Titanium sponge for A&D market to be majorly driven by the surging involvement of aerospace conglomerates in R&D activities

Publisher : Fractovia | Published Date : 2018-06-14Request Sample

Titanium sponge for A&D market has been treading on a profitable growth path lately, pertaining to the efforts undertaken with regards to unearthing new material application and optimization. On these grounds, it would be fair to state that titanium, on account of its corrosion resistance and high strength-to-weight ratio, is being deployed extensively across aerospace and defense applications. Analyzing the future scope of advanced materials in the aerospace & defense sector, renowned aircraft product manufacturers are increasingly investing in facility expansions of titanium alloy production plants. In addition, they are also signing contracts with leading titanium sponge suppliers to produce aircraft products in a cost-effective manner.

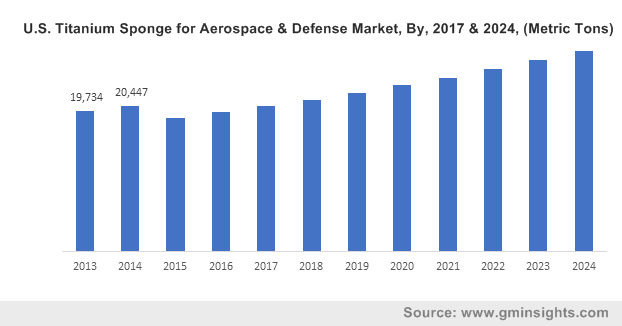

U.S. Titanium Sponge for Aerospace & Defense Market, By, 2017 & 2024, (Metric Tons)

Having been a subject of intense research since the last five decades, titanium stands as one of the reliable materials for complex industrial operations for quite some time now. The material’s dependability and its preference rate over aluminum can be aptly credited to its outstanding properties, ranging from light weight, lesser maintenance costs, reusability, resistance to corrosion, biocompatibility, and fire & shock resistance. The applications of titanium are thus, classified in a way that specifically pertains to every individual property of the material, widening the expanse of titanium sponge for aerospace & defense industry.

Citing an instance of the aforesaid statement, titanium’s lightweight, corrosion resistance, and fire & shock resistance properties particularly aid its deployment for manufacturing engine parts and aircraft fuselage. Considering its adaptable usage in producing aircraft components, the developed economies are highly proactive with regards to its demand and deployment. Numerous countries have even been establishing new plants to increase their production capacity, thereby striving to consolidate their position in A&D titanium sponge industry.

Titanium’s has lower density as compared to steel – a parameter that has helped contribute toward lesser overall weight. The material’s strength, in addition, is also higher than aluminum, on account of which it has conveniently replaced aluminum in aerospace and defense applications, despite having 60% more density than the latter. Cashing in on its lighter weight, numerous players in titanium sponge for A&D industry have shifted their outlook toward green production. The increasing concerns regarding fuel efficiency and minimization of carbon footprints have thus been fueling the demand for this lightweight material, augmenting titanium sponge for aerospace & defense market trends.

While low weight is a prime factor of consideration, another parameter that has been propelling the demand for titanium is its lesser maintenance cost. This is specifically important in the current scenario, as aerospace giants have been looking forward to using materials which will offer lesser maintenance and longer life. Despite the higher initial costs, titanium alloys provide high structural durability and are relatively inexpensive to maintain. Owing to its superior corrosion resistance capability, titanium alloys also possess excellent durability and are used to manufacture interface links for satellites, gas bottles, liquid propellant tanks, and intertank structures. Taking into account the widespread applicability of titanium alloys, aerospace and defense product manufacturers have been increasing leaning toward the deployment of this material. The surging use of titanium sponge to increase the cost-effectiveness of the final product will thus propel titanium sponge for A&D market size.

Aerospace magnates are constantly on the lookout for brainstorming new manufacturing processes and advanced products to enhance the performance of aircrafts. In this regard, a few years ago in 2014, Boeing made an investment in Tamil Nadu, India to establish a maintenance-repair and overhauling facility. Incidentally, Tamil Nadu has been producing 10,000 tons of titanium sponge per annum, which may have been a contributing factor for Boeing to expand its presence in the regional A&D titanium sponge market.

Speaking of India, it would be fair to mention that the region has emerged as quite a lucrative avenue for titanium sponge for A&D industry. The Indian Aerospace and Research Organization in fact, has drafted a National Space Program to launch an indigenous titanium sponge manufacturing plant in Kerala specifically for defense and space applications. The plant is now commissioned and has become operational as well, through which India now ranks seventh in the global list of titanium producing countries. Heavy investments in the commercial production of titanium in India will thus effectively drive APAC titanium sponge for aerospace and defense industry share in the forthcoming years.

Aided by revolutionary manufacturing facilities and the excellent benefits of titanium alloys, A&D titanium sponge market is likely to carve out a profitable growth graph ahead. Since material manufacturers and aerospace industry giants are committed to facility expansions, the future business scenario seems to be quite lucrative for this vertical. As per estimates, titanium sponge for aerospace and defense industry size is expected to be pegged at USD 1.94 billion by the end of 2024.