Polystyrene (PS) & expanded polystyrene (EPS) market to garner substantial gains via packaging & construction applications over 2018-2025, Asia Pacific to majorly impact the industry valuation

Publisher : Fractovia | Latest Update: 2018-11-22 | Published Date : 2017-09-29Request Sample

Total’s recent launch of CX5237 has sent the polystyrene (PS) & expanded polystyrene (EPS) market in state of consistent consternation, given that this high melt strength polystyrene, designed exclusively for extruded foam packaging of food items, is endowed with the properties of light weight, cost-effectiveness, performance efficiency, and eco-friendliness. Rumored to be depicting excellent packaging performance, CX5237 has massively upscaled Total’s product portfolio, while simultaneously augmenting its position in polystyrene (PS) & expanded polystyrene (EPS) industry. Given the thermoplastic’s widespread application spectrum, it comes as no surprise that polystyrene (PS) & expanded polystyrene (EPS) market size stood at USD 35 billion in 2017.

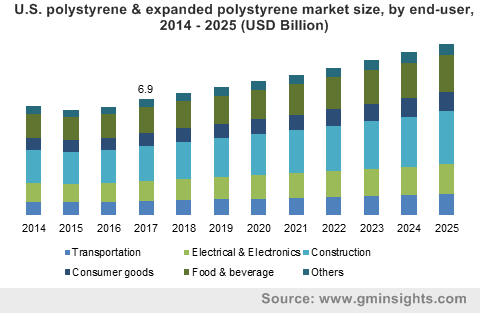

U.S. polystyrene & expanded polystyrene market size, by end-user, 2014 – 2025 (USD Billion)

Periodic breakthroughs in the field of biotechnology are expected to complement the growth map of polystyrene (PS) & expanded polystyrene (EPS) industry over the next few years. Citing a recent instance, Corbion, a giant firm across the biotechnology industry, has developed a new anti-static agent, referred as PATIONIC® polymer additives, for expanded polystyrene applications. Earlier this year, the firm introduced its newly developed product in the Middle East region during the Arabplast 2017 meet. PATIONIC® glycerol esters help in enhancing the processing efficiency of EPS beads and are perfectly suited to low density products of EPS (Expanded Polystyrene), owing to which they have garnered considerable popularity across polystyrene (PS) & expanded polystyrene (EPS) market. In addition, PATIONIC 909 minimizes the EPS bead clusters to maintain the consistency and continuity of the bead screening process, further augmenting its popularity in this business sphere.

Expanded polystyrene finds wide applications in packaging, building & construction, and electrical & electronics industries. The moisture resistance and thermal insulation property of the product has enhanced its popularity across the building & construction sector. Based on its widespread deployment across roofing and insulation applications, polystyrene (PS) & expanded polystyrene (EPS) industry share from the building & construction sector has been forecast to grow at a rate of 5% over 2018-2025. The escalating need for packaging of processed food items and consumer goods has resulted in high product penetration across the packaging sector as well, which contributed over 30% toward polystyrene (PS) & expanded polystyrene (EPS) market share in 2016.

Experts have predicted that Middle East & Africa polystyrene (PS) & expanded polystyrene (EPS) industry has immense growth potential in the ensuing years, with the regional governments lending their support for innovative product launching activities, such as the Arab Fest 2017. The Middle East may emerge as a key revenue pocket for the polystyrene (PS) & expanded polystyrene (EPS) market over 2018-2025, given the robust infrastructural development witnessed across the Gulf.

An increase in the construction spending across the countries such as China and India is expected to catalyze APAC polystyrene (PS) & expanded polystyrene (EPS) industry to quite an appreciable extent. In fact, APAC held the highest share over 40% in polystyrene (PS) & expanded polystyrene (EPS) industry.

Polystyrene (PS) & expanded polystyrene (EPS) market, unfortunately, may be constrained by certain factors. Strict legislations across the U.S., South Africa, and Zimbabwe banning the use of EPS, subject to the fact that it is a non-biodegradable polymer which can cause health and pollution issues, may restrain the industry growth. In addition, expanded polystyrene (EPS) cannot be recycled, which can further contribute towards ecological damage. As a part of their corporate social responsibility, major conglomerates have been attempting to brainstorm optimal solutions to combat the issues related to environmental damage, that may be cropping up sue to excessive PS and EPS utilization.

Total S.A., The Dow Chemical Company, SABIC Industries, BASF SE, and Kumho Petrochemical Company Limited are some of the companies comprising the competitive spectrum of polystyrene (PS) & expanded polystyrene (EPS) market. It has been forecast that these firms are likely to make appreciable contributions toward this business space, on the grounds of which they would be able to strengthen their positions in polystyrene (PS) & expanded polystyrene (EPS) industry. Global Market Insights, Inc., forecasts polystyrene (PS) & expanded polystyrene (EPS) market share to grow at a CAGR of 4.5% over 2018-2025, with a revenue projection of USD 49 billion by 2025.