How will automotive sector evolve to be a major application avenue for polypropylene fiber market?

Publisher : Fractovia | Published Date : 2019-06-14Request Sample

Growing environmental concerns and increasing adoption of light-weight materials have driven polypropylene fiber market expansion, owing to key automotive applications such as reduction of greenhouse gas emissions along reduced waste disposal. In recent years, the automotive industry has recognized the potential of polypropylene (PP) fiber composites which deliver excellent mechanical properties and moldability, suited for a variety of auto parts, including bumper facia, instrumental panels and door trims.

Lately, the environmental adaptability of PP fibers have drawn significant attention from automobile part manufacturers, suggesting considerable growth prospects for polypropylene fiber industry over time.

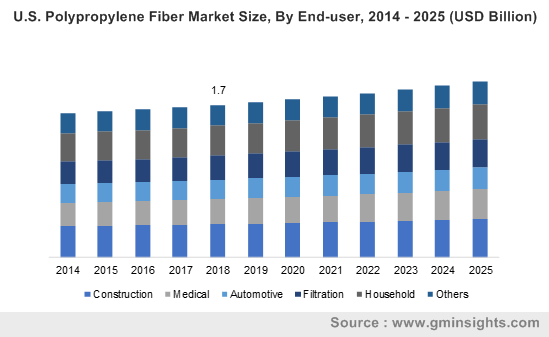

U.S. Polypropylene Fiber Market Size, By End-user, 2014 – 2025 (USD Billion)

Review of changing material trends in the automotive sector:

Over the past decades, a significant change has been observed in the usage of materials in automobiles. The main driving forces that are shifting the focus of component manufacturers are:

- Cost reduction

- Weight reduction

- Flexibility and design opportunities

Apparently, advancements to fulfill these needs and a broad range of performance requirements for automotive parts have led to several traditional composite materials being gradually replaced by PP compounds. Polypropylene fiber manufacturers have witnessed remarkable consumption by carmakers, through the production of automobile carpets, safety belts, airbags seating fabrics, door panels, insulation materials, among others.

Besides, demand for lighter parts in upcoming electric cars will undoubtedly generate substantial revenues for polypropylene fiber market.

Use of polypropylene fiber in automobile components:

1. Automobile carpets:

Carpets used in the automobiles are essentially required to be durable and free from dirt, wear, and salt corrosion. Along with this, they are expected to insulate the noise from below and have a pleasing appearance. Carpets which are made from PP surfaces offer excellent thermal and dimensional stability, along with high tear strength and processing stability.

Apparently, environment friendliness is an ongoing trend influencing automobile carpet production. In this context, lightweight carpets have been developed from recycled PP materials to reduce the total weight of the car while simultaneously addressing pollution of the environment.

Reportedly, global automotive production had crossed 95 million units in 2018, with around 70.5 million passenger cars being produced. Introduction of new models by automakers and increasing production of hybrid as well as electric vehicles will transform the automobile sector, ensuring consistent demand for polypropylene fiber industry.

2. Door panels:

From past few years, the combination of natural fiber composites and thermoplastics have been embraced by major car manufacturers for door panels, as they have potential to provide better stiffness, sound damping at low density and entail lower costs than mineral fillers and glass fibers.

For instance, these non-visible and innovative door panel elements could contain a combination of polypropylene (PP) and wood fibers, providing parts that are 20% lighter than conventional components. Several auto companies are adopting this trend for electric vehicles across major countries, including U.S., U.K. and Germany, for the development of lighter cars.

Seemingly, in the BMW i3 all electric sedan, the instrument and control panel cover and door paneling are made from kenaf natural non-woven fabric which is combined with fibers made of PP and are around 0.9 g/cm3, the lightest of all the chemical fibers. These are ideal prerequisites to meet lightweight and safety design requirements, offering a lucrative target base for polypropylene fiber industry and promising a continuous demand in forthcoming years.

3. Safety belts and airbags:

Automotive textiles play a vital role in maintaining a light weight of passenger cars and heavy duty vehicles alike, fueling polypropylene fiber market growth. The percentage of textile material used in vehicles could amount to 2.2% of the overall weight, with some of their key applications being safety belts, airbags, and fuel filters.

Due to stringent government regulations, safety devices have become increasingly important for the automotive sector. Seat belts and airbags are commonly used for safety in vehicles and according to the studies, seat belts could reduce fatal and severe injuries by 50%. Seemingly, several automotive companies are adopting polypropylene fiber over other traditional materials, together with other fibers, due to lower density, chemical resistance and low energy consumption during manufacturing.

Nowadays, especially in Europe and North America, many automotive components are made from bio-fiber composite materials which are based on polypropylene with supporting kenaf fibers. Ford Motor company in Germany is widely using kenaf fiber in its Ford Mondeo model while on the other hand, Ford North America is also broadly using kenaf fiber reinforced PP composites in their new Escape SUV model.

Owing to the substantial weight and cost reduction, combining PP fibers with other fiber materials is becoming a preferable alternative for auto part makers. Reports estimate that polypropylene fiber market is expected to surpass a valuation of USD $13 billion by 2025. Continuous developments in automotive parts manufacturing and advent of electric cars will create enormous growth opportunities for polypropylene fiber industry.