it resistant to extremely hot or chilly weather, owing to which it is increasingly deployed in the residential sector, thereby providing an impetus to the overall uPVC window and door frame market size. The weather resistance and sea water endurance factors also enables the deployment of this material across the coastal areas, owing to the prevalence of storms and hurricanes, further propelling window and door frame industry size.

A crucial determinant that needs to be mentioned is that uPVC frames are highly resistant to corrosion and do not require painting. They are also endowed with fire resistance and possess a lower softening temperature as opposed to wood or aluminum, which enables convenient escape in case of fire emergencies. Furthermore, the factor that has been pushing window and door frame market players to increasingly adopt uPVC as a prominent material is that uPVC offers excellent insulation against external noises. What’s more, it is highly cost-effective, energy-efficient, and double glazed, on account of which it boasts of a superlative adoption rate across the residential and commercial arenas. In effect, this has led to increased prominence of uPVC in window and door frame industry.

Window and door frame market players have been experimenting with a variety of styles and colors in uPVC, which has led to today’s uPVC frames being highly sophisticated, secure, and reliable. While wood frames swell and rot with time and aluminum and steel frames corrode in a while, uPVC frames last a considerably long while, making the material potentially ideal for places where wood and metal cannot be utilized. uPVC frames also come in a variety of trendy colors and smooth finesse of late, such as the sophisticated urban Anthracite or the highly elegant Chartwell Green. An instance demonstrating the efforts of window and door frame industry players is the all-new product range introduced by the UK-based Everest Home Improvement Company. Everest’s uPVC product range is seemingly one of the best in window and door frame market. In addition, the company’s Smoothweld technology makes uPVC window corner joints rather seamless, leading to an aesthetic appearance and smooth finish.

In effect, the deployment of uPVC fulfills the twin benefits of energy efficiency and classic looks, on the grounds of which uPVC window and door frame industry is likely to garner supreme precedence in the ensuing years. These frames in fact, would amass instant popularity across U.S. window and door frame market, given that the region boasts of a high infrastructural budget, follows green construction standards of late, and houses consumers who have been preferring eco-friendly as well as stylish, luxurious looking homes.

With the definitive rise in the growth rate of the construction arena, coupled with increased governmental support toward manufacturing fire-resistant, eco-friendly, and weather-proof door & window frames for the residential and commercial domains, window and door frame market is all set to traverse along a lucrative growth path in the years ahead. The prospective decades would witness the introduction of even more energy efficient material for constructing hardware components, cite analysts. Having held a valuation of close to 28,000 kilotons in 2015, in terms of volume, window and door frame industry size, augmented by the extensive need for aesthetic-looking, weather-resistant frames, will surpass a revenue of USD 130 billion by 2024.