PV inverter market to attain commendable proceeds from on-grid connectivity, rising number of RE initiatives undertaken by regional governments to impact the industry trends over 2018-2024

Publisher : Fractovia | Latest Update: November 2018 | Published Date : January 2017Request Sample

Over the past few years, the growing impact of renewable energy installation across the globe has ushered lucrative trends for PV inverter market players. Given the robust commercialization scope of this vertical, the core industry players are continuously seen expanding their global reach, in turn favoring the growth of PV inverter market. A recent instance bearing testimony to the same is of prominent PV inverter manufacturing company, Sungrow Power Supply making it to the headlines for establishing a new subsidiary in Dubai, UAE, as it aims for business expansion in the region.

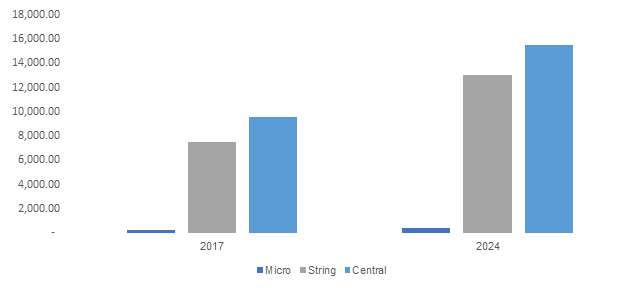

North America Photovoltaic (PV) Inverter Market Size, By Nominal Output Power, 2017 & 2024 (USD Million)

The PV inverter manufacturing company reported that the Middle East and Northern Africa (MENA) market has huge growth potential and is growing rapidly with 12 GW of utility-scale solar contracts. Recent market studies further reveal that 21 GW is likely to be installed in the pre-contract phase, in turn creating huge space of PV inverter market players to source lucrative growth avenues.

Speaking along similar lines, as a technology pioneer in the global PV inverter industry, Sungrow showcased its leading 1500V product portfolio, turnkey station SG3400HV-MV, and the string inverter SG125HV at the Vietnam Solar Energy Summit 2018. This has helped the companies alike to receive many contracts across myriad geographies to install PV inverter that reduces overall costs and help in overall renewable energy targets. Such growth strategies adopted by the companies to expand their business faster is expected to support the overall PV inverter industry trends.

If reports are to be believed, the rising monetary funding and governmental support in terms of schemes such as feed in tariff, net metering, and subsidiaries to promote the establishment of innovative projects have been the key enablers for healthy business growth. In fact, over 75% of the global photovoltaic industry growth in 2017 was attributable to the financial incentives, 14% through net metering and 5% from the competitive tenders across the globe. Quite overtly, the governmental support for deploying off-grid electric networks for micro grids and renewable energy projects have paved way for the robust demand of PV inverters. Owing to these increasing electrification programs, it is prudent to mention that, the on-grid PV inverter market has been projected to register a significant CAGR of 9% over 2018-2024.

Impact of China’s solar deployment cut on global PV inverter industry players

The Chinese government’s latest decision of curtailing the distributed generation & utility scale PV deployments has not only surprised the entire industry, but has also fuelled a significant decline of inverters and modules. Several international companies including Jolywood, Sungrow, Tongwei, and Risen Energy have reported that their financial performance had been negatively impacted by the new deal, because of the tremendous decrease in regional PV installation in the Q3 of FY2018. China, for the record, has been one of the biggest investment grounds for potential industry players. The latest move, however, is expected to support the domestic PV inverter, wafer, module, cell, mounting system manufacturers, given the vast scale of renewable energy & micro grid projects in China.

Amid China’s solar deployment cuts, industry analysts predict that Singapore, U.S., Germany, UK, and India will emerge as vital renewable energy hotspots that are committed toward the generation of greener & cost-effective energy solutions, propelling the overall industry growth in the ensuing years.

All in all, the increasing dependency on renewable energy from solar, hydropower, and wind, coupled the supportive regulatory stance for energy transformation from regional governments have been undeniably generating lucrative growth opportunities for the PV inverter market participants. Further driven by strong product innovation trends, the commercialization matrix of PV inverter market is expected to nothing but proliferate in the ensuing years. A presumption validating the same is of Global Market Insights, Inc., that claims the global PV inverter market size to hit USD 11 billion in terms of the remuneration by 2024.