Global Synthetic and Bio Emulsion Polymers Market to surpass the 40-billion-dollar mark by 2024, driven by extensive product demand from the paint and coatings sector

Publisher : Fractovia | Published Date : 2017-09-14Request Sample

DOW Chemical Company, a renowned name in synthetic and bio emulsion polymers industry, has recently signed a deal with Saudi Arabia with an aim to build a new waterborne polymer manufacturing plant that would manufacture polyacrylate dispersant polymers and coatings emulsion polymers for consumer and water treatment applications. Additionally, DOW Chemical, through the construction of this plant, would be willing to supply multiple kinds of acrylic polymers for architectural and industrial coatings as well as detergents applications. The chemicals giant is reportedly investing over USD 100 million to develop this new polymer manufacturing plant, which will help to strengthen its position in MEA synthetic and bio emulsion polymers industry. Augmented by myriad M&As, synthetic and bio emulsion polymers market is likely to observe appreciable gains by 2024, having held a revenue of USD 25 billion in 2016.

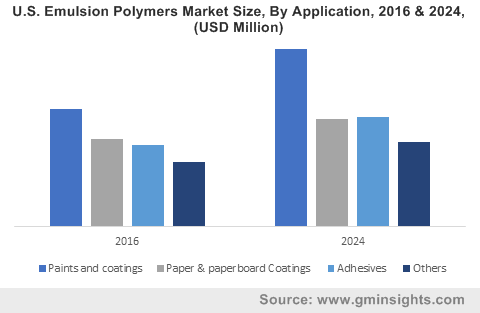

U.S. Emulsion Polymers Market Size, By Application, 2016 & 2024, (USD Million)

Acrylics, a principal product encompassed by synthetic and bio emulsion polymers industry, is used across for a massive range of end-use sectors, such as adhesives, textiles, paints & coatings, paper coatings, cement, and concrete flooring. The increasing usage of acrylics across the aforementioned sectors is thus certain to bring about an upswing in synthetic and bio emulsion polymers industry share. Statistically though, acrylics synthetic and bio emulsion polymers market size is expected to grow at a CAGR of more than 4% over 2017-2024.

In recent times, smart painting technology has been gaining considerable popularity in the urban areas, pertaining to its ability to reduce the effect of excessive heat, which is certain to propel synthetic and bio emulsion polymers industry. Smart painting is also being deployed in the construction of smart cities. In fact, scientists recommend that this technology be deployed extensively across the urban landscape, to paint the streets and maintain a cooler atmospheric level. Pertaining to the same, the U.S government has been undertaking initiatives to work on the effects of climatic change across the urban locales. LA, for instance, has become the first city to implement the smart painting technology for the purpose of street cooling. LA’s city planners are looking forward to reducing the overall temperature in the city by 3°F over the coming twenty years. Apart from delivering the benefit of temperature control, cooling paints offer several other advantages - less energy requirement and extra reflectiveness, to name a few. Subject to the aforementioned fact, they are also used for lighting up parking lots and roads. This goes to prove that the extensive applications of paints across myriad end-use sectors is likely to stimulate synthetic and bio emulsion polymers market share.

A dynamic change has been observed in the eating and living standards of the global populace, which, in a way, is leaving a rather pronounced impact on synthetic and bio emulsion polymers market share. Considering the determinant of health benefits, people have been increasingly giving preference to hygienic, high-quality food. Also, adhering to consumer demands, manufacturers have been deploying high-grade packaging facilities to avoid chemical, physical, and biological contamination in food, thereby increasing its shelf life. It is to be remembered that companies have been adopting distinct types of compounds in packaging film production, to develop impregnated packaging films that last longer. Major players in synthetic and bio emulsion polymers market have also been extensively investing in research and development activities to improve the effectiveness of packaging. For instance, MCP (Mallard Creek Polymers) has developed functional barrier coatings, equipped with the ability to prohibit oxygen and moisture vapor contamination, thereby increasing the shelf life of food. The increasing use of emulsion polymers for packaging dairy and food products is thus expected to lucratively boost synthetic and bio emulsion polymers industry size.

Key participants partaking in synthetic and bio emulsion polymers market share have been lately adopting production mechanisms that are marginally distinct from traditional manufacturing methods, to increase the production capability. This initiative has stemmed from the rising demand for the product from the end-use industries such as construction, automotive, aviation, and packaging. Some of the players have even been developing bio-based products to comply with rules and regulations enforced by regulatory bodies to reduce toxic emissions in the environment. As bio-based polymers are totally renewable, the European countries are significantly promoting the product deployment across a plethora of application arenas. Subject to the favorable support from the government, Europe synthetic and bio emulsion polymers industry is anticipated to collect more than USD 10 billion by the end of 2024.

Coating techniques such as priming, painting, and sealing tend to increase the air pollution level. In this regard, regulatory bodies across the globe are implementing strict norms to control emissions from the methodologies adopted in the coatings sector. In the San Diego county, for instance, the San Diego Air Pollution Control District (SDAPCD) has established VOC (Volatile Organic Compound) limits to reduce air emissions resulting from the aforestated activities. The deployment of such regulations leads to a significant rise in the demand for low VOC content based products, which will considerably fuel synthetic and bio emulsion polymers industry trends. Subject to the increased demand for packaging, the growing e-commerce sector is also likely to have a positive impact on synthetic and bio emulsion polymers market size, slated to cross USD 40 billion by 2024.