Rigid spray polyurethane foam market revenue to cross the billion-dollar milestone by 2024, global drive for energy conservation to fuel the industry growth

Publisher : Fractovia | Published Date : 2018-04-06Request Sample

In the last half decade, energy efficiency has become a major goal across myriad verticals, on the basis of which rigid spray polyurethane foam market also seems to have gained significant traction. In compliance with the local and state jurisdiction to build more energy efficient buildings, construction material manufacturers in particular, have delved deeper into developing products that can meet the rising standards of energy efficiency. Rigid spray polyurethane foam undoubtedly, has emerged as one such product that can enhance building envelop insulation.

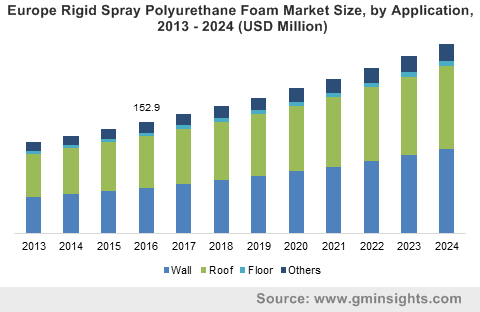

Europe Rigid Spray Polyurethane Foam Market Size, by Application, 2013 – 2024 (USD Million)

Estimates state that an inefficient building insulation system results in 40% of energy loss. Rigid spray polyurethane foam however has proved to be efficient in resisting air leak and providing effective thermal insulation. This in consequence helps to neutralize half of the building’s energy loss, as estimated by the U.S. Department of Energy. As energy efficiency standards are anticipated to be continuously raised by regulatory bodies, rigid spray polyurethane foam market will witness increased growth with architects preferring the product as a one-step solution to energy loss mitigation.

With energy efficient buildings becoming the norm of the future, it is irrefutable that rigid spray polyurethane foam industry will play a big role in the achievement of zero net energy in buildings. Rigid spray polyurethane foam has high insulating R-value that would help in attaining the construction of thinner walls and roofs while increasing space utilization and optimizing energy efficiency. In addition, the material also helps in noise insulation, making it ideal to be used for walls. Verifiably, rigid spray polyurethane foam industry size from wall applications recorded a valuation of $250 million in 2016.

The application of rigid spray PU foams in roofs has also become highly popular, owing to the fact that it renders the roof seamless, adhered to a wide variety of substrates. Resistance against water leakage and the ability to contain water leakage, if any has also encouraged the increased use of spray foam in roof applications. It is prudent to mention however, that despite appreciable growth prospects, the roof application of rigid spray polyurethane foam market may face constraints on account of the rising popularity of open cell spray polyurethane foam. This may be due to the fact that the latter exhibits better ability to prevent cracks on roofs.

However, these foams drastically reduce interior damage, cost of repair, and roof replacement costs as well, due to easy reapplication and renewable solutions. On these grounds, it comes as no surprise that roofs accounted for 45% of the overall rigid spray polyurethane foam market share in 2016.

The preferable properties of rigid spray polyurethane foam like low density structure, remarkable strength, dimensional stability, low moisture, and vapor transmission have made the material indispensable in the construction arena. Manufacturers of insulating products have widely applied rigid SPF for enabling thermal insulation as a self-supporting material that can be combined with a wide range of substrates without any need of additional adhesive. On these grounds, rigid spray PU has found extensive applications in both commercial and residential buildings.

Elaborating on the aforementioned pointer, it is imperative to state that rigid spray polyurethane foam is widely used in the fabrication of various categories of steel faced commercial building panels. Application spaces range from warehouses and airports to high tech offices and cold storage buildings for food and beverages industry players. In fact, commercial buildings accounted for 30% of rigid spray polyurethane foam market share in 2016. A pivotal reason why this material is typically preferred for insulation in commercial buildings is that the external building cladding can be left in place and the lightweight insulating material does not require any reinforcement of the external structure.

Rigid spray polyurethane foam is synthesized from MDI and TDI, which are petroleum derived feedstocks. MDI and TDI are derivatives of benzene which in turn is derived from crude oil. This indirect derivation from crude oil is likely to have a slightly negative impact on rigid spray polyurethane foam market trends in light of supply-demand gap and fluctuating price of crude oil. Political unrests and embargo on crude oil supply may also undesirably transform rigid spray polyurethane foam industry outlook. Despite the proposed hindrances, rigid spray polyurethane foam market is expected to witness substantial expansion in the ensuing years. The insulating and energy conserving capabilities of the material have been forecast to overcome the challenges posed by the oscillating prices of the product. Indeed, Global Market Insights, Inc., claims the overall rigid spray polyurethane foam industry size to expand at a CAGR of 6.5% over 2017-2024.