How will the dynamics of system on module market transform with the robust product demand from the medical sector and the impact of industrial automation?

Publisher : Fractovia | Published Date : 2019-05-06Request Sample

Fueled by rapid technological advancements in embedded systems and the growing demand for compact, power-efficient products, system on module market has been traversing alongside a highly profitable path lately. Essentially, the product is a fully-featured single board computer comprising of a single microprocessor, RAM, input-output controller and many other components, and is designed specifically for integration into embedded applications.

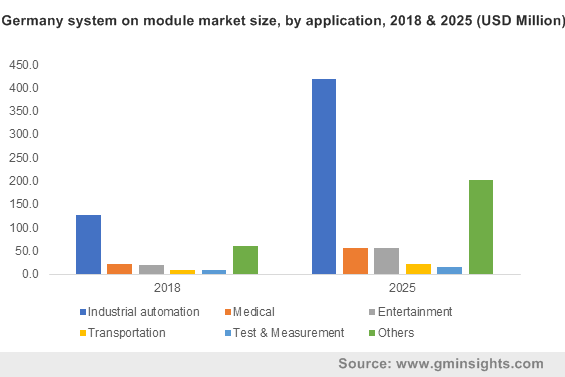

Germany system on module market size, by application, 2018 & 2025 (USD Million)

Indeed, with multiple embedded wireless solutions like 802.11a/b/g/n/ac and Bluetooth, the product can offer cellular connectivity and mobility as well as offer device security for connected IoT applications. Endowed with such profound features, manufacturers are increasingly opting for system on modules (SoM) to significantly reduce development efforts and time to market (TTM) by eliminating the challenges associated with designing boards with complex microprocessor, further offering a more reliable and cost-effective embedded platform for building end-products.

ARM processors have emerged as a vital alternative to x86 chips

Designed by British semiconductor giant ARM Holdings, ARM is one of the major processor architectures used for SoM modules. In an era where IoT has been proliferating the industrial automation sector, the processor holds significant prominence. Indeed, ARM-based SoM market is projected to exhibit a lucrative growth rate in the coming years. ARM offers a wide-range of features like low cost compared to other processors in market, higher battery life, faster operational speed, and compatibility for numerous end-user application.

Moreover, rapid technological advancements and growing demands have led manufacturers to develop newer versions of SoMs. For instance, in 2018, chip designer Arm unveiled its new Cortex-A76 CPU, claiming it would deliver 35% better performance than its predecessor. Advancements such as the aforementioned will enable the development of more power-efficient end-user products, supplementing SoM market growth.

Impact of SoM on the medical equipment manufacturing sector

Portable medical devices are increasingly gaining traction in recent times, given that they help enhance healthcare for millions of patients worldwide. With the influx of products like blood glucose monitors, heart rate monitors, pain-blocking implants, ingestible gastrointestinal (GI) tract monitors and several other devices, the incorporation of this technology has effectively enhanced a patient’s quality of living in recent years. Notably, these clinical aids are integrated with miniature SoMs that enable high-level integration of analog components, offering more enhanced capability in smaller spaces.

Furthermore, by using portable medical equipment, patients with chronic diseases can easily and quickly monitor their own vitals and look for abnormalities that can eventually help them call for medical services as well as aid doctors to better diagnose their condition and take necessary steps.

Device manufacturers are also developing more compact, battery-powered products like smart patches, health monitors, and even inhalers that use machine learning technology to effectively allow clinical diagnosis, delivery or monitoring conditions remotely. For instance, Respiro smart inhaler, an Arm-based clinical device, can effectively track and record parameters like inhalation technique & frequency, inhalation flow rate, volume, flow acceleration and inspiration time, allowing doctors to gain a deeper understanding of patient’s varied conditions.

Europe’s industrial automation sector to significantly propel the regional SoM industry

The Europe system on module market is lately witnessing rapid growth trends due to the soaring demand for powerful & efficient embedded systems in industrial automation. According to the International Federation of Robotics (IFR) reports, Germany is one of the most automated countries in Europe – the nation ranked 3rd worldwide in 2016, with 309 robot units installed per 10,000 employees in the manufacturing sector.

Further, in 2016, the country’s operational stock and annual supply of industrial robots were pegged at 41% and 36% respectively. Also, between 2018 and 2020, the annual supply in Germany is anticipated to grow by at least 5% on an average per year due to the increasing demand for robots in the region’s thriving automotive and industrial sectors. Aided by the expensive proportion of industrial automation in other European economies such as France, Sweden, Denmark, Italy, and Spain, the region is bound to experience a substantial demand for SoM installations. In consequence, this would majorly impact the commercialization matrix of the Europe system on module market.

As the demand for automated technologies in operations like assembly, manufacturing, logistics and supply chain support continues to escalate, the integration of embedded computing solutions is bound to depict an upsurge. Additionally, the rising requirement for energy-efficient, smart electronic products for automation applications has led to the rapid consumption of embedded systems, in turn driving the growth of the global SoM market.