Network as a service market to garner massive profits from SMEs over 2019-2025, extensive demand from telecom companies to drive the industry landscape

Publisher : Fractovia | Published Date : 2019-05-14Request Sample

The global network as a service market has been gaining a commendable impetus in the recent years as NaaS can provide companies with greater flexibility and improve the performance of their network infrastructure. The worldwide NaaS market is also making a major headway as enterprises of all sizes are striving to run IT infrastructure more efficiently and methodically operate and manage their networks.

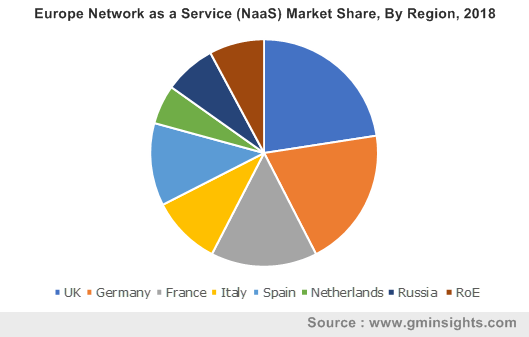

Europe Network as a Service (NaaS) Market Share, By Region, 2018

Business models like network as a service promise the much needed efficiency, through an on-demand provisioning model. Companies can act more cost-consciously with on-demand purchasing as they need to pay for only for the networking services they need. NaaS helps businesses that want demand provisioning flexibility without requiring to rearchitect networks from the ground up. NaaS also offers palpable return on investment by helping customers to trade Capex for Opex and refocusing person hours on other, more demanding priorities. Such benefits are majorly driving the NaaS market size, expected to surpass $50 billion by 2025.

One of the instances to demonstrate the growth of the NaaS market can be provided through the WAN as a service segment that is slated to garner nearly 30% of the NaaS market share by 2025. In traditional networking architectures, the hub of the network was built around a company’s building headquarters or a data center which housed most of the equipment for computing, storage, communications, and security. This location traditionally hosted enterprise applications and traffic is typically backhauled to this location in case of people in branch and other remote locations.

This formula has recently started to fail the needs of many enterprises today, especially due to the major migration to the cloud. The demand for cloud network services has also began to increase due to its networking cost reduction capabilities. Enterprises are also coming to prefer WAN infrastructure to connect remote employees & devices and NaaS market is capitalizing such a shift, as enterprises are showing increased preference for NaaS offerings that help in minimizing costs associated with WAN networks management. NaaS models also eliminate the need of network rearchitecting and enable a subscription-based pricing model for enterprises.

Network function virtualization will act as yet another driving force for the NaaS industry as telecommunication companies strive to meet the rising demand for bandwidth, cut down costs, and speed up delivery of new services. Companies are launching major initiatives that underline the acceleration of network function virtualization which in turn will help propel NaaS market. For instance, Bell Canada, the Canadian telecommunication company used an Open Network Automation Platform for the implementation of its first automation use case in early 2018 and AT&T, the American telecommunication giant announced 75% of its that network will be virtualized by 2020.

Market forces that have inspired the idea of network function virtualization have continued to raise pressure on telecommunication companies to make significant changes. While the revenue per megabyte of data has continued to become minimal, over-the-top businesses like Uber and Netflix have contributed to the explosion of mobile data usage. Estimates show that over the next few years, mobile video usage will grow by 870% and telecom companies are turning to transform their networks basically to survive such tectonic shift in mobile data usage. Gradually, telecom companies are coming to add a considerable impetus to the growth and expansion of the NaaS market.

The Network as a Service market has garnered some of its most loyal customers among the small and medium enterprises as NaaS allows companies to buy into infrastructure services and solutions, they could hardly afford to buy outright but can now pay a subscription to avail as needed. NaaS market through SMEs is expected to record a significant CAGR of 35% over 2019-2025. This is because NaaS not only provides the bandwidth, flexibility and technology besides 24-7 support and on-call expertise that SMEs desperately need, but also saves such small and medium sized enterprises from the crippling one-off CAPEX cost, swapping it with the predictable monthly OPEX bill.

With digital transformation, each and every aspect of all businesses have become highly competitive. This, however, is not an easy feat in an environment where technology seems to be changing daily. More often than not, all businesses cannot afford to jump on to the bandwagon mostly due to cost challenges. With network as a service however, businesses of all sizes can afford become more flexible and scalable and remain competitive by taking a risk of upgrading, as the service can be easily cancelled if the business decides against its requirement. Endowed with such a unique offering as making technology accessible, affordable and flexible, network as a service market is poised to witness explosive expansion over 2019-2025.