U.S. wind turbine market to be driven by decarbonization targets and favorable regulatory directives, plummeting offshore wind turbine installation cost to add momentum to the industry growth

Publisher : Fractovia | Published Date : 2018-08-30Request Sample

Global wind turbine market players recently witnessed a path-breaking announcement by energy giant GE, regarding the deployment of the most powerful offshore wind turbine called the Haliade-X in 2021. The deployment of the 12-megawatt wind turbine is expected to put GE in the leading position in the offshore wind turbine market as the new wind turbine will be capable of generating 45% more electricity than the current largest offshore wind turbine.

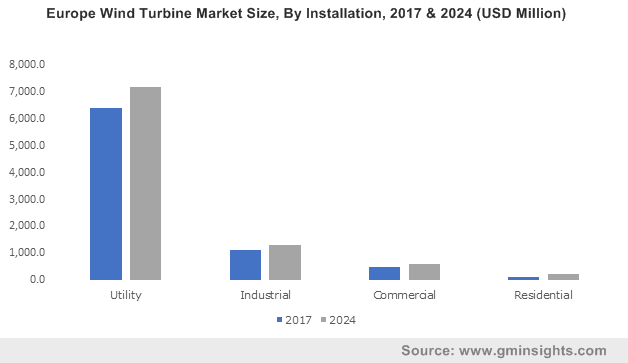

Europe Wind Turbine Market Size, By Installation, 2017 & 2024 (USD Million)

Incidentally, GE Renewable Energy will be investing $400 million over the next five years to develop Haliade-X. GE’s eagerness, ambitious timeline and aggressive scale up from its existing 6-megawatt turbine product clearly points out the competitive aspect of the global wind turbine industry where GE is trying to oust industry leaders like Siemens Gamesa Renewable Energy and MHI Vestas.

It is rather overt from the aforesaid incidence that global wind turbine market is characterized by an intensely fierce competitive spectrum. Industry leaders such as GE, Siemens Gamesa, and other well recognized names such as Enercon, MHI-Vestas, Senvion, Goldwind, Envision Energy, Suzlon, Mingyang Wind Power, Impsa, Bergey Wind Power, LM Wind Power, Enessere, and Northern Power Systems have been vying with each other in several regions across the globe causing wind turbine market to surge at an unprecedented pace. According to the American Wind Energy Association, a record amount of wind capacity is under development in the U.S. as strong demand for low-cost wind power is increasing from utilities and other customers which include major corporations such as Walmart and AT&T.

With the Production Tax Credit phasedown by 2019 and the technological innovation that has increased in the U.S. to further bring down production costs, wind power is rapidly reaching a point where it has kicked into a high gear. U.S. authorities are encouraging the growth of the wind energy industry as it not only delivers new revenue to the economy and facilitates affordable energy to consumers, but also puts the country in line to meet its sustainable energy targets, besides the promise of creating 600,000 jobs in the country by 2050. A single new American wind turbine is equipped to generate 2.32 MW of power on average, which can provide electricity to roughly 750 homes. The U.S. is thus poised to become one of the most significant contributors to the growth of the wind turbine industry over 2018-2024.

Europe will also have its share in the growth of the global wind turbine market over 2018-2024 as indicated by latest reports which show that in the first half of 2018, Europe installed 4.5 gigawatts of wind power which is enough to power 4 million households. 1.6 GW of the 3.3 GW of the new onshore wind power that came online across Europe, was generated in Germany. France and Denmark followed behind with 605 and 202 megawatts of wind power generation. The UK commissioned 911 MW of new projects in the offshore market and continued to dominate the sphere followed by Belgium generating 175 MW. The wind energy industry in Europe is often plagued by the problem of fluctuating weather patterns where wind turbines can remain ineffective for days due to overcast skies and low winds. Europe is however looking to bypass this hurdle by creating a model for trading energy between different countries and subsequently augment the regional wind turbine market.

The use of renewable energy, especially wind and solar energy has quadrupled in Europe between 2007 and 2016. Therefore, a model has been developed to plan the future of continent-wide energy systems that will help in the sharing of renewable resources across countries. If the model is implemented, then it is estimated that Europe could apply the use of renewable energy resources to draw two-thirds of its electricity requirements by 2030.

Increased installations of wind turbines in the wide-open countryside has however raised complaints among many about visual pollution and a general decline of life quality. This has led the wind turbine industry to seek locations that are away from the public view. Such a factor combined with ambitious plans to promote wind energy application has led to the development of offshore wind farms. For instance, Vineyard Wind, located off the coat of Massachusetts is one of USA’s first commercial offshore wind farm which is planned to generate 800-megawatt, enough electricity to power at least 400,000 homes.

Driven by the cost of generating electricity with wind turbines having dramatically decreased off the coast in Europe and the public and political support for increased wind energy generation, the installation rates for offshore as well as onshore wind turbines is bound to surge. In essence, this would have a pivotal impact on wind turbine industry size, slated to cross USD 70 billion by 2024.