Portable air compressor market to be characterized by advanced product developments

Publisher : Fractovia | Published Date : 2018-05-23Request Sample

An inherent vertical of the HVAC and construction space, portable air compressor market has carved out a lucrative growth path for itself in the last few years. Taking into account the growing applicability of these products, esteemed compressor manufacturers have been working to launch a range of novel air compressors in the market.

U.S. Portable Air Compressor Market Size, By Application, 2013 – 2024 (USD Million)

Concentrating particularly on the compression capacity, light weight, compact size, and cost-effectiveness, companies have been striving to develop innovative versions of portable air compressors. The surging demand for these advanced products for construction equipment and machinery is thus slated to augment portable air compressor industry trends in the ensuing years.

Given the extensive deployment of these machines in the construction sector, construction machinery manufacturers have lately been signing contracts with leading compressor developers that has offered a plethora of growth opportunities for portable air compressor industry giants. Numerous firms have also been attempting to expand their regional reach in portable air compressor market.

In 2018, the Saudi Arabia based leading rental equipment provider, Ejar Cranes & Equipment (L.L.C) signed a USD 2.3 million deal with Doosan Portable Power (DPP) at Paris. Through this deal, DPP will supply 50 portable air compressors, which can be installed on Ejar’s welding machines, lift trucks, trucks, cranes, and many other fleets of compressors. In the coming years, Doosan will provide back-up support and services to this Saudi Arabian leasing giant which can turn out to be quite lucrative to strengthen its stance in portable air compressor market.

Doosan’s deal with Ejar may turn out to be highly profitable for MEA portable air compressor industry as well, given that compressed air is deployed liberally for drilling equipment, construction equipment, sandblasting, and oil & gas operations in the region. MEA has also witnessed extensive investments in oil & gas exploration activities, that would help to further propel the regional portable air compressor industry outlook.

Myriad firms across the electronics, pharmaceuticals, and food & beverages sectors, for a while now, have been on the look-out for sensitive compressed air for oil-free compressors. In accordance, portable air compressor market giants are increasingly focusing on the development of products for dedicated oil-free plant air & back-up oil free air, which will further boost oil free air compressor market size.

Recently, portable air compressor industry contender Sullair launched an oil-free air compressor incorporated with the latest emission technology. This newly developed product has been coated with FDA approved food-grade PTFE and is specially designed for oil-free operations. The PTFE coating helps to extend the air end life and enhances the corrosion resistant capability of the compressor as well.

Quite overtly, owing to their maintenance free and lightweight nature, oil-free compressors are becoming highly popular across numerous end-use domains. Driven by their highly impressive features and their subsequent demand, oil-free portable air compressor market size is expected to record a decent CAGR over 2019-2025.

On-going research and development activities focusing on the design of air compressors are leaving a remarkable influence on product demand. Air compressor manufacturers are increasingly introducing new units with which they are looking forward to retaining their dominance in portable air compressor industry. The launch of compact, lightweight, and technology-assisted air compressors is becoming more and more popular, fueling the commercial graph of portable air compressor market.

The competitive hierarchy of portable air compressor industry, apart from innovative product developments, is also characterized by mergers and acquisitions. For instance, in 2017, Hitachi purchased Sullair’s portable air compressor business for entering into North America portable air compressor market. With the partnership, Hitachi plans to strengthen its air compressor portfolio by acquiring Sullair’s large consumer base.

As core companies continue to brainstorm creative business strategies for strengthening their global footprint, portable air compressor industry outlook will witness a dynamic transformation in the years to come.

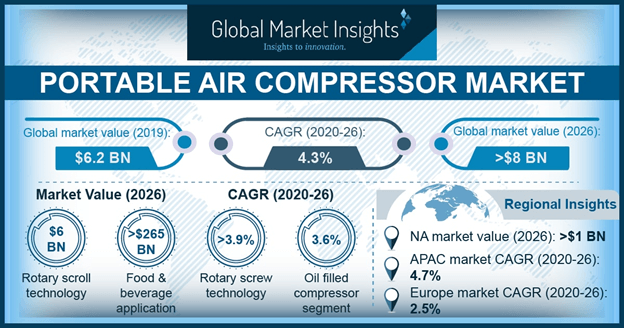

The extensive growth of the pharmaceutical and food & beverage sectors will also have a vital role to play in augmenting portable air compressor market trends, as these industries continuously demand healthy and safe air compressors. This has been providing additional growth opportunities for core players, as both these verticals are strictly regulatory driven. Having recognized the immense potential this business space holds for myriad end-use domains, Global Market Insights, Inc., predicts portable air compressor market to generate a revenue of more than USD 9 billion by 2024.