U.S. to hold 90% of North American youth ATV & UTV market valuation by 2024, rising proportion of recreational activities to augment the regional industry growth

Publisher : Fractovia | Published Date : October 2018Request Sample

Recognized as a highly lucrative vertical of the overall automotive & transportation cosmos, North American youth ATV & UTV market has been gaining quite a momentum in the recent years. The remarkable surge in expenditures pertaining to recreational and tourism activities, exploration trips, and campaigning have undoubtedly paved the way for renewed sense of dynamism in the North American youth ATV & UTV industry share. Given the tremendous surge in demand for recreational sports, prominent contenders as well as the regional governments have been going the whole hog to bring forth innovative vehicles, while boosting the statewide tourism.

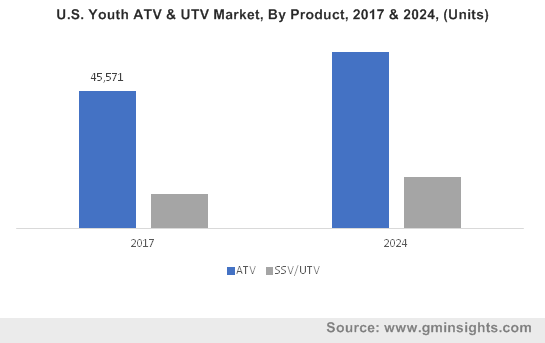

U.S. Youth ATV & UTV Market, By Product, 2017 & 2024, (Units)

The recent news of Monroe approving the ATVs on the city streets is an apt substantiation to the aforesaid. Elaborating further, reports reveal that in a bid to boost tourism in rural areas and expand recreational activities, the government of Monroe City in the U.S. state of Missouri, has voted in the favor of allowing ATVs on the city streets, with some rules. The move is expected to significantly influence the estimated 25,000 ATV owners in Washington, while propelling the North American youth ATV & UTV market share.

If reports are to be believed, Monroe is the latest Snohomish County city to allow ATVs on city roads and joins Granite Falls, Darrington, Stanwood, Granite Falls, Mill Creek, and Sultan to have allowed ATVs on their street. Wisconsin is another U.S. state, that has let UTVs and ATVs to use city streets with speed limits of 35 mph or less, thanks to the change in Wisconsin laws and growing popularity of ATV and UTVs across the North American belt.

Considering the rising demand for these off-road vehicles, it is important to note that the UTV segment accounted for over 20% revenue share of North American youth ATV & UTV industry in 2017. Given the multiple benefits of standard safety equipment, roll cage, windscreen, and seatbelts, the UTVs are expected see considerable pickup in demand in the ensuing years. With further rise in off-road leisure activities, adventure tourism, riding, and camping, the UTV segment of North American youth ATV & UTV market is projected to register a CAGR of 6% over 2018-2024. The ATV segment on other hand is expected to grow at a rate of 3.5% over the forecast period, primarily on the cusp of the increasing number of sports events and Championships attracting the participation of youth. For the record, the trail sports activities accounted for a significant 13% of outdoor recreational spending, in turn expanding the market demand throughout North American.

U.S. to majorly influence the regional trends of North American youth ATV & UTV market

Having a vast geographical expanse of around 430 wilderness areas, over 150,000 miles of trails, and large farms, ranches, and unpaved roads, the U.S. has emerged as a lucrative investment hub for North American youth ATV & UTV industry expansion. Reports claim that the profound surge in recreational activities and the presence of major industry players bringing forth technologically advanced vehicles will be the key factors driving the regional share. Accounting for a revenue share of USD 220 million in 2017, estimates claim the U.S. youth ATV & UTV market to be a dominant player with a volume share of over 90% by 2024.

Quite overtly, the significant geographical benefits in conjunction with the rising popularity of motor sports & recreational activities are slated to robustly fuel the ATVs & UTVs product demand across North American. And furthermore, with the growing product popularity, the extensive efforts of industry contenders & regional governments to expand the scope of these activities are all set to carve a profitable roadmap for North American youth ATV & UTV industry in the years ahead. As per a reliable report from Global Market Insights, Inc., the North American youth ATV & UTV market size is forecast to exceed USD 383 million by 2024.