Packaging materials market to penetrate the trillion-dollar business space by 2024, product innovations and M&As to define the competitive landscape

Publisher : Fractovia | Published Date : April 2018Request Sample

The macroeconomic developments in the F&B sector have played a pivotal role in packaging materials market proliferation over the recent years. The business sphere is slated to witness a stronger growth across emerging belts with rapidly increasing consumption of processed food and economic development – both the factors immensely driving the demand for sophisticated packaging. As per reliable estimates, the food and beverage sector in APAC recorded a valuation of nearly USD 3 trillion in 2016 and is forecast to witness an ascent over the ensuing years as well. The data further documents strong growth prospects of packaging materials industry in Asia Pacific. In fact, as per reliable sources, the number of rigid plastics unit claimed to be consumed in APAC belt this year is more than 365 billion units. Overall packaging materials market from rigid plastics is slated to experience a CAGR of 3.5% over 2017-2024.

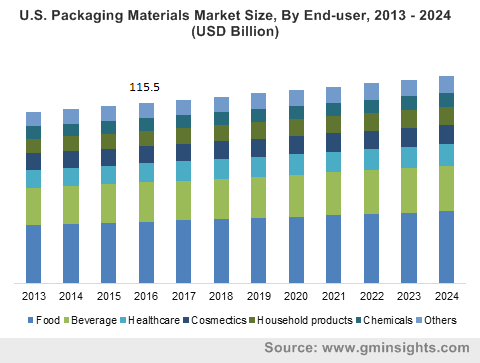

U.S. Packaging Materials Market Size, By End-user, 2013 – 2024 (USD Billion)

The structure of packaging materials industry is changing at a rapid pace. Though these changes are not dramatic individually, but the amalgamation in long term would reach an inflection point where it can be claimed transformation. Sustainability, e-commerce, waste challenges, and subsequent advancements in packaging technologies are few of the major rationales aptly characterizing the market trends. Quoting a recent case that clearly depicts the extent by which packaging materials market giants are driven by the sustainability trends is Suntory Holdings’ recent investment in Anellotech.

Elaborating further, the former is reported to invest nearly USD 9 million in Anellotech’s Bio-TCat technology in a bid to develop complete bio-based PET beverage bottles. Reportedly, the deal is a part of the companies’ corporate sustainability goals, in which Suntory would be making a hefty investment of USD 15 million on Anellotech’s advanced solutions. For the uninitiated, Anellotech and Suntory, two of the renowned sustainability groups partaking in packaging materials market began their cordial partnership in the year 2012 for the development of cost effective renewable chemicals. While Suntory’s active response to the sustainability call is not unheard of, its latest venture of producing 100% bio-based PET botte is undoubtedly a news to be reckoned with. Unlike most PET beverage bottles that are made from fossil sources comprising 70% parazyline and 30% MEG, Suntory uses 100% plant derived materials for its Mineral water Tennensui Mineral water brand.

It is imperative to mention that collaborative approaches toward product innovation is observed to be a rising trend across the strategic landscape of packaging materials market. Say for instance, C&A and Arvato SCM Solutions, together, have recently developed a new packaging solution for e-commerce business. Reportedly, with the help of this solution, cartons of online fashion products can be cut as per the required size automatically. If reports are to be relied on, the innovation comes on the heels of developing a cost-effective packaging by optimizing the shipping material. This move is deemed to be one of the most futuristic ones of its kind in packaging materials market, given the increased pressure faced by the manufacturers from the fluctuating raw materials price trends.

Regionally, North America has always been one of the most outpacing regions in terms of advanced packaging solutions, the factor that has made this belt lucrative for packaging materials industry as well. The regional packaging materials market procured more than half of the overall industry share in 2016, having garnered a revenue of USD 500 billion. Increased consumption of processed food and high volume of regional as well as international trade are two of the prime factors driving the business growth. U.S. is deemed to be at the growth front, as most the exports of the region occurs from this country.

Industry players have been extensively focusing on production capacity enhancement, which by extension is generating a considerably massive demand for advanced packaging materials. Amcor Rigid Plastics’ yesteryear expansion of the bottle manufacturing plant in Ohio is an apt instance of the same. Reportedly, the 40-million-dollar investment made by the leading packaging giant at the Bellevue plant is in response to the increased packaged food demand across this belt. The program is supported by JobsOhio Economic Development Grant, via the assistance of RGP (Regional Growth Partnership).

A trend toward minimization of environmental impacts has been observed in global packaging domain, triggering technological integration and advanced value chain models. Packaging materials market, being at the core of the industry space, needless to mention, is also driven by the similar trends. With further enhancement in material characteristics by the technological beneficiaries, overall packaging materials market is forecast exceed a massive valuation of USD 1.3 trillion by 2024.