Peracetic acid market to accrue much of its revenue from the F&B sector, global industry valuation to surpass the coveted billion-dollar benchmark by 2025

Publisher : Fractovia | Latest Update: 2018-12-05 | Published Date : 2017-06-30Request Sample

Increased demand for effective cleaners and disinfectants across a slew of industry verticals has fueled the peracetic acid market growth worldwide, as manufacturers and water treatment facilities realize the advantages of these chemicals. Peracetic acid is supposedly more potent than hydrogen peroxide, which is the other type of disinfectant used commonly. Chemically treating food and beverage products to eliminate microbial contamination has proliferated the peracetic acid industry over the last few years, since food safety has become a prime subject among regulators. As the global population is rising at an unprecedented rate and will certainly propel the demand for various types of beverages, the peracetic acid market will experience tremendous boost in revenues.

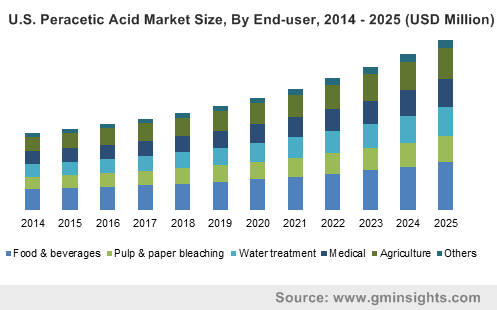

U.S. Peracetic Acid Market Size, By End-user, 2014 – 2025 (USD Million)

A number of bottling facilities around the globe use this chemical as a disinfectant and sanitizer to contain microbial activity and it does not leave any hazardous residues after the treatment. Subsequently, the Environmental Protection Agency has exempted residues of peracetic acid in its regulations from tolerance solutions up to 500 ppm applied to equipment and up to 100 ppm in food products like vegetables, fruits and many others. This exemption has widely propagated the peracetic acid industry and encouraged food and beverage producers to use concentrations of this acid in treating consumables and production equipment.

Bottled water is among the most consumed beverage product in the world and is an ideal target industry for the peracetic acid market. In the U.S. itself, the bottled water market was estimated to be valued at around USD 18.5 billion in 2017, which was almost 8.8% higher than the previous year. It held the largest 23.9% share in the U.S. beverages segment and if the growth trend is any indication, can be expected to march further ahead. With similar consumption patterns for bottled beverages to be observed worldwide, the peracetic acid industry is slated to expand rapidly in the near future. Peracetic acid is also being vastly utilized as a sanitizer in the brewery segment, which stands to gain immensely from the elimination of microbial contamination in brewing process.

Aseptic bottling method, which involves sterilizing both, the bottle and the container in a controlled environment, is a procedure gaining traction among manufacturers as it helps to enhance shelf life and reduce shipping costs. As beverages packed with this method do not require refrigerated transport vehicles and can be stored at room temperature without the risk of getting spoilt, adoption of aseptic packaging techniques has reinforced the peracetic acid market. Citing an instance to demonstrate the advantages of aseptic packaging, some time ago LiDestri Food and Drinks had introduced a range of non-alcoholic drinks which were packed in Tetra Pak’s cold-fill aseptic cartons.

Speaking further, due to the aseptic package, the LiDestri products did not require refrigeration and lowered shipping costs considerably, besides proving to be of great continence to customers. It was also noted that no preservatives were required to be added into these products, which suited health-conscious customers well and tasted better than hot-fill packaged beverages. As global manufacturers look to adopt low-cost and efficient processes to deliver safe-to-consume beverages like juices, energy drinks and milk products, the peracetic acid industry will amass more than USD 300 million in remunerations from the food and beverages segment by 2025.

Traditionally, chlorine solutions were used in washing fresh produce that is sold in supermarkets or other retail space. Gradually, people have shifted to peracetic acid-based antimicrobial solution to reduce pathogens in fresh vegetables, including spinach, lettuce as well as most fruits. Poultry and meat products are being treated with this chemical it does not cause the formation of carcinogens in the food, unlike chlorine. Undeniably, the consumption of food products will consistently rise in conjunction with the growing population and escalate the need for healthy food and beverage offerings, driving the peracetic market worldwide.

All in all, the food and beverages segment is projected to witness a fast-paced growth internationally and in 2017, it was predicted that nearly 48% of U.S. companies in the segment would be looking to geographically expand their business in the coming years. Comprising of key industry participants like Airedale Chemical, Diversey, Enviro Tech Chemical, Evonik, Hydrite Chemical, Mitsubishi and SEITZ, the global peracetic acid market earnings will surpass USD 1.2 billion by 2025.