Increasing number of solar installations to favor silanes market trends over 2019-2024

Publisher : Fractovia | Published Date : 2019-07-17Request Sample

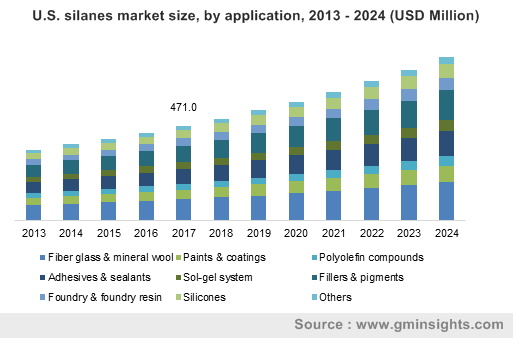

Endowed with an extensive application domain, the worldwide silanes market share has been garnering appreciable momentum over the past few years. Owing to its various impressive properties, the inorganic compound is being used in silicones, foundry & foundry resin, fillers & pigments, sol-gel system, adhesives & sealants, polyolefin compounds, paints & coatings, and fiber glass & mineral wool.

U.S. silanes market size, by application, 2013 - 2024 (USD Million)

When it comes to the application expanse of the worldwide silanes industry, the adhesives & sealants segment is witnessing an impressive growth over the past few years. Sealants serve the dual purpose of preventing the passage of chemical, air, and water through a zone where it is applied and as an adhesion to the surface. As per reliable estimates, the adhesives & sealants segment accounted for about 15 percent of the overall silanes market size in the year 2017 and is poised to register a decent growth rate over the forecast years as well.

As silanes are able to form bonds in ceramic, glass, metal, and other surfaces, adhesives & sealants are utilized in a range of sectors such as construction, automotive, aerospace, etc. Out of these business verticals, silanes are being currently used extensively in the construction sector. In this context, it is prudent to take note of the energy conservation trends that have swamped the global construction sector and the role of silanes in increasing energy efficiency in buildings.

Various governments have launched initiatives directed toward bringing down carbon footprint of buildings. For instance, India’s Ministry of Power recently announced ECO Niwas Samhita which is an energy conservation building code for residential buildings. With the guidelines being implemented with a goal of saving up to 125 billion units of electricity each year by 2030, it is quite a given that materials like silanes would be incorporated in the construction of new residential complexes to achieve optimal energy efficiency levels. Therefore, India silanes market trends would benefit from the ever-expanding construction sector of the nation in the years ahead.

In terms of regional expansion, the North American countries have gradually emerged as one of the most profitable growth terrains of the global silanes market. Owing to the ever-growing electronics sector in the region coupled with proactive research programs being undertaken by crucial industry players, the demand for silanes in this region has increased over the last few years. For the record, silanes are being widely utilized as a critical component of photovoltaic cells, circuit boards, electronic chips, and semiconductors, etc.

Moreover, silanes are being highly preferred in the manufacturing of solar cells which are, in turn, utilized for solar energy power generation. Due to its technological prowess, environmental conditions, and technical expertise, the North American nations have the world’s largest solar installations. In fact, as per the latest data from the Solar Energy Industries Association and Wood Mackenzie Power & Renewables, the U.S. has recently surpassed 2 million solar installations and is expected to exceed the 4-million mark by 2023. Apparently, these numbers are a testimony to the fact that the North America silanes market size, which was valued at USD 500 million in 2017, would expand at an exceptional pace in the forthcoming years.

With respect to the competitive hierarchy of silanes industry, the major players include Gantrade Corporation, Momentive Performance Materials, Tokyo Chemical Industry, Air Liquide, Evonik Industries, Dow Corning. A few of these companies are focusing on making substantial investment to construct new research centers and refine the silane technology. For instance, Evonik Industries recently announced to have constructed a new silanes competence center at its Rheinfelden facility.

As the demand for innovative specialty silanes is increasing across various end-user verticals, the launch of new research centers by industry players would benefit the overall silanes market outlook in the forecast years. Moreover, the increasing pace of solar energy deployment and construction of energy-efficient buildings would undoubtedly favor the growth prospects of silanes industry. Reportedly, worldwide silanes market size is expected to surpass an impressive figure of 3.9 billion by 2024.