NiTi-based Shape Memory Alloys Market share to garner significant proceeds by 2025, rising automotive part sales to boost industry growth

Publisher : Fractovia | Published Date : 2019-06-04Request Sample

Rising complexity and regulatory stringency in the automotive, biomedical & construction sectors have fueled shape memory alloys market lately. The material is renowned for key properties like superelasticity and the ability to return to its original shape after deformation when subjected to a specific transition temperature. This unique behavior is explored across several technological and industrial applications where capacity for strain recovery is a vital design parameter. Government initiatives, favorable policies, heavy investment from market leaders and rising expenditure has also augmented the product demand and is anticipated to drive shape memory alloys industry growth over the coming years.

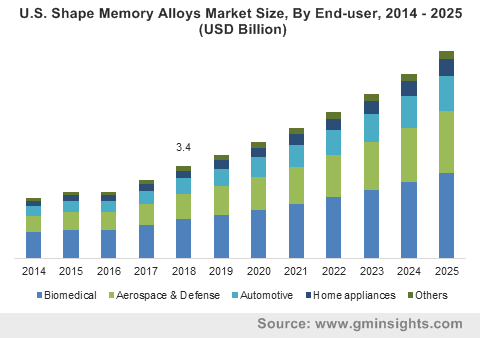

U.S. Shape Memory Alloys Market Size, By End-user, 2014 – 2025 (USD Billion)

Expansive growth of the APAC automotive sector and its impact on the shape memory alloys market share

In today’s automotive market scenario there is a growing demand for safer, more comfortable and high-performance vehicles, requirements that have encouraged automakers to adopt smart design materials in their upcoming vehicle fleets. Shape memory alloy is one such material that has found increased application in automotive bumper beams as it can absorb the accidental kinetic energy by deflecting low-speed impact or deforming during high-speed vehicle crash.

In order to reduce packaging requirements and costs of production, automakers are employing SMA based wires in vehicle door locking system to contract and expand latches more easily to activate their locking function. Additionally, use of Ni-Ti shape memory alloys is preferred due to high strength, high electrical resistivity, easy workability, excellent corrosion resistance and large recovery strains.

Regionally, the Asia Pacific shape memory alloy market is expected to grow on account of the presence of large number of leading auto part manufacturer in the region. Countries like India and China have registered record high sales of vehicles. Meanwhile, both domestic purchase & export of vehicle components have increased significantly in the past couple of years, which is likely to augment product adoption and consequent expansion of the shape memory alloys market over the coming years.

Citing potential growth, reports from India Brand Equity Foundation (IBEF) claim that that the country’s engine & exhaust components, along with body & structural parts segment is expected to make up 50% potential sales in the domestic and export space by 2020. Meanwhile, the Indian auto-components industry is expected to record US$100 billion by 2020 following strong exports ranging between US$80-100 billion by 2026. Such strong growth indicators in the auto industry coupled with the need for advanced materials in the manufacturing of automobiles will act as potent drivers for the expansion of shape memory alloys market share from the automotive industry over 2019-2025. Indeed, estimates claim that the automotive sector will account for 15% of the market share by 2025.

NiTi shape memory alloys market to gain increased traction via surging demand from the biomedical sector

Currently, shape memory alloys (SMA), particularly nickel-titanium alloys (NiTi), are extensively used as biomedical implants primarily owing to characteristics like original shape-recovering capability offered after large deformations are induced by mechanical load as well as the ability to maintain a deformed shape until heat is induced to transform back to original shape. Apart from biological factors, the bone healing process strongly relies on the mechanical properties exhibited by such implants.

Custom made NiTi-SMA, with a transition temperature of around 45-50°C, could reduce the impact of the heating process and further expand this concept to novel medical applications like anchoring or expansion and compression of implants or devices. Rising cases of bone injuries and fractures across North America will further boost the regional shape memory alloys industry growth in the region. For instance, nearly 6.3 million bone fractures occur annually in the U.S., while the condition is slated to be one of the most common orthopedic problems in the country, forcing over 6 million Americans to seek medical attention each year, claims America Law Center reports. Since NiTi SMAs can essentially “remember” its original shape, unlike stainless steel wires that tend to lose tension and lead to improper fracture recovery, the shape memory alloys market is expected to amass substantial proceeds through biomedical application of the material.

Shape memory alloys are increasingly used in automobile and biomedical sectors. Increasing number of vehicle sales in the APAC and rising cases of bone injuries in U.S. will thus drive the demand of SMAs in the upcoming years. Furthermore, reports suggest that the shape memory alloys market would exceed USD 20 billion by 2025.