APAC small hydropower industry to accrue significant revenue over 2016-2024, high demand for uninterrupted power supply to soar the regional growth

Publisher : Fractovia | Published Date : 2017-05-18Request Sample

Rising pollutant emissions have necessitated the enforcement of strict norms supporting green energy usage, which will spur small hydropower market expansion. Subject to the increasing demand for regulated and balanced power supply, it has become a mandate to ensure uninterrupted electricity everywhere across the globe. Inadequate power supply in rural areas due to unavailability of electric grids will thus lead to the installation of hydropower plants in the region, thereby creating a huge demand for small hydropower market. Rapid industrialization in countries such as Russia, China, India, and Brazil along with the rising global population will also provide lucrative opportunities for the business to prosper. Global Market Insights, Inc., states that Small Hydropower Industry size will hit 145 GW by 2024, recording a CAGR of 2.5% over the duration of 2016-2024.

Small hydropower plants reduce the need for high capital investments and prevent ecological damage. Also, old and unused hydro sites requiring renovation, but facing budget restrictions can be operated as small hydropower projects, which will impel the small hydropower business landscape. Rising domestic consumption of electricity across Asia and North America will contribute notably towards small hydropower market revenue.

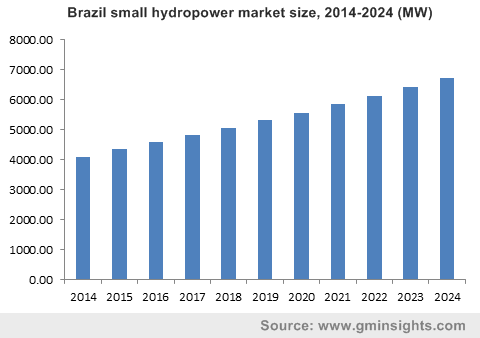

Brazil small hydropower market size, 2014-2024 (MW)

Considering the regional trends, Asia Pacific small hydropower industry is expected to experience a remarkable surge over the coming seven years. India, Vietnam, China, and Japan are projected to drive the regional demand. Easy availability of skilled manpower along with ample hydropower potential locations will steer India and China small hydropower market development.

Vietnam small hydropower industry is projected to grow at a rate of 6.5% during the period of 2016 to 2024, driven by the large presence of natural water sources in the region. Dense rivers more than 9 km long and the presence of at least 2000 river streams are expected to propel small hydropower market in the region.

Small hydropower market in North America is slated to record substantial gains of over 2.5% during the time span of 2016 to 2024. Beneficial legislations promoting the use of sustainable energy along with escalated requirement of power supply across the remote areas & non -grid connected regions are expected to drive the business expansion. The U.S. and Canada are likely to be the key regional growth drivers. The U.S. small hydropower industry had made substantial contributions towards the North America industry in terms of installation by deploying small hydropowers having an installation capacity of 6.98 GW in 2015.

Europe small hydropower industry is projected to grow at a rate of 2.3% over the coming seven years, owing to the rising number of renovations of the existing hydro projects along with favorable legislations enacted by ESHA (European Small Hydropower Association) to encourage the construction of small hydropower plants. Italy had dominated the Europe Industry in 2014 with a total small hydropower deployment capacity of more than 3.1 GW. Ample availability of natural sustainable energy sources along with enhanced use of green technologies are some of the key growth drivers of the region. France small hydropower market is slated to record a CAGR of 3% over 2016-2024.

Central & South America small hydropower market is forecast to record an annual growth of 4.5% over the coming timeframe, driven by the presence of established manufacturing firms across the region accompanied by high hydropower potential in the vicinity of the Amazon river. Brazil is foreseen to dominate the regional share and is expected to deploy small hydropowers having a capacity of 6.73 GW by 2024.

Small hydropower industry in Africa will expand at a rate of 3.9% over the years ahead, owing to largely unexplored hydropower potential along with heavy foreign direct investments influencing the business development.

The Voith GmbH, Lanco Group, Siemens AG, Andritz Hydro GmbH, Fortum Corporation, GE Corporation, Agder Energi, StatKraft, RusHydro, and Derwent hydroelectric power limited are the key players of small hydropower industry.