Secondary Alkane Sulfonate (SAS) Market to collect substantial revenue from household detergents & cleaners, APAC to drive the regional landscape over 2016-2024

Publisher : Fractovia | Published Date : 2017-07-03Request Sample

Secondary alkane sulfonate (SAS) market will grow exponentially owing to the shifting focus of the consumers toward cleanliness. Hygiene and cleanliness are after all, the key factors that drive the food and beverage sector. The F&B sector has been expanding rapidly across the globe, with shifting consumer preferences toward packaged meals and aerated drinks. Secondary alkane sulfonates are prominently used for dish washing across the F&B sector, which in turn, will influence secondary alkane sulfonate industry size considerably. According to Global Market Insights, Inc., “Worldwide secondary alkane sulfonate market was worth USD 900 million in 2016 and will surpass a revenue generation of USD 1.3 billion by 2024 with a CAGR of 5% over 2016-2024.”

Subject to some of the noteworthy product characteristics such as superior foaming capability, excellent water solubility, significant oil and grease separation ability, and notable wetting action, SAS is extensively used as a prime ingredient in detergents, which will stimulate secondary alkane sulfonate industry share. Owing to the product’s excellent chemical stability and solid surfactant nature, it is prominently used in highly acidic environments. Its highly significant properties have led to its surging usage in the manufacturing process of industrial and household detergents. SAS offers noticeable cleaning, emulsifying, and washing characteristics, which will favorably boost secondary alkane sulfonate market size over the years ahead.

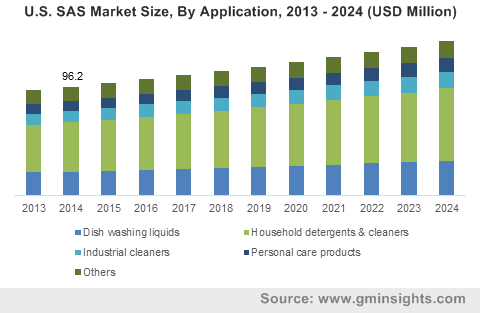

U.S. SAS Market Size, By Application, 2013 - 2024 (USD Million)

Asia Pacific secondary alkane sulfonate market covered more than 40% of the regional contribution in 2016 and will collect significant revenue by the end of 2024. The exponentially increasing population across the region coupled with the increasing per capita income and subsequently changing lifestyles will fuel the demand for personal care products and household detergents. This, in turn, will augment the industry growth favorably. Supportive initiations taken by the government to promote industrialization will further stimulate secondary alkane sulfonate (SAS) market.

Leading industry giants have been utilizing such cleaners prominently to remove dyes caused by oil and grease. This usage is primarily derived from the need to maintain an environment friendly atmosphere. Secondary alkane sulfonate market size from industrial cleaners will collect significant revenue by 2024 with a CAGR of 4% over the coming seven years. Growing industrialization across the globe will also fuel the demand for the product notably.

North America SAS market is slated to generate considerable revenue with an annual growth rate of above 3.5% over 2016-2024. The product is extensively used in personal care products and household detergents. The surging need of personal care products, dish washing cleaners, and industrial cleaners will propel SAS market trends.

Household detergent and cleaners accounted for more than 40% of secondary alkane sulfonate industry share in 2016 and will collect considerable revenue by 2024. Pertaining to the product’s anionic nature, it is essentially used in detergents and cleaners. The escalating requirement of the product for domestic applications such as cleaning and washing will contribute toward the expansion of SAS industry. In addition to this, the increasing awareness about health and hygiene among the consumers across the globe has led to the adoption of detergents and cleaners, which in turn, will enhance secondary alkane sulfonate (SAS) market share substantially.

Growing consumer inclination toward healthy living standards is substantially increasing the market demand from personal care applications. Secondary alkane sulfonate market size from personal care products will generate a considerable revenue by the end of 2024. Due to superior moisturizing, emulsifying, and foaming nature, the product is primarily used in cosmetic products such as shaving creams, shampoos, and soaps. As per estimates, the global cosmetic industry collected a revenue of USD 220 billion in 2016.

Most of the market players are increasing their production capacity to fulfill the global demand for this product. The key participants in secondary alkane sulfonate (SAS) market are Clariant Corporation, Acar Chemicals, BIG SUN Chemical Corporation, The WeylChem Group, Lanxess AG and Rajvin Chemicals Pvt Ltd.