U.S. home infusion therapy market to garner extensive profits from the rising prevalence of HAIs, overall valuation to exceed USD 13 billion by 2024

Publisher : Fractovia | Published Date : 2018-07-06Request Sample

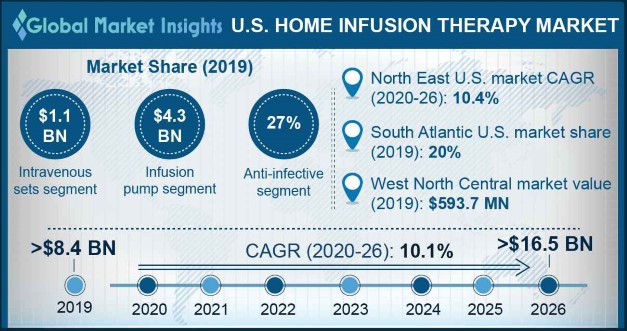

Driven by the changed outlook of value-based healthcare model, U.S. home infusion therapy market growth has been rather pronounced in the recent years. As healthcare organizations are mapping strategies to identify ways that could meet the parameters of higher quality and reduced costs, home infusion therapies have gained paramount importance in the U.S. healthcare ecosystem. Undeniably, continuous improvisation of existing medical devices for ensuring an enhanced user experience, has brought a consequential transformation in the business space. Say for instance, traditional infusion pumps that were previously used in the U.S. home infusion therapy market are now replaced with smart infusion pumps in a bid to narrow the dosage error margins. In fact, estimates claim, infusion pumps held approximately 51% of U.S. home infusion therapy industry in 2017, primarily owing to the rising number of baby boomers.

East North Central Home Infusion Therapy Market, By Product, 2013 – 2024 (USD Billion)

According to a recent report by Global Market Insights, Inc., home infusion therapy industry in the U.S. is forecast to cross USD 13.5 billion by 2024 with a double-digit CAGR of 10% over the coming six years. The figure is almost double to that of the yesteryear’s market valuation of USD 7 billion, which validates the commendable growth prospects of this business vertical in the ensuing years. As per experts’ opinion, the increasing geriatric population base in the country vulnerable to chronic infections due to poor immunity system is a vital factor boosting the growth.

Estimates suggest, the proportion of senior population (aged 65 years and above) in the U.S. is expected to increase from 15% in 2016 to more than 20% by 2050. Statistics put forth by World Atlas further quotes that the overall elderly populace in the U.S. would be over 98 million by 2060. The growing demand of these therapies by the elderly population is majorly attributed to the ease and convenience ordered by the approach.

Another driving force catalyzing the expansion of U.S. home infusion therapy market is increased prevalence of chronic diseases and hospital acquired infections. According to a report by CDC, healthcare associated infections (HAIs) unfortunately affects nearly 5% to 10% of the hospitalized patients in the U.S. annually. Reportedly, the 1.7 million HAIs annually result in 99000 casualties and an estimated USD 20 billion as healthcare costs.

This mammoth prevalence is prompting regional healthcare market players to redefine the way infusion drugs are delivered in home, thereby creating lucrative growth avenue for U.S. home infusion therapy market. Also, it has been observed that patients suffering from chronic diseases like cancer are inclining more toward home infusion therapies, in a bid to neutralize the side effect of invasive chemotherapy.

Speaking of the competitive spectrum, home infusion therapy market in the U.S. is inclusive of renowned biggies like Amsino International, Becton Dickinson, ICU Medical, Moog, Baxter International, Smiths Medical, and Fresenius Kabi. From what has been observed from the recent trends, a majority of these players are taking laudable interests in product innovations to consolidate their market stance in the strategic landscape. Baxter International’s yesteryear launch of a DeviceVue advanced asset tracking system is a vital testament to the aforementioned declaration. The American healthcare giant has reportedly deployed a Sigma Spectrum Infusion System for better monitoring of infusion pumps through smart phones. With appreciable efforts undertaken by the industry players on product front in tandem with the growing prevalence of healthcare associated infection rates, U.S. home infusion therapy market is certain to witness lucrative proceeds over the ensuing years. Anti-infectives application which procured a prominent chunk of the industry in 2017 with a share of more than 27% is slated to continue its dominance in the coming years, with North East region emerging as a major beneficiary of this trend.