Thermal spray coating market to garner a substantial percentage of the overall revenue from the aerospace domain by 2024, R&D projects to bring forth a slew of innovative products

Publisher : Fractovia | Published Date : 2018-02-27Request Sample

ThermaSpray’s yesteryear exhibition of coatings vividly underlines the exceptional transformation thermal spray coating market has undergone in recent times. ThermaSpray’s thermal spray coating technologies, reportedly of a high superior quality and excellent dependability are renown to operate brilliantly in harsh environments, deeming them completely suitable for end-use domains such as power generation, petrochemicals, chemicals, and mining. One of the pivotal factors these coatings have gained widespread traction for in thermal spray coating industry is that they offer enhanced performance along with cost-saving benefits in addition to helping end-users and OEMs with regards to enhanced uptime, increased productivity, and lowered maintenance. Indeed, ThermaSpray’s coating range validates the efforts undertaken by major players in thermal spray coating market to upscale the product portfolio in order to expand the end-use landscape of these coatings beyond the automotive, aerospace, power, and healthcare sectors.

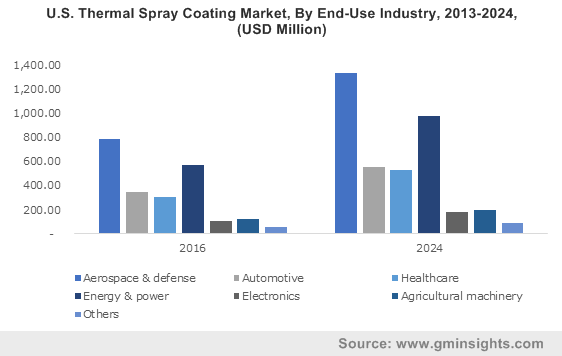

U.S. Thermal Spray Coating Market, By End-Use Industry, 2013-2024, (USD Million)

Unveiling thermal spray coating market trends in the aerospace sector

The aerospace & defense domain has evolved extensively since its inception, and now stands as a vital growth avenue for thermal spray coating market. Metal and polymer coatings are widely deployed in the manufacture and finesse of parts such as flame tubes, HPT outer stationary seals, turbine blades, and more. Highly specialized coatings and spray technologies are extensively used in aircraft manufacturing, repair, and maintenance, which in consequence would have a profitable impact on thermal spray coating industry size. As per reliable estimates, in 2016, the top 100 aerospace & defense companies chronicled a cumulative valuation of USD 700 billion – registering an aggregate profit of more than USD 65 billion from the revenue recorded in 2015. Indeed, extensive spending on commercial and military aircraft is likely to massively propel thermal spray coating market size from the aerospace sector.

The expansion of the aerospace industry has been particularly vivid in North America, given the fact that the region has established itself as a highly lucrative growth ground for aircraft manufacturing and maintenance across the commercial & defense sectors, gradually impelling the regional thermal spray coating market share. Estimates claim that the U.S. civil aviation sector recorded an expenditure of more than USD 79 billion in 2015. Undeniably, the aviation domain stands tall as far as the adoption of thermal coatings is considered. In consequence, the demand for these coatings in the manufacturing process of aircraft components has witnessed an upsurge across major geographies, augmenting thermal spray coating market size from the aerospace & defense sector, which was pegged at USD 2.5 billion in 2016.

As on today, the increasing consumer disposable incomes, rising threats from enemy countries, and the growth in air traffic flow has led to a massive demand for general, defense, and commercial aircraft. Estimates claim that in 2017 alone, global annual air traffic witnessed a growth rate of close to 4.5%. This has upscaled the requirement of ceramic, metal, and polymer coating technologies in aerospace, gradually propelling thermal spray coating industry outlook.

An instance depicting the impact of R&D programs on thermal spray coating market expansion

Merely a few days ago, NASA took notice of a research study in thermal spray coating market that entailed a new technology to be deployed in aerospace gas turbine engines. The study claims that controlled segmented YSZ (Yttria Stabilised Zirconia) plasma-sprayed coating technology has the potential to lower thermal spray coating costs by nearly 50%. Rather, the segmentation (cracks) in the coating prove beneficial for gas turbine engine designs used in aircrafts. Indeed, the new technology has been acknowledged as an inexpensive solution for the existing YSZ thermal barrier coatings developed by the APS (atmospheric plasma sprayed) technique and stands to be in a more accepting position to be commercialized sooner than anticipated. The new technology that may soon officially debut in thermal spray coating industry also seems to have an advantage over expensive techniques such as EB-PVD or SPS deposited coatings.

It is thus vividly coherent that the rising number of R&D ventures have a pivotal role to play in enhancing the commercialization potential of thermal spray coating market. Another prospective growth avenue for thermal spray coating industry however, is that of the repair and maintenance of damaged parts. Processes such as air plasma spray and HVOF (High Velocity Oxygen Fuel) sprays are massively used for component repair in the aviation domain. Say for instance, a few years back in 2014, it came to the attention of a popular turbo-prop aircraft that nickel electroplated coatings used to protect roller wear surfaces wore away after a while accompanied by major wear and tear in the metal substrate. In response, VAC AERO, one of the prominent players of thermal spray coating market specializing in the repair of structural components of airplanes, came up with a solution to deploy the HVOF process for applying a tungsten carbide coating over the worn component area that acted as an apt wear resistant overlay and helped restore the damaged substrate. Post the acceptance of this technology in the aerospace domain, numerous thermal spray coating industry players were known to follow suit, thereby leading to the growth of a lucrative revenue ground in the business.

Endorsed by an extensive end-use spectrum, thermal spray coating market stands as a strong niche vertical in the global bulk and specialty chemicals sphere. The aforementioned declaration can be aptly justified by means of reliable estimates that claim thermal spray coating industry size to cross a coveted mark of 900 kilo tons by 2024. Indeed, in the ensuing years, the automotive, energy, healthcare, and aviation sectors have been projected to grow at an unprecedented pace, the impact of which is certain to be felt across the global thermal spray coating market.