North America photoresist and photoresist ancillaries market to earn substantial revenue over 2017-2024, high demand for antireflective coatings to spur the regional growth

Publisher : Fractovia | Published Date : 2017-05-17Request Sample

The growing demand for electronic devices embedded with semiconductors will impel Photoresist and Photoresist Ancillaries Market expansion. A photoresist is used in processes such as photo engraving, to form coatings that are vital in the electronics and telecommunication sector. Photoresist ancillaries on the other hand, are used to enhance the efficiency of processes such as photolithography, which again are, crucial in the electronics sector. The growing demand for semiconductors will also expedite photoresist and photoresist ancillaries industry growth, as these products are used in the fabrication and packaging of semiconductors, integrated circuits, printed circuit boards, and flat panel displays.

Global semiconductors industry was valued at more than USD 300 billion in 2016. The growth of the semiconductor and integrated circuit market is a major driver propelling photoresist & photoresist ancillaries industry size, which was worth USD 3.5 billion back in the year 2016, and is anticipated to grow at a rate of 6.5% over 2017-2024. Subject to the fact that photoresists are used for high density wiring and packaging configurations to manufacture multi-layered semiconductors, that are embedded in consumer electronic goods such as smartphones, music players, tablets, laptops, household appliances, servers, and phones, photoresist and photoresist ancillaries market from electronics applications will witness a noticeable surge.

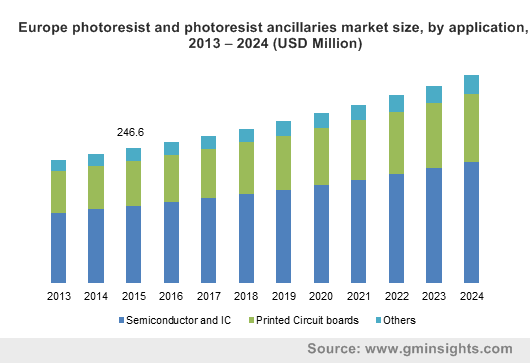

Europe photoresist and photoresist ancillaries market size, by application, 2013 – 2024 (USD Million)

Global photoresist & photoresist ancillaries industry is quite consolidated, with the top four firms holding more than 75% of the overall share. Major companies have been striving to expend their business through strategies such as increased production capacity, alliances, and increased R&D investments. For instance, the Tokyo Ohka Kogyo Company expanded their production facility in Japan. JSR Corp. entered into a strategic alliance with PERI Corporation to expand their business in South Korea.

Key companies in global photoresist and photoresist ancillaries market include FUJIFILM Electronic Materials Co., JSR Corporation, AZ Electronic Materials SA, Shin-Etsu Chemical Co., DuPont, Avantor Performance Materials Inc., LG Chem Ltd., The Dow Chemical Company, Tokyo Ohka Kogyo Co., Ltd., and Sumitomo Chemical Co., Ltd.

Photoresists and photoresist ancillaries find applications in printed circuit boards, semiconductors and integrated circuits, microelectromechanical systems, sensors, and nanoelectromechanical systems.

Photoresist & photoresist ancillaries industry from semiconductors and integrated circuits is expected to grow at a remarkable rate over 2017-2024, subject to the high demand for semiconductors.

PCBs find widespread usage in medical, defense, lighting, and automotive sectors, subject to which photoresist and photoresist ancillaries market from printed circuit board applications will grow at a substantial rate over 2017-2024.

The demand for semiconductors is heavy across the APAC region, owing to the growing electronics sector. Electronics manufacturing activities are being outsourced from developed regions like the U.S. and Europe to countries such as South Korea and China. Additionally, APAC photoresist and photoresist ancillaries industry is anticipated to grow heavily owing to the increased disposable incomes of the consumers across this region.

North American photoresist and photoresist ancillaries market size, worth more than USD 350 million in 2016, will experience a surge over the next few years subject to the consistent growth of the electronics sector and the significantly high demand for antireflective coatings.

Antireflective coatings are basically a product grade of photoresist ancillaries market. These coatings possess properties such as multiple reflection suppressions and contrast improvement which are directly proportional to the operational costs of the processes that are crucial to the electronics sector. Subject to this fact, photoresist ancillaries market size from antireflective coatings is expected to grow significantly.

Edge bead removers find extensive usage in processes such as photolithography, to help eliminate edge bead build-ups in procedures like spring coatings. Owing to its superior qualities, photoresist ancillaries industry share from edge bead removers will grow at a massive rate over 2017-2024. Ideally, photoresist ancillaries are not biodegradable and by nature, release toxic gases during when reacting with sunlight. Photoresist developers however, are an exception – these products are user friendly and environment friendly, subject to which photoresist ancillaries market from photoresist developers is forecast to register a notable growth rate over the years ahead.

Photoresist market size from KrF products was valued at USD 400 million in 2016. These products are used to manufacture microelectronic devices and will earn significant revenue over the next few years. G- and i-line products provide resolution from 0.3 µm to more than 1 µm and have the capability to function in mid-UV wavelengths, subject to which photoresist industry from g- and i-line products is forecast to grow at a steep rate over 2017-2024.

Of late, the electronics sector has been witnessing the trend of manufacturing small-sized, compact, and high performing electronic devices with extended functionalities. Pertaining to this growing trend, ArF immersion products are used to develop micro-scale and nano-scale electronic devices, which will spur photoresist market size from ArF immersion grades over the coming years.

Photoresist & photoresist ancillaries industry products are mainly solvent-based, and include stabilizers, cross-linking agents, electronic-grade solvents, surfactants, polymer resins, and photosensitive chemicals. These solvents release carcinogenic volatile organic compounds that react with sunlight to emit dangerous pollutants that harm the environment and human health. Subject to this fact, regulatory bodies such as the EPA and REACH have enforced norms regarding the usage of these solvents, which is likely to pose as a major hindrance to photoresist and photoresist ancillaries market. Companies have been undertaking numerous steps to manufacture bio-based alternatives to combat this restraint, which is likely to impel photoresist & photoresist ancillaries industry over the next few years.