Europe recycled glass market to witness phenomenal gains over 2018-2025, region procured more than half of the product share in 2017

Publisher : Fractovia | Published Date : 2018-07-24Request Sample

With the environmental sustainability getting largely threatened by the increasing stockpiling of glasses in landfills, recycled glass market is certainly a force to be reckoned with in the global economy. As per estimates, in the year 2017, glass bottle disposal in Malaysia was close to 521 metrics per day, which led to a huge deterioration in the regional air and soil quality. The scenario is indeed synonymous across the globe, vividly evident from the increasing rate of GHG emissions. Reportedly, more than 0.5-0.8 EJ energy is used for glass production globally. The energy used in producing the container and flat glass leads to about 50-60 Mt carbon emissions annually. Backed by the fact the glass forms a major model of the circular economy, recycled glass industry can be touted as one of the most opportunistic growth grounds in the sustainable ecosphere.

Germany recycled glass Market Size, by Type, 2014 – 2025 (USD Million)

As per the U.S. EPA, in 2013, 41.3% of beer and soft drink bottles, 15% of food and other jars, and 34.5% of wine and liquor bottles were recovered for recycling. Out of this, 34% of the overall containers were recycled which led to a huge impact on environment with reference to the abatement of GHG emissions – a figure equivalent to taking 210,000 car units off the road annually.

In yet another reliable study, it was claimed that proper recycling of overall building glass waste could prevent close to 925.000 tonnes of landfilled waste annually. This would also save more than 1.23 million tonnes of primary raw materials. These statistics stand strong enough to validate the synonymous impact of recycled glass market on the global economy as well as the environment sustainability.

Europe recycled glass market stands tall in the global hierarchy – The recycling rate in Europe was approximately 74% in 2017

Europe having reigned supreme in recycled glass market in 2017 in terms of product demand is likely to retain its position as one of the strongest regional contenders in the coming years. The regional market is extensively characterized by a plethora of regulatory initiatives with regard to collection and treatment of building glass waste. Not to mention, the private entities across Europe are also contributing immensely toward the expansion of recycled glass demand.

Sweden stands tall in the Europe recycled glass market landscape and is expected to account for a market share of more than USD 6.9 million by 2025. The Sweden government has played a pivotal role in proliferating the industry trend, backed by its zero-waste future mission by 2020. The country has been renowned for importing waste from Norway, Italy, UK, etc. to recover more energy from the waste.

Below is an outline of how the European recycled glass market would progress, with regulatory landscape as a frame of reference:

- The European Commission has mandated essential norms with regards to improvement in cullet quality, which plays a vital role in shaping Europe recycled glass industry trends. The EU regulation 1179/2012 has specifically categorized when a cullet should be considered as waste under the Directive 2008/98/EC of the European Council.

- Europe Producer Responsibility Obligation Regulation’s recently introduced PRN (Packaging Recovery Note) in conjunction with Climate Change Levy has further emphasized on improving the cullet quality for a considerable reduction in energy consumption. In addition, the environmental legislation relating to Pollution Prevention and Control further compels glass companies to increase the utilization of recycled product, which in turn has provided significant impetus to Europe recycled glass market.

Despite a plethora of growth opportunities, material contamination in the waste recycling process remains a major concern for the industry players. The penetration of these impurities in the process largely impacts the financial benefits of the recycling methodology, ultimately hampering the efficiency, affordability, and quality quotients.

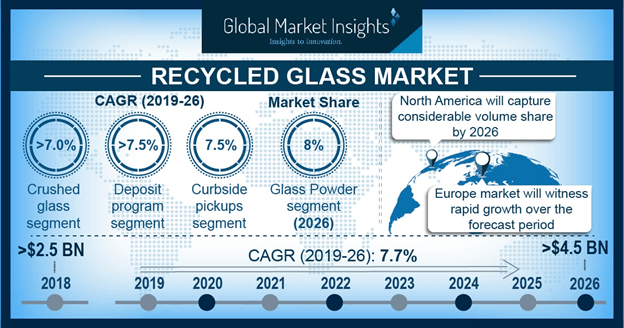

Nonetheless, the incessant efforts by the recycled glass market players toward designing efficient collection and production strategy in tandem with the increasing consumer awareness toward adopting the recycling technology approach will carve a lucrative roadmap for the recycled glass industry in the coming years. Global Market Insights, Inc. forecasts this industry space to surpass a valuation of USD 4.4 billion by 2025.