Growing energy infrastructure development to impel submarine power cable market

Publisher : Fractovia | Published Date : 2019-08-09Request Sample

Submarine power cable market is poised to garner immense momentum owing to the increasing applications in offshore wind energy generation. Additionally, the use of submarine power cable for intercountry power transmission is expected to augment submarine power cable market outlook throughout the forecast period.

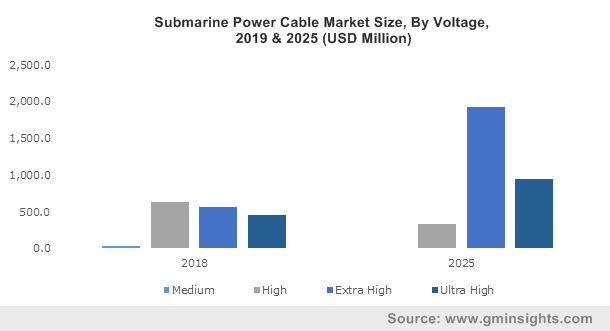

Submarine Power Cable Market Size, By Voltage, 2019 & 2025 (USD Million)

Government and private participants have been driving huge investments towards the renewable offshore energy generation to support sustainable electrical network infrastructure. The advent of offshore wind energy generation is completely based on the application of submarine power cable that carries the power generated offshore to the land. Increasing investments to create a sustainable electrical network favored by regulatory initiatives to integrate renewable grids will foster submarine power cable market trends.

With a wide diversity in terms of core and capacity, submarine power cable finds variability in applications also. For instance, single core cables aid long distance power transmission with minimal line loss coupled with high voltage power supply capacity. Likewise, medium voltage cables are deployed for offshore wind generation accounting to its low installation cost. So, each type of cable plays individual role in the subsea power transmission. Furthermore, the availability of flexible product specification and the high dependency of offshore renewable energy generation will add impetus to submarine power cable industry outlook.

Offshore wind turbines are connected by smaller low capacity submarine power cables that run from each turbine to an offshore substation. The substation then transmits the collected power over a higher capacity cable connected to the onshore grid. Furthermore, other offshore renewables like ‘wave’ and ‘tidal’ energy generation also totally depends on submarine power cables to bring the energy on shore. So, the increasing expansion of the offshore renewable energy generation will propel product demand and thus will boost submarine power cable industry size.

Europe has emerged as a strongest contender for submarine power cable market, owing to the increasing number of offshore wind farms and intercountry power transmissions. The growing concerns about the security of supply and grid stability imposed by the volatile peak load across the countries have created strong demand for interconnection of power cables. These inter-connector cables laid under the water moves electricity throughout the Europe allowing the countries to share energy and eliminate the concerns of price spikes. Thus, the role of submarine power cable to ensure the security of supply and stabilize fluctuating energy prices will foster submarine power cable market share.

In 2018, Europe submarine power cable market surpassed USD 2.5 billion owing to the enhancements in efficient power transmission systems complemented by rising electricity demand across emerging nations of the region. Currently the longest inter-connector power cable between Norway and the Netherlands accounts to 580km with a capacity of 700MW. However, the technological advancements in manufacturing submarine power cable can stretch the potential capability to 1,500km.

Currently, Great Britain serves four major electricity inter-connectors which link the country to the Netherlands, France, Ireland, and Northern Ireland. These interconnectors allow to link total 4 gigawatts (GW) of power, representing around 5% of the UK's existing power generation capacity. In addition to this there are numerous island power links in the region. The efficient cross-border power trade in the region will thrust business outlook propelling the product demand.

According to the report published by the WindEurope, the UK alone accounts to 44 percent of all offshore wind capacity in Europe, owing to the massive generating capacity of 8.2 gigawatts. Offshore wind farms around the British coastline are very essential for UK’s growing energy needs. Currently, there are eighteen operational wind farms consisting of total 1075 turbines around the coast of the UK. The UK government is also planning to increase the number of wind farms owing to the growing energy needs that will create intense product demand in the region. For instance, UK recently unveiled a new partially operational world’s biggest offshore wind farm project Hornsea one, which has currently 50 of its 174 turbines spinning. Next year, after completion, Hornsea project one will have a generating capacity of 1.2 gigawatt, which is more than double the existing largest offshore wind farm in the UK.

Ever-increasing reliance on the renewable offshore energy generations complemented by the growing intercountry subsea transmission links will enhance submarine power cable industry forecast. The heavy investments by the regional governments in the development of energy facilities are poised to impel industry share over the years ahead. In addition, supportive regulatory scenario fueling sustainable energy infrastructure will further strengthen product demand. Global Market Insights, Inc., reported that submarine power cable market size will exceed USD 3 Billion by 2025.