Sulfone polymers market to derive commendable proceeds from aerospace sector over 2017-2024, capacity augmentation maneuvers to characterize the global industry space

Publisher : Fractovia | Published Date : 2018-05-03Request Sample

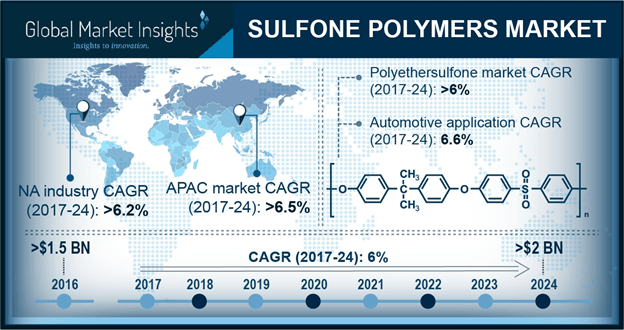

Endorsed by an extensive end use spectrum, the revenue graph of sulfone polymers market is bound to witness a substantial upswing in the forthcoming years. Sulfone polymers offer high oxidation resistance, thermal stability, heat resistance, low mold shrinkage, hydrolytic stability, and heat absorbing benefits. Apparently, these rigid and strong thermoplastic materials have continued to gain widespread popularity across numerous business verticals owing to their exceptional characteristics. Consequentially, this has further impelled the commercialization potential of the overall sulfone polymers industry which has been forecast to register a y-o-y CAGR of 6% over 2017-2024, as per reliable estimates.

Europe Sulfone Polymers Market Size, 2013 – 2024 (USD Million)

Capacity expansion strategies to favorably impact the sulfone polymers market share

Speaking of the strategic landscape, some of the prominent firms operating in sulfone polymers market have been making concerted efforts to expand their product manufacturing capacity over the recent years. Quoting a recent instance, BASF SE has announced to construct an additional production line to scale up the manufacturing of its flagship polyethersulfone product range, Ultrason®. For the record, Ultrason consists of polyethersulfone (Ultrason E), polysulfone (Ultrason S), and polyphenylsulfone (Ultrason P).

Apparently, the latest expansion would add a production capacity of about 6,000 metric tons of these polymers each year and the new line had reportedly commenced its operations toward the end of 2017. Subject to this expansion bid, the sulfone polymers industry giant would now be able to optimize its supply capacities to cater the diverse demands of various business verticals, cite experts.

In yet another instance, the renowned chemical firm Solvay has recently announced to expand its global production capacity of sulfone polymers. With an objective to strengthen its competitive position in the ever-evolving sulfone polymers market, the Belgium based company is slated to raise the manufacturing capacity of its high-performance thermoplastic material by more than 35% over the next five years of duration. It would be prudent to mention that the major polymers produced by Solvay, which includes Udel polysulfone (PSU), Radel polyphenylsulfone (PPSU), Veradel PESU, have found massive applications across a number of end use sectors.

Apparently, with the latest expansion, the firm now aims to scale up its investment in process optimizations and enhance the overall production process. Moreover, Solvay is currently constructing a new production facility in India and has announced to expand its operations in the U.S. As a consequence of such encouraging growth strategies being adopted by established companies, the sulfone polymers industry share would observe a marked uptick across Asian and North American regions in the times to come, cite analysts.

Aerospace sector to emerge as one of the fastest growing end use segments of sulfone polymers market

Owing to the escalating demand for lightweight aircraft components, sulfone polymers, polyethersulfone in particular, have found extensive popularity across the aviation domain in the recent years. Consequentially, a number of industry participants appear to have gradually realized the rising significance of these materials in the aviation sector. This has, in turn, compelled the major firms to unveil innovative products and boosted the competitive landscape of this business sphere.

Citing an instance to validate the efficacy of the aforementioned statements, PlastiComp, Inc had teamed up with BASF Corporation to launch ‘Polyarylethersulfone-based Long Fiber Thermoplastics (LFT) for Metal Replacement in Aircraft Interior Applications’. Apparently, it is quite imperative to mention that both the firms had showcased these thermoplastics at the High-Performance Composites for Aircraft Interiors Conference, 2013 which was held in Washington.

According to industry experts, the applications of PlasticComp’s LFT technology had reinforced the long carbon fibers. Moreover, owing to their high strength to weight ratios, these materials are able to penetrate into conventional metal components in the cabin interior – a factor that assists in manufacturing more sustainable and lighter aerospace parts. In consequence, the launch of such advanced products would have a positive influence on sulfone polymers market share from the aerospace vertical.

With polymers being utilized abundantly across a plethora of mainstream industries such as automotive, electrical & electronics, consumer goods, medical, and aerospace, the meteoric rise of sulfone polymers market is sure to persist in the ensuing years. In fact, as per a research report collated by Global Market Insights, Inc., the total remuneration portfolio of this sulfone polymers market business space is estimated to exceed USD 2 billion by 2024.