North America to lead voice over internet protocol market over 2019-2025, increasing preference for cloud-based telephony to augment the regional landscape

Publisher : Fractovia | Published Date : 2019-05-06Request Sample

The rapid influx of advanced technologies has brought another vertical to the forefront of the voice over internet protocol (VoIP) market landscape. Incepted somewhere in the 1990s, the VoIP technology is now garnering universal attention on account of the fact that it is one of the most effective methods of voice calling across the globe. As the landscape of mobile industry evolves by the day, it is being touted that VoIP might soon overtake the presence of PSTN as far as voice calling is concerned, thereby augmenting the global voice over internet protocol industry.

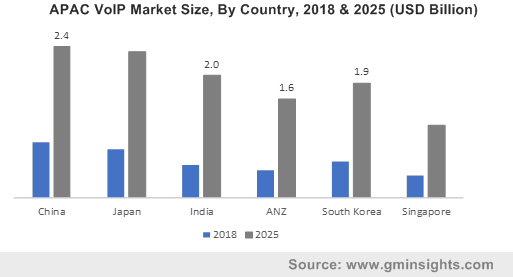

APAC VoIP Market Size, By Country, 2018 & 2025 (USD Billion)

Out of managed IP PBX, hosted IP PBX, and integrated access, all of which constitute the most common types of VoIPs, the integrated access protocol – also tagged SIP trunking, is known to garner the maximum popularity worldwide. Indeed, the usage of SIP trunks is known to offer several advantages, such as flexibility and control over call routing, commendable cost savings compared to conventional protocol types, and disaster recovery. Integrated access devices are largely adopted by organizations, as they help them integrate their legacy phone systems with VoIP software.

Given the incredible advantages provided by SIP trunks, it comes as no surprise that integrated access/SIP trunking dominated the overall VoIP industry in 2018 with a market share of 52%. As enterprises continue to deploy this platform over traditional alternatives, integrated access segment will remain dominant in VoIP market over 2019-2025.

Unveiling North America voice over internet protocol industry trends over 2019-2025

As far as the geographical penetration of VoIP industry is concerned, the global technology hub – North America, will irrefutably emerge as one of the most lucrative regional grounds of this business space. The reason for the same can be attributed to the massive adoption of cloud services and the escalating popularity of workplace mobility. Not to mention, the continent is home to some of the most established technology providers that strive to bring about a spate of novel products to the mainstream. Additionally, they are also involved in consolidating their regional and international reach by means of innovative collaborations and M&As.

Say for example, the California-based CyberData Corporation, a notable North America VoIP industry contender, recently declared that it has expanded its range of innovative VoIP endpoints with the release of four all-new devices for SIP- and InformaCast-driven environments enabling audio and visual alerting. These devices include, Singlewire’s InformaCast-enabled Outdoor RGB Multi-Color Strobe, the Outdoor Auxiliary Strobe Kit, the SIP Outdoor RGB Strobe, and the SIP Outdoor Call Button. Apparently, these devices can be deployed across playgrounds, garages, parking lots, safe houses, shelters, and more, and are known to feature TLS 1.2 for enhanced security.

Driven by the presence of an advanced telecom infrastructure and the paradigm shift from traditional networks to cloud-based telephony, North America is anticipated to remain a dominant region in the global VoIP market. Indeed, as per estimates, North America is slated to capture 40% of the global VoIP industry share by 2025.

Targeted to revolutionize enterprise communication, VoIP has emerged as one of the most sought-after technologies for organizations to help them streamline communication channels and enhance productivity at lesser costs. In recent times, WebRTC (Web Real Time Communication) has cropped up to be another technology that is expected to revolutionize the future of the VoIP industry.

Companies nowadays have begun to depict practical demonstrations such as instant website calling and live video assistance for customers. As the demand for these solutions increases across numerous end-use verticals, the global voice over internet protocol is expected to emerge as one of the most pathbreaking technology verticals in recent times. As per a report by Global Market Insights, Inc., the overall voice over internet protocol market size is anticipated to surpass USD 55 billion by 2025.