APAC recycled metal market to amass sizable gains by 2025

Publisher : Fractovia | Latest Update: 2019-06-27 | Published Date : 2018-08-22Request Sample

Powered by the rising environmental sustainability trends, recycled metal market has established itself as one of the most lucrative business spheres in the polymer industry space. The fraternity has observed a drastic makeover with the changing perspective toward scrap metals, which were earlier considered nothing more than lost profit.

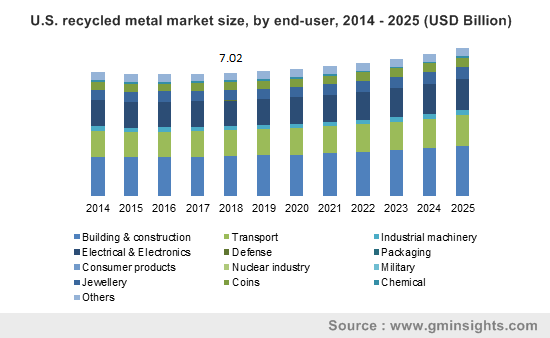

U.S. recycled metal market size, by end-user, 2014 - 2025 (USD Billion)

These metal wastes are acting as major threat to the environment contributing their bit to the growing concerns pertaining to carbon emissions. Amidst this backdrop, a slew of regulatory bodies are imposing strict regulations to reduce the emissions which is prompting the companies to turn toward ecological strategies, the foremost amongst which is the recycling approach.

Europe, in this regard, has emerged as one of the most viable growth avenues for recycled metal industry. The growth is primarily attributable to the significant initiatives undertaken by the legislative bodies in the country toward protecting the environment from hazardous wastes. One of the prominent legislations underlining the sustainability landscape of the continent is Directive 2012/19/EU, which emphasizes on promoting the recycling of electrical and electronics waste. For the record, electrical and electronics sector contributes to a major chunk of the recycled metal market end-use landscape.

The electrical and electronics sector deploys a humongous ratio of recycled metals via applications in metal plating. In fact, the approach has generated quite a momentum in this fraternity driven by its cost-effectivity. North America recycled metal industry has stood as a major beneficiary of the growing deployment of these metals in the electrical and electronics sector.

The technological proliferations in the region is further proliferating the demand for recycled metals. Both the ferrous and non-ferrous recycled metals have had a remarkable demand in this sector. In terms of commercialization, in the year 2018, recycled ferrous metal market share was pegged at USD 850 million.

Elaborating further on the regional trends, driven by the peak in urbanization and industrialization rate, the Middle Eastern and the Asia Pacific belts will also observe a massive progression pertaining to the recycled metal industry demand. The massive infrastructure spending in these regions will further trigger the product escalation graph.

Reportedly, under the Union Budget 2017-2018, India has been granted USD 55 million toward infrastructural development. As per carbonbrief.org, India’s carbon emissions were up by an estimated 4.6% in 2017. Further, China, which is renowned for its industrial growth, recently announced its plans of investing USD 2.7 trillion in transportation & infrastructure industry. As per estimates, APAC recycled metal industry is estimated to register more than 4% over 2019-2025.

These statistics not only validate the massive growth opportunities in the emerging economies but also highlight the surging opportunities of recycled metal market in the transportation and construction verticals. Not to mention, a strict regulatory landscape governs the industrial spectrum in the emerging countries, which makes these regions viable growth grounds for recycled metal industry.

Metals like carbon steel, copper, stainless steel, and aluminum are commonly used in the construction of building frameworks, drainages, bridges, roofing and various others. With the growing rate of urbanization that has surged the need for more buildings and infrastructural development and the expanding construction equipment market, the construction sector is likely to contribute massively to the recycled metal market.

Serving as an ecological source for countless applications and touted as a rather cost-effective approach as compared to manufacturing, the recycled metals market is projected to carve a profitable roadmap in the coming years. The competitive landscape is inclusive of players such as Steel Dynamics, ELG Haniel Gmbh, European Metal Recycling, Sims Metal Management, Schnitzer Steel and Novels and Nucor Corporation. In terms of profitability, the overall recycled metal industry is anticipated to surpass USD 85 billion by 2025.