APAC resin capsule market to emerge as a major regional ground over 2019-2025

Publisher : Fractovia | Published Date : 2019-08-02Request Sample

Increased demand from mining and construction sectors is expected to drive resin capsule market trends over 2019-2025. The growth of mining sector in APAC region with the contribution of India and China will help to expand resin capsule market size. The use of resins, such as acrylic, epoxy, polyester, in sectors like construction for flooring, roofing, etc., will also help augment the industry outlook over the forecast years.

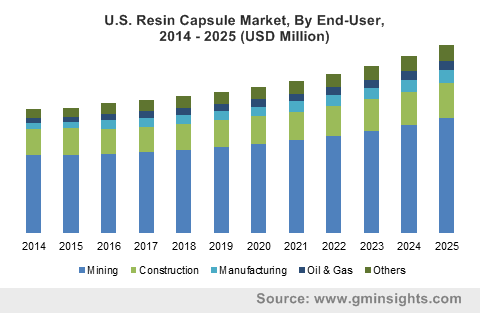

U.S. Resin Capsule Market, By End-User, 2014 - 2025 (USD Million)

Acrylic resins are prominently used in industrial paints, either as solvent-borne paints or as water-borne emulsion paints. Due to their excellent weatherability and durability as coating materials, they are used extensively in applications such as architectural, plastic and automotive coatings. Acrylic product segment in resin capsule industry contributed to revenue share of more than $120 million in 2018. Acrylic resin capsule market has been forecast to grow with a protuberant CAGR over 2019-2025.

Another product segment is epoxy resins which has its applications in a wide array of industrial and consumer products. It possesses toughness, strong adhesion, chemical resistance and other specialized properties. Water-based epoxy paints dry quickly, providing a tough, protective coating and thus are used in building and construction applications. Water based catalyst demand is anticipated to grow and garner higher CAGR over the times to come.

Significantly growing construction industry is predicted to have positive influence on resin capsule market outlook due to comparatively very low setting time of resin. Construction is expected to be one of the most dynamic industrial sectors in the coming times. The volume of construction output is expected to grow by 85% to reach approximately $15.5 trillion worldwide by 2030, with three countries, China, India, and the U.S., leading the race and being responsible for 57% of worldwide growth. The use of resin capsules for anchoring bolts into concrete, roofing, flooring etc. will help to augment the resin capsule industry growth.

Construction segment in APAC region has been immensely accelerated by the infrastructure development of India, a trend which will help to propel the growth of resin capsule industry over 2019-2025. In 2018, infrastructure sector of the country noted venture capital and private equity investments worth $1.97 billion. The Government of India has offered a massive boost to the infrastructure sector by allocating INR 4.56 lakh crore (US$ 63.20 billion) for the sector. Foreign Direct Investment (FDI) obtained in Construction Development sector from April 2000 to March 2019 stood at $25.05 billion. Such investments and steps taken by government in India are likely to accelerate growth of APAC resin capsule market.

Besides the construction segment, India will also hold a significant share in mining sector that will in turn augment the growth of resin capsule market. India possesses 1,531 operating mines and produces over 95 minerals. The industry accounted for around 2.9% of the total gross value added (GVA) in 2017-18. India is forecast to become the second largest steel consumer by end of 2019 and per capita steel consumption is expected to rise from 69 kg to 160 kg by 2030.

Likewise, China also plays a significant role to increase the revenue share of resin capsule market by contributing to mining sector. China is the world’s largest producer of gold, coal, and most rare earth minerals. It is the world’s leading consumer of iron ore and thermal coal accounting for about 58% and 49% of global demand, respectively. Resin capsules are used in mining for roof and wall support bolting. Owing to the high mining output in Asia, over 50% share in resin capsule industry was reported by Asia Pacific in 2018 and is expected to grow with a CAGR of 5.7% over 2019-2025.

The U.S. will also emerge to be a significant growth ground in the coming years, supporting resin capsule market expansion. In 2017, Mexico manufactured 4.3 million tons of the several resins, with PVC, HDPE, and PET accounting for up to over 50% of these resins. Even with the capacity of Mexico for resin production, a similar amount was imported from the U.S., reaching 4.2 million tons. U.S. exporters to Mexico participate in a market worth over $30 billion, with opportunities for the U.S. to consistently partake in the sale of resins, capital equipment, plastic parts, and plastic materials. Such a huge market and growing production and imports will help the U.S. resin capsule industry to expand its revenue share over 2019-2025.

Several resin capsule industry players have been undertaking strategies like mergers, collaborations, acquisitions etc. to expand their footprint across the globe. For instance, an adhesive resin and resin capsule provider company DSI Underground Australia recently announced that it has acquired the Fero Group (Fero). The anti-corrosion products and services provider company serves the mining, oil and gas, civil, commercial, marine, residential, and industrial sectors. With the acquisition, DSI will be able to invest further in innovation and developments to continue driving effectiveness and safety across the mining sector. Such acquisitions will contribute to enhance resin capsules market share through mining sector.

With considerable contribution made towards the growth of global resin capsule industry by construction and mining sectors, Global Market Insights estimates resin capsule market share to surpass $1.07 billion by 2025.