A regional outline of oil filled air compressor market: Mexico to emerge as a prominent revenue contributor over 2018-2024

Publisher : Fractovia | Published Date : 2018-05-28Request Sample

In a world where most industries largely depend on pneumatic operations, oil filled air compressor market has found immense scope for growth. This is essentially on account of the fact that air compressors have efficiently replaced all other massive and complex systems from which traditional air tools used to draw their power. Oil filled compressors however, have found a wider market because of their durability and usability in industries like oil and gas, mining, manufacturing and quarrying. Driven by the product benefits of durability, longer life span, capability to work in extreme environments, and better protection against interior rust, oil filled air compressor market size was pegged at USD 20 billion in 2017.

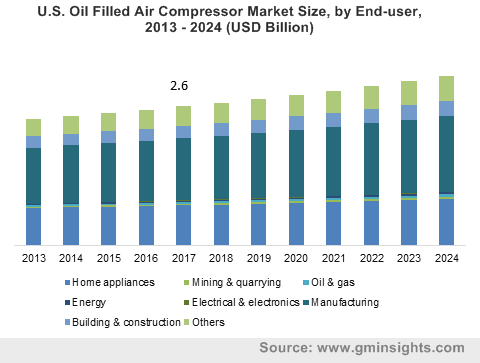

U.S. Oil Filled Air Compressor Market Size, by End-user, 2013 – 2024 (USD Billion)

An insight into Asia Pacific oil filled air compressor market trends:

Asia Pacific has been forecast to emerge as one of the most lucrative growth grounds for oil filled air compressor market. The growth can be primarily attributed to the expanding energy sector in the region that demand highly advanced compressor technology. Countries such as China and India are touted to majorly contribute toward APAC oil filled air compressor industry share, driven by the growing industrial and manufacturing sectors in the region and the rising number of initiatives that are being undertaken to promote innovative compressor technology.

Validating the aforementioned fact, the Chinese government, as a part of its ‘Made in China 2025’ plan, proposed around 46 pilot projects that were centered around novel technological advancements for the implementation of smart manufacturing in the country. The vast expanse of the projects is likely to generate extensive demand for air compressors, thereby propelling the regional oil filled air compressor market size.

As per estimates, Asia Pacific held more than 60% of the global oil filled air compressor market share in 2017 and will witness a remarkable growth rate over 2018-2024, powered by the rising installation of new thermal power plants in the region. Reliable statistics claim that India and China alone will be responsible for installing more than 50 and 160 thermal power plants respectively over the forthcoming six years.

Unveiling Brazil oil filled air compressor market trends:

One of the pivotal driving forces behind Brazil emerging as a revenue pocket for oil filled air compressor industry is the growth in its mining industry. According to estimates, the mining sector accounts for almost 7% of the region’s GDP, driven by the rising investments by the regional government in mining programs. Brazil is seemingly the third-largest iron ore producer in the world and is renowned to produce 72 other minerals. With principal mining areas concentrated in Carajas and the Iron Quadrangle, Brazil is a major exporter of minerals such as bauxite, iron, and niobium.

Statistics affirm that a mammoth 8,870 companies form a part of the competitive landscape of the region’s mining industry, though Vale, Camaro, and Namisa own a lion’s share of the market. With the expansion of the mining sector, the demand for oil lubricated air compressors for heavy duty equipment is likely to surge, driving the regional oil filled air compressor market. As per estimates, Brazil oil filled air compressor market size is forecast to be pegged at USD 300 million by 2024.

Mexico’s contribution to the overall oil filled air compressor market:

Despite a slight slump for quite a few years, Mexico’s oil & gas sector has remarkably surged in recent times, paving the way for the growth of the regional oil filled air compressor market. Oil apparently forms 50% of the country’s total energy usage, and estimates claim that the regional oil production may nearly double to 5 million bpd by 2030. Development costs in the oil business are pegged at USD 23 per barrel, while almost 60% of the country’s output comes from areas where development costs average between USD 10 - USD 20 per barrel, generating a plethora of shale opportunities in the nation.

As the energy and oil & gas sectors continue to flourish in Mexico, the demand for air compressors is expected to soar several notches higher. Recently in 2018, Mexico accrued an investment of almost USD 100 billion for Deepwater exploration. Powered by such a remunerative energy scenario, Mexico oil filled air compressor market size is expected to grow at a highly profitable growth rate over 2018-2024, having been pegged at USD 700 million in 2017.

The escalating costs of these compressors has made it difficult for some of the small and medium scale businesses to become regular end-users of oil filled air compressor market. This has, in consequence, led to SMBs renting the product instead of purchasing it. Renting has also resulted in the generation of another lucrative growth avenue for oil filled air compressor industry contenders such as Doosan Portable Power, Atlas Copco, Quincey Compressor, Sullivan-Palatek. It is essential to state that these giants have also been working towards upgrading air compressor technology for better performance and less upkeep. Driven by their efforts to modernize compression techniques, in conjunction with the widespread application spectrum of these products, oil filled air compressor market size is expected to cross USD 25 billion by 2024.