Competitive sketch of commercial drone market in terms of recent investments, global business to witness a staggering CAGR of 25% over 2017-2024

Publisher : Fractovia | Published Date : 2017-01-25Request Sample

Although initially conceived as a sophisticated military tool, commercial drone market has successfully empowered its stance in the corporate world over time. This is quite evident from the increasing investment capital pouring into the business space lately. Estimates depict, in 2016, UAV market witnessed almost 105 deals, resulting in a total valuation of USD 541 million. In the same year, global shipments of commercial drones surpassed 100 thousand units.

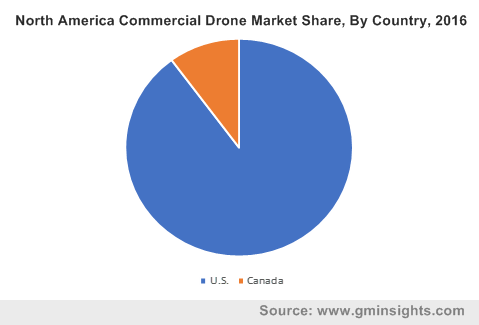

The United States is claimed to hold a commendable proportion of authority in terms of commercial growth prospects. According to reliable estimates- valuation of regional drone activity has risen from USD 40 million to USD 1 billion over 2012-2017. By 2026, experts believe, U.S. commercial drone activity both from consumer as well as corporate applications, would witness an annual impact of USD 30 billion to USD 45 billion. These statistics strongly depict the lucrative growth curve of U.S. unmanned aerial vehicle industry over the forthcoming years. In tandem, regional government initiatives in promoting increasing usage of UAVs for multiple commercial purposes will further proliferate the business growth.

U.S. Commercial Drone Market Volume Share, By Application, 2016

The Trump administration has recently installed a program for expansion of drone testing, allowing UAVs to fly over people at nighttime or beyond the visual line of sight (VLOS). It is perhaps the latest scoop that is grabbing most of the headlines in U.S. commercial drone marketplace, amidst the strict regulations regarding VLOS. Reportedly, the program comes on the heels of the country’s long-standing plan of integrating UAVs in the regional airspace sector for testing and detection. The White House hasn’t yet disclosed any clear timeline for these advancements, nor did it include any new regulations. These kinds of proactiveness on the regional governmental front is sure to impel unmanned aerial vehicle industry share over the coming years. For the record, the program is still subject to Federal Aviation Administration (FAA) approval.

Commercial drone market, of late, has been witnessing an inflection point. While investment is soaring, companies are trying out their hands on untested applications. Air Taxis, for instance, is one such application vertical that have created a buzz in the business space lately. Renowned sports car manufacturer Porsche, has recently declared its plan of developing air taxi, in a bid to compete with other drone maker rivals like Uber, Volocopter, Airbus, etc. While most of the operations in the vehicle would be automated, the passengers, reportedly would also have some control on the flying machine. It now remains to be seen how this breakthrough project leaves an impact in commercial drone industry, once the full-fledged architecture come onboard.

Inherently influenced by the opportunistic wave, the strategic landscape of the business space has been experiencing hefty investment projects via M&A activities. ADIF’s recent declaration of significant funding in Aerodyne’s drone technology can be symptomatic evidence of the same. Though the total sum has not yet been revealed, the venture capital fund formed by Axiata Group has reportedly poured close to double digit million in the globally acclaimed drone solution provider. Allegedly, through this alliance with Axiata, Aerodyne Group is planning to establish itself as a forerunner in the global commercial drone market. As per experts’ opinion, this hefty investment represents Axiata’s confidence in Aerodyne Group’s advanced drone technology, currently deployed across 10 nations globally.

While big shots involved in the business space tend to grab most of the limelight, start-ups have also made quite significant impact on UAV activity. In this regard, unmanned aerial vehicle industry space has recently witnessed the collaboration of AirMap with Skyguide, the Swedish air navigation service provider. Through this deal, both the organizations are aiming to develop and deploy Europe’s first drone traffic management system. Reported to commence its pilot phase from June this year, the project would witness an integration of AirMap’s UTM platform with Skyguide’s Infrastructure. This amalgamation of technologies from both the giants would lead to introduction of automated flight authorization in one aerospace platform.

However, it is imperative to mention that the ongoing product innovations in commercial drone market are hinged to regulatory approvals. Major economies have been grappling with regulatory issues with regards to drones’ usage, primarily on account of its safety concerns. Regulators nowadays are aggressively involved in evaluating the consequences of utilizing UAVs, before these systems are commercialized in the market. U.S. for instance, has established a Drone Advisory Committee, in a bid to support safe integration of UAVs in NAS (National Airspace System). As the regulatory framework continues to shape UAV market with better guidelines, the outreach of the application landscape is sure to widen. As per authentic estimates, global commercial drone industry size is forecast to cross a valuation of USD 17 billion by 2024.