Global Polyurethane (PU) market share to touch USD 77 billion by 2023

Publisher : Fractovia | Published Date : 2016-10-24Request Sample

Polyurethane (PU) market size worth USD 51.5 billion in 2015, is predicted to reach USD 77 billion by the end of 2023. Growing global concerns about carbon emissions coupled with rising significance about energy conservation are the key factors expected to promote the market growth. Polyurethane finds its applications in automotive, electronics, construction, packaging, furniture & interiors, and footwear industries owing to its excellent performance and light weight features.

Construction applications are predicted to dominate the applications segment in the next few years owing to the extensive use of rigid foams as flooring materials, sealants, and insulators in homes to reduce power consumption.This, in turn, is expected to increase the product demand in the next few years stimulating the application growth. In addition to this, government initiatives to encourage the infrastructure growth in countries like Mexico, Brazil, and India is predicted to encourage the use of polyurethane in construction applications.

India polyurethane (PU) market size, by product, 2012-2023 (KT)

Automotive applications segment worth USD 8.4 billion in 2015, is predicted to witness a noticeable growth in the next eight years owing to large PU foam applications in automotive parts like seats, armrests, instrument panels, roof liners, engine encapsulation, and cables & wires as the metal substitutes. Furthermore, polyurethane can provide maximum weight reduction in vehicles

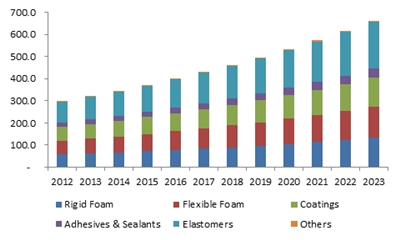

Flexible foam market was dominant in 2015 having had a worth of USD 13 billion and is predicted to grow at a CAGR of 4.7% over the period of 2015-2023. Factors such as rising gross income and changing lifestyles in BRICS countries have contributed to the flexible foam applications in furniture and automotive sectors.

Rigid foam market, contributing 4,600 kilotons in 2015, is expected to record a CAGR of 4.9% over 2016-2023. The growth can be attributed to the use of these products in insulation and construction applications to reduce carbon emissions as well as power consumption.

PU coatings market is forecast to grow at a CAGR of 5% over the period of 2016-2023. Their extensive applications in automotive, hardwood, and construction sectors is anticipated to drive the product demand. The PU elastomers market share is expected to surpass USD 14.5 billion by the end of 2023.

The Asia Pacific Market leading the overall PU market, is anticipated to contribute USD 33.5 billion revenue by the end of 2023. High demand for electronics applications due to the growing trend of sensors and circuits will drive the market growth in the region. Furthermore, heavy investments in construction applications in India and China are anticipated to promote the regional growth.

The Europe polyurethane (PU) market is projected to surpass USD 21 billion by the end of 2023. EU legislations favoring the maximum use of thermal insulations in low-income households to reduce power consumption is projected to drive the regional growth. Italy, Germany, and UK markets are predicted to contribute significantly towards the growth of the region.

The U.S. PU market size is forecast to touch USD 13 billion by 2023 owing to the increasing PU rigid foam use in thermal insulation applications to increase power conservation and energy efficiency of the buildings. Latin America, dominated by Brazil PU Market, is projected to witness noticeable growth over the period of 2016-2024. MEA PU Market, led by Saudi Arabia, will witness a surging trend over 2016-2024.

Key market players include Covestro, BASF, Foamex Innovations, Mitsui Chemicals, Dow Chemical Company, Nippon, Bayer, and Huntsman Corporation. These industry participants will try to increase their market share as well as ROI through mergers & acquisitions, product innovation, and new product launches.