An outline of smart metering system market in terms of regional and regulatory landscape, global valuation to exceed USD 21 billion by 2024

Publisher : Fractovia | Published Date : 2017-03-23Request Sample

Deployment of smart grid infrastructure worldwide is expected to trigger significant economic benefits for smart metering system market. Electric utilities have been actively reshaping the processes, organization models, and systems in a bid to realize the full potential of smart grid technologies. Amidst this backdrop, smart metering system industry, categorized as one of the lucrative business verticals of the sustainable ecosphere, ironically finds itself among the most debatable industry spheres. This can be possibly attributed to the fact that the deployment of smart meters is being questioned by regulatory bodies on grounds of the basic requirements and barriers to its implementation. The domination of the regulatory framework however, cannot be considered as a constraint to the growth of smart metering system market. In fact, implementation of fiscal incentives along with supportive governmental plans have pushed the replacement of conventional meters.

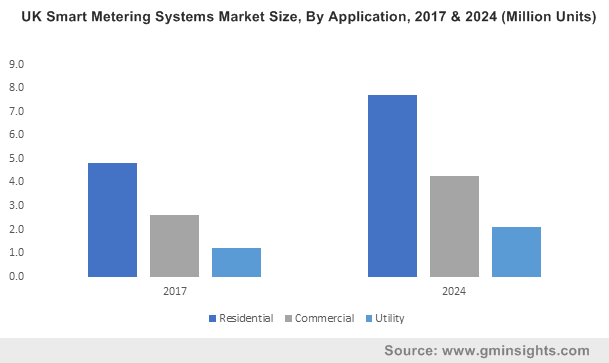

UK Smart Metering Systems Market Size, By Application, 2017 & 2024 (Million Units)

Say for instance, by the end of 2020, UK government aims to install smart meters in almost 50 million homes. Currently there are almost 10 million smart meters installed in this belt. Grounding on the present installation number, it is arguably precise to mention that U.K. is one of the major recipients of smart metering system industry growth. Add to it, the nation has also made its way to the front page few months back, with the news of saving almost 300,000 homes from potential mishaps such as gas leaks and fires last year, after installing smart meters.

Since smart meters track energy consumption in real time, it not only allows dynamic pricing range based on season and peak time, but also better monitors the electric grid health. That is to say, it restores services much faster during power outages and effectively communicate to users via highly advanced alerts. If reports are to be relied on, these devices helped to detect faulty appliances such as CO or other harmful gas leakage, defective wiring etc. in almost 270,000 homes in UK in the year 2017. Incidentally, the record has triggered a considerably massive product penetration across the entire belt, which by extension has contributed to the regional smart metering system market share. With increasing consumer awareness regarding the benefits of deploying these systems in tandem with governmental measures addressing the same, UK smart metering systems industry is forecast to witness a y-o-y growth of 8% over 2018-2024.

U.S. has evolved to be another pivotal region for smart metering system market progression. According to a report by U.S. Energy Information Administration, in 2016 U.S. electric utilities installed nearly 70.8 million AMI based smart meters. Reportedly, 88% of these AMI installations were deployed across residential sectors. The ongoing regulatory measures with regards to optimization of energy consumption have generated an appreciable demand for advanced meters. The CPUC (California Public Utilities Commission) has given an official sanction to investor-owned utilities for replacement of conventional meters with smart meters. In effect of this legislation, U.S.’s primary electricity supply channel, Southern California Edison, has received a green signal to install approximately 5.3 million smart meters in the country. Aided by the backdrop of such stringent regulatory regimes pertaining to energy conservation, U.S. smart metering system market is slated to be pegged at USD 3 billion by 2024.

Speaking of the competitive landscape, renowned biggies involved in the business space have been bending over backwards on mergers & acquisitions to bolster smart metering systems market in terms of revenue streams. Itron’s strategic takeover of Silver Spring Networks is an apt instance depicting the same. For the records, in the first quarter this year, Itron recorded a total revenue of USD 607 million, which is claimed to be 27% hike from what it recorded in the year 2017 (USD 478 million). As per the official confirmation, out of this USD 129 million increment, USD 86 million came from Silver Spring Networks (Networks segment), without which Itron’s share would have raised only by 9%. The presence of strict governing bodies along with tried and tested strategies by the industry players are bound to generate a plethora of opportunities for smart metering system market. The fraternity is forecast to exceed USD 21 billion by 2024.