Fluoropolymer-based solar PV backsheet market to accumulate substantial proceeds over 2017-2024, China to emerge as one of the most profitable growth avenues

Publisher : Fractovia | Published Date : 2017-11-27Request Sample

DuPont’s recent alliance with Desert Technologies is remnant of the fact that solar PV backsheet market in indeed buzzing with a plethora of activities. Contemplating the robust rise of the overall solar space in the last decade, it goes without saying that related business verticals are bound to observe a similar expansion in terms of revenue. Desert Technologies, one of the reputed renewable energy moguls of the Gulf, apparently has teamed up with PV materials manufacturer, DuPont, to speed up its mono module production to a capacity of 120 MW by Q4 2017. As part of the agreement, Desert also plans to deploy DuPont’s Tedlar backsheets and cells featuring its Solamet metalization paste. In effect, this partnership would provide reciprocal benefits to both the top shots – while DuPont would further consolidate its position in solar PV backsheet industry, Desert would have the advantage of kickstarting its solar ambitions with renewed gusto across the Gulf. In the subsequent years, the expansion of the solar manufacturing business in the region is likely to have a profound impact on solar PV backsheet market size, which was pegged at a valuation of USD 2 billion in 2016.

Europe Solar PV Backsheet Market, By Product, 2016 & 2024 (Million Square Foot)

The expeditious growth of the renewable energy sector across the globe, especially the solar business sphere, is undoubtedly going to have a tremendous influence on solar PV backsheet market. As the construction of more and more residential and commercial establishments is underway, the deployment of roof-top units would gradually observe a rise, thus augmenting solar PV backsheet industry. Furthermore, the adoption of PV technology has also increased by several notches in recent times. This rise in deployment can be attributed to the expansion of micro-grid networks for fulfilling the off-grid energy demand, which would commendably impel solar PV backsheet market share over the forthcoming years. With fossil fuel resource depletion and a favorable regulatory landscape to boot, solar energy system deployments have witnessed a notable rise lately. Furthermore, the utilization and promotion of PV systems is being aggressively supported by regional governments in the form of support programs, solar investment tax programs, tax rebates, and numerous other incentives. Recently for instance, in the year 2016, the Asian Development Bank, under the Solar Rooftop Investment Program, declared an investment of USD 505 million for deploying solar PV systems in India – a move which would considerably impel PV adoption, in turn influencing the regional solar PV backsheet industry trends.

Fluoropolymer adoption to escalate over 2017-2024, driving solar PV backsheet market share

Fluoropolymer essentially, is one of the most pivotal materials utilized for the construction of PV backsheets, on account of its innumerable benefits. The popularity of this material can be justified from an instance that solar PV backsheet market witnessed recently. Arkema, one of the most renowned names across the bulk and specialty chemicals arena, announced that the company has purchased online Kynar fluoropolymer production capacities in China. The Kynar PVDF films manufactured by this French conglomerate have been utilized for a long time in the solar business sphere for PV panel backsheet protection, subject to the firm’s claims that its films are endowed with special properties such as excellent UV resistance, increased longevity, white color stability, high humidity performance, increased energy yield, and high temperature. Amidst the backdrop of this scenario, Arkema’s fluoropolymer expansion is likely to bring about a welcome change in solar PV backsheet industry, especially since the material has been gaining renewed traction lately for backsheet production.

As per reports, Arkema’s 25% increase in fluoropolymer capacity is intended toward improvising customer services in the PV sector across the Asian zone, which would eventually have a profound impact on the regional solar PV backsheet market outlook. Speaking of which, fluoropolymers accounted for more than 50% of the overall solar PV backsheet industry share in 2016, pertaining to the material’s characteristics of unit longevity and efficiency. On account of its excellent insulation properties as compared to its non-fluoro counterparts, fluropolymer-based solar PV backsheet market may accumulate appreciable gains over 2017-2024.

China to evolve as a majorly lucrative avenue for global solar PV backsheet market

China has, since the longest time, been one of the world’s largest investors in clean energy, and the country plans to considerably increase its solar output as well – a move that is certain to drive the regional solar PV backsheet market. The numerous investments toward solar energy on account of the rising concerns regarding carbon emissions are slated to massively increase the adoption of PV modules, inherently impelling the regional solar PV backsheet industry share. In fact, The National Energy Administration recently reported that the power output from PV plants in the country has increased by a mammoth 80% - a crucial benchmark that would help augment the number of PV facilities in the region, gradually inching toward making solar PV backsheet market a completely niche vertical.

China’s presence in solar PV backsheet industry may date back to more than three years earlier, when the tabloids were afloat with the news that three major Chinese companies, namely, Cybrid, Jolywood, and Taiflex held nearly 25% of the overall backsheet business share in 2014 and accounted for more than 9 GW worth of shipments in 2013. Now, with a plethora of investments in place, in conjunction with numerous PV facility expansions across the nation, China solar PV backsheet market size has been anticipated to cross a yearly installation of more than 2 billion square foot by 2024, which would make the country one of the most pivotal contributors toward solar PV backsheet industry growth in the ensuing years.

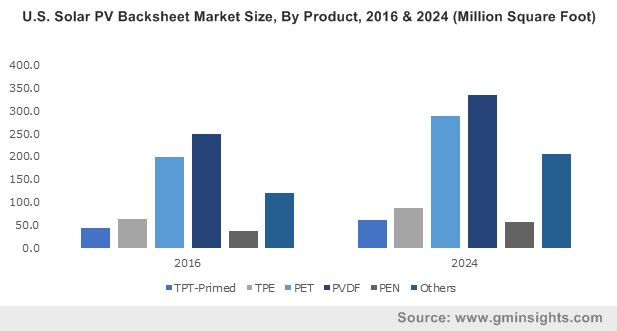

The appreciable rise of the solar energy spectrum has been forecast to have a tremendous influence on solar PV backsheet market, given the pivotal role the PV backsheet plays in shielding solar module components from outside stress. As investments in PV module manufacturing increase, the demand for PV backsheets would observe a simultaneous boost, thereby increasing the scope of expansion for solar PV backsheet industry. In fact, the latest trends across this business space ride around the deployment of polyolefin-based backsheets – a topic that garnered substantial attention at this year’s European European Photovoltaic Solar Energy Conference and Exhibition (EU PVSEC). Analysts claim that while TPT-based solar PV backsheet market would hold more than 50% of the overall share, polyolefins are likely to be utilized heavily in the years to come, leading to the genesis of newer solar PV backsheet industry trends. With more and more innovations prevalent across this business arena, supported by numerous government programs and incentives, solar PV backsheet market is forecast to accomplish commendable heights in the years ahead. A solar PV backsheet industry report, as a matter of fact, claims this space to cross an annual installation capacity of close to 7 billion square foot by 2024.