An outline of Switchgear Market with reference to the geographical landscape: U.S. touted to be a major revenue contributor

Publisher : Fractovia | Published Date : 2017-09-19Request Sample

Eaton’s latest contract acquisition is one that is likely to strengthen its position in Switchgear Market, given that the contract entails the company to provide a range of electrical distribution equipment inclusive of medium-voltage switchgear, power transformers, etc., for Minnesota’s solar installations. In principle, this business space encompasses a widespread application scope across the utility, residential, and commercial sectors, subject to the massive requirement of uninterrupted power supply across the globe. If reports are to be believed, Eaton’s solutions are guaranteed to support safe, reliable, cost-efficient electricity generation at three sites, namely Randolf, Cottage Grove, and Taylors Falls. This project incorporates Eaton’s solar BOS (balance of system) solutions for effective solar power generation. Eaton’s contract acquisition is an instance depicting the dire need for electricity across the globe, generated through renewable or non-renewable sources, which would undeniably propel switchgear market in the years to come.

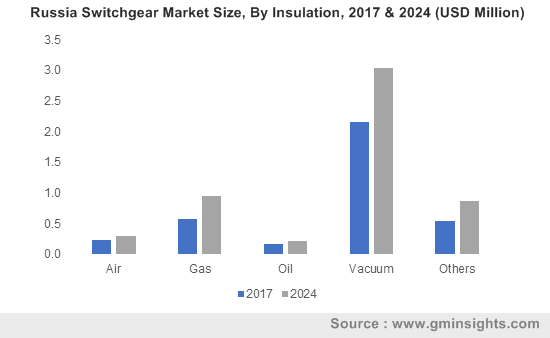

Russia Switchgear Market Size, By Insulation, 2016 (USD Billion)

An insight into U.S. switchgear industry

The United States is undeniably a potential hotbed for investors staking their claim in switchgear market. One of the prime reasons for this proposed claim is the extensive demand for power in the country that is vividly palpable. With a massive rise in power consumption, the government has been attempting to upgrade older electric networks and power grids for electricity transmission, which has been forecast to act as a major factor propelling U.S. switchgear market. Several investments have been undertaken in the recent years across electric networks and residential and commercial sectors with an aim to upgrade power grids that will ultimately stimulate switchgear industry size, slated to surpass a mammoth valuation of USD 160 billion by 2024.

- In 2016, the Boston-headquartered Eversource Energy made an investment of USD 950 million for the upgradation of transmission networks across the United States. This move served to sufficiently augment U.S. switchgear market size, given their extensive demand during the refurbishment. Eversource’s contribution is an apt instance validating the fact that the expansion of transmission and distribution networks across the country will serve to impel U.S. switchgear industry.

- Recently, in 2017, during the time President Donald Trump visited Saudi Arabia, renowned private equity behemoth, Blackstone Group, reported an investment of USD 40 billion with the Gulf region, toward the development and refurbishment of aging infrastructure in the U.S. With sufficient funds pouring in from the Saudi Arabia Public Investment Fund and other partners, a total of USD 100 billion would be spent in renovating the infrastructure in the U.S. A project of this expanse would undeniably require the deployment of switchgears on an extensive scale – a fact which would certainly push U.S. switchgear market to greater heights.

- The U.S. government has also been making extensive investments in railroad infrastructure projects lately. In 2017, for instance, the U.S. Federal Transit Administration declared an investment of close to USD 100 million toward the development of the San Carlos Peninsula Corridor Electrification Project, involving the refurbishment of California’s rail networks. This major electrification program is likely to necessitate a heavy demand for switchgears and other equipment, gradually propelling U.S. switchgear industry share.

The aforementioned instances stand to testify that investments in grid upgradation and electrification programs by the governmental bodies are the principal drivers fueling U.S. switchgear market size, which was worth more than USD 7 billion in 2016. Pertaining to the extensive demand across the nation for refurbishing aging power infrastructure, in conjunction with government initiatives toward the upgradation of power grids, U.S. switchgear industry share is likely to depict an appreciable increase by 2024.

An insight into Europe switchgear market

Europe, having marked its position as one of most established and developed continents across the globe, is expected to boast of substantial contributions toward switchgear industry. The region is likely to be augmented by the innumerable initiatives undertaken by the regional governments. An apt instance of the aforementioned statement is the recent announcement by the Western Europe governments with regards to the expansion of smart grid networks. Apparently, all the Western European countries along the likes of France, UK, Italy, Sweden, and Germany have jointly announced a mammoth investment of USD 133.7 billion toward refurbishing smart grid networks across the continent, which would unquestionably carve out a positive growth path for the regional switchgear market.

Despite the presence of highly developed nations such as France and Italy, Europe switchgear industry share is essentially dependent of UK and Germany. As per analysts, the region will be driven by the shifting trends toward energy conservation impelled by the increasing environmental concerns. The adoption of clean energy initiatives, for instance, is likely to augment Germany switchgear market share, slated to depict a CAGR of 6% over 2017-2024. The regional governments, it is forecast, would spare no expense to construct efficient micro-grid networks and enhance the existing transmission networks to lower T&D losses, which would act as a key driver fueling Europe switchgear industry growth.

Players partaking in switchgear market share are on the lookout for newer technologies that would reduce power transmission & distribution losses. Cost-efficiency and environmental concerns, it has been predicted, are other principal reasons that would prompt companies to bring about innovative power-saving technologies that can be deployed in switchgears, thereby driving switchgear industry. Of late, switchgear market is afloat with the trend of deploying SF6 (sulfur hexafluoride) alternatives as predominant insulation mediums, subject to the fact that SF6 leads to environmental degradation. With numerous investments to its credit, augmented by government initiatives for upgradation projects, in tandem with attempts to use eco-efficient gases for electrical insulation, switchgear market is slated to grow at a rate of 7% over 2017-2024.