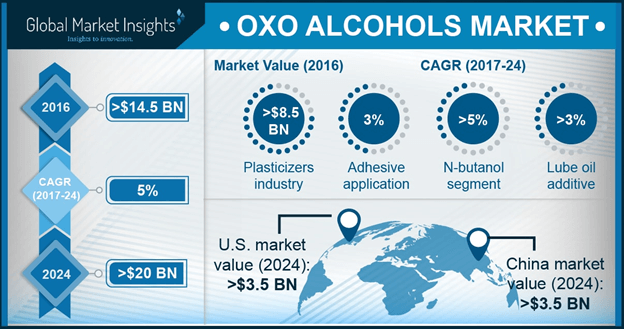

Oxo alcohols market revenue to witness an ascent via huge product demand from the petrochemicals sector over 2017-2024

Publisher : Fractovia | Published Date : 2018-01-18Request Sample

The changing face of myriad end-use sectors like petrochemicals, packaging, and paints & coatings have much to contribute toward oxo alcohols market expansion, undoubtedly, pertaining to the fact that these products are extensively used as intermediaries and solvent formulations for acrylates, glycol ethers, lube oil additives, plasticizers, acetates, and adhesives. The global demand for the aforementioned application arenas, as per ongoing trends, is on an all-time high, which would undeniably generate a favorable growth scenario of sorts for oxo alcohols market. This business sphere is thus witnessing quite an admirable progress, especially with participants striving to increase production capacities of niche products that are likely to find applications across numerous sectors.

U.S. Oxo Alcohols Market Size, By Application, 2016 & 2024 (USD Million)

Bearing testimony to the aforementioned fact is that recently, Andhra Petrochemicals, one of the most renown names in oxo alcohols industry, and the only manufacturer of oxo alcohols across the Indian sub-continent, has planned to expand its facility in Visakhapatnam. The company apparently holds around 30% of India oxo alcohols market share and is a reputed producer of 2-ethylhexanol, n-butanol, and isobutanol – pivotal hydrogenated aldehydes that comprise the product landscape of oxo alcohols market and are used in acetates, printing inks, plasticizers, rubber chemicals, pharmaceuticals, acrylates, fuel additives, surfactants, detergents, agrochemicals, solvent extractions, and more. Through this move, worth USD 50 million, the facility, which was established in 1994 with a debut capacity of 30,000 mtpa, would be able to liberally expand its production capacity to much more than what it used to dish out in 2010 (close to 73,000 mtpa), thereby contributing substantially toward the growth of India oxo alcohols industry.

Oxo alcohols market trends from acrylates

One of the most commonly used intermediates for the textile, automotive, and packaging sectors, acrylates stand as one of the most prominent application domains of oxo alcohols market. These products, obtained by means of a reaction between an alcohol feedstock and an acrylic acid with a strong acid catalyst, are heavily used in adhesives and paints, owing to which they find heavy applications in the construction sector. Not to mention, the construction and infrastructure development space has been witnessing exponential growth in recent times, on account of increasing consumer disposable incomes that have led to a paradigm shift in lifestyles and a subsequent rise in renovation and refurbishment activities. On these grounds, global acrylates industry size has been forecast to cross USD 10 billion by 2024, which would consequently have an impact on the revenue chart of oxo alcohols industry, given the extent of their utilization in acrylate manufacturing.

Speaking of acrylates and their influence on the commercialization potential of oxo alcohols market, BASF, the multinational Germany oxo alcohols industry player, recently lifted its FM (force majeure) on glacial acrylic acid (GAA) and the acrylate esters, aiming to seek gains of USD 66 per ton (around 3 cents/lb). The step had been undertaken along the heels of reduced petrochemical-based feedstock and other supply-based constraints. BASF’s decision of eliminated the FM on GAA has proved to be beneficial for acrylate sales, thereby lifting the pressure on the manufacturing of products across the plastics, construction, adhesives, and paints & coatings sectors. In essence, it has been observed that the move may have proved to be quite beneficial for other U.S. oxo alcohols market players such as Dow Chemical Company, Sasol, and Arkema as well.

The deployment of acrylates in the petrochemicals sector and their impact on oxo alcohols market

The petrochemical sector, undoubtedly, is one of the most crucial growth grounds that determines the growth curve of oxo alcohols industry. Most oxo alcohols, such as 2-Ethylhexanol, are deployed in downstream applications for the production of 2-Ethyl Hexyl Acrylate and Di-2-Ethyl Hexyl Phthalate (DEHP), that further find applications in the petrochemical domain, on account of their excellent fuel performance and lower rate of emission. As per estimates in fact, 2-Ethylhexanol based oxo alcohols market size is expected to surpass USD 10 billion by 2024.

The vast expanse of the petrochemical sector is rather obvious from the efforts undertaken by regional governments, reputed industry players, and state-owned corporations to expand the profitability quotient of the petrochemical sector. For instance, the Kerala Industrial Infrastructure Development Corporation (Kinfra), the BPCL Kochi Refinery, and the Kerala State Industrial Development Corporation (KSIDC) have recently joined forces to establish a mammoth petrochemical park at Ambalamugal, with the intent of making Kochi one of the global petrochemical hubs. As reported, the park is likely to prove advantageous for downstream petrochemical-based companies, that would be able to use raw materials available from PDPP – the Propylene Derivative Petrochemical Project to be commissioned by the BPCL Kochi Refinery. PDPP would apparently simplify the availability criteria of butyl acrylate, isobutanol, acrylic acid, ethylhexanol, ethyl hexyl acrylate, and normal butanol - specialty petrochemicals that would further enhance the productivity of the Kochi park. Subsequently, the establishment of this park would have a profound impact on the profitability spectrum of the regional oxo alcohols industry, given how extensively these hydrogenated aldehydes would be used for this petrochemical park.

Oxo alcohols market stands to gain heavy proceeds from the petrochemical sector even at a global scale. Bearing testimony to the aforesaid statement is the fact that recently, LG Chem, one of the leading oxo alcohols industry players, announced an investment of USD 278.6 million (KRW 300 billion) for expanding its petrochemical facilities in Yeosu, South Jeolla and increase the annual production capacities of super absorbent polymer and crude acrylic acid by 100,000 tons and 180,000 tons respectively. Given that the latter is essentially used for the production of acrylates and other derivatives deployed in the adhesives and specialty coatings sectors, LG Chem’s move is likely to benefit the regional oxo alcohols market size to quite an extent.

The powerful end-use spectrum of oxo alcohols industry has a pivotal role to play in the expansion of this business vertical. With packaging, construction, paints & coatings, and other businesses depicting profound progression, it is undeniable that oxo alcohols market would traverse a lucrative growth path in the years to come. With significant R&D activities and product differentiation techniques adopted by leading companies, the application spectrum of oxo alcohols market would only increase in the ensuing years. In consequence, this would majorly impact the revenue generation of oxo alcohols industry, slated to cross USD 20 billion by 2024.