Surging plant protein demand to fuel rice protein market growth over 2017-2024, Europe to majorly influence the regional landscape

Publisher : Fractovia | Published Date : 2017-08-16Request Sample

Rice protein market is extensively characterized by novel product launches and lucrative mergers & acquisitions by major corporations. For instance, in August 2017, Bounce, a leading healthy snack making firm based in Australia, has introduced a new kind of vegetarian & plant-based protein product. As per reports, lactose & gluten free brown rice proteins and peas along with easily digestible amino acids are the key product ingredients that are apparently expected to enhance the nutritional value of these protein balls. Bounce is renowned to have always provided its consumers with a delicious and nutritious diet through the introduction of new food flavors. Even a considerable amount of time back, the company had launched food products such as almond kale and cashew peanut, which contained over 8.5 gm of plant proteins as well as minerals and vitamins as some of its most vital functional ingredients, thereby creating a lucrative growth path for rice protein market.

Another instance of an effective product launch in rice protein market is of Fry Family Food introducing a new, healthy-range burger. Fry Family Food, a plant protein food manufacturing brand based in the UK, had launched a new burger comprising brown rice & soy proteins as well as gluten-free quinoa. These new products, which are rich sources of vitamin B12, are expected to create lucrative business avenues for rice protein industry players. The launching of this innovative product marks an important addition to the product portfolio of the firm. Global Market Insights, Inc., reports that rice protein industry revenue, worth USD 60 million in 2016, is anticipated to surpass USD 115 million by 2024.

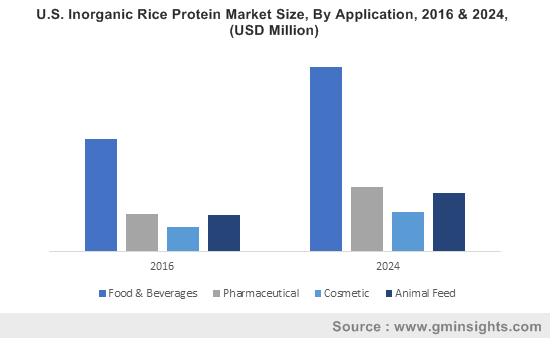

U.S. Inorganic Rice Protein Market Size, By Application, 2016 & 2024, (USD Million)

The food & nutrition sector, in 2015, had witnessed a slew of mergers & acquisitions. For instance, Whitewave Foods, a consumer driven packaged food & beverage firm based in the U.S., had acquired Vega, a plant protein based powder & bar producer based in Canada, for USD 550 million. In yet another important strategic move, Glanbia Plc, a global nutrition group headquartered in Ireland, had acquired thinkThin LLC, a leading U.S. based manufacturer of protein rich bars, for USD 217 million. These acquisition deals are expected to play a significant role in positively influencing the revenue of rice protein industry over the next few years.

In what seems to be a major breakthrough in the rice protein industry, in 2016, the Food & Drug Administration had approved the first GRAS (Government Receipt Accounting System) classification of Axiom foods for its medically researched Oryzatein® organic brown rice protein constituent. The firm’s Vegotein pea protein was also provided with a GRAS classification. This move is aimed at reducing the use of soy & whey proteins and replacing it with plant proteins as a best & appropriate substitute. For instance, General Mills had introduced a new project - 301 Incorporation, which made heavy capital investments in Beyond Meat, a plant-based meat producing firm in the U.S., whose main objective is to curb the consumption of animal protein through the production of plant protein based food products along with promotion of vegan-friendly diets across the globe.

Speaking in the terms of regional landscape, rice protein market is slated to establish its presence across key geographies – Europe, North America, Latin America, and Asia Pacific. As per analyst predictions, Europe rice protein industry is set to expand at a rate of 7% over the coming seven years. The industry growth curve across the region is likely to incline toward the positive axis subject to the escalating consumer preference toward allergen & gluten free food items. Germany inorganic rice protein industry, which is set to record a CAGR of 4% over the coming years, will also spur the regional growth.

U.S. hydrolysate-based organic rice protein market is expected to contribute more than USD 1.5 million towards North America industry over the coming timeline. An increase in the application of hydrolysates across weight management, sports nutrition, and infant food sectors is forecast to boost the product demand across the region.

Regulations favoring the use of organic products along with extensive organic rice farming activities will impel the development of rice protein industry in Brazil, which is predicted to register a CAGR of more than 9% over the years ahead. The growing consumer trend toward the intake of a nutritional diet along with implementation of healthy food practices will enrich the growth of rice protein industry across China.

Global rice protein industry size is highly competitive with major players trying to accrue maximum gains through high R&D investments, product innovations, and joint ventures. Axiom Foods, Shafi Gluco Chem, Golden Grain Group Limited, Nutribiotic, RiceBran Technologies, AIDP Incorporation, Nutrition Resource Incorporation, and North Coast Naturals are the major participants who will make notable contributions toward rice protein market share.