Ethane natural gas liquid market to register massive revenues between 2019-2025, rapid industrialization and urbanization to boost business graph

Publisher : Fractovia | Published Date : 2019-06-04Request Sample

The natural gas liquid market is likely to receive commendable acclaim in the forthcoming years primarily by the immense application the product registers from a wide array of industries. Advancements in shale exploration and drilling have led to a surge in U.S. oil & gas production in recent years with profound economic and geopolitical implications. The rise in consumption of natural gas for heating, cooking, and burning purposes in residential spaces has propelled natural gas liquid industry growth.

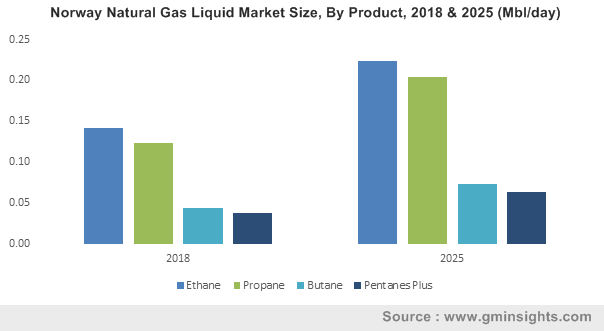

Norway Natural Gas Liquid Market Size, By Product, 2018 & 2025 (Mbl/day)

Meanwhile, growing demand for automotive products like engine belts, tires, flooring mats and more from both OEM and aftermarket players have supplemented natural gas liquid market reach as butane is one of the major feedstocks for manufacturing of ethylene, a key ingredient for synthetic rubber manufacturing.

Needless to say, that with growing population and urbanization created a potent growth scope for natural gas liquid market and the export of NGLs has increased significantly over the past few of years. In fact, according to U.S. Energy Information Administration (EIA), natural gas exports and consumption averaged 93.4 Bcf/d (billion cubic feet per day) during the first half of 2018, which is 12% more than recorded consumption during the first half of 2017.

Meanwhile, U.S. natural gas consumption in the first half of 2018 increased in all sectors, particularly with large scale growth in the residential and commercial sectors which increased consumption by 3.8 Bcf/d approximately 16% more when compared to the first half of 2017. Improved standard of living, rapid industrialization and consumption of synthetic rubber and plastics across diverse businesses will also stimulate natural gas liquid market growth across developed as well as growing economies.

How has the increase in the production of natural gas plant liquids impacted natural gas liquid industry trends?

According to EIA, the production of natural gas plant liquids (NGPL) in the U.S. has roughly doubled since 2010, outperforming the rate of production growth and setting an annual record of 3.7 million (b/d) barrels per day in 2017. For the record, NGPLs are a mix of propane ethane, butane, isobutane and natural gasoline that needs additional processing to convert into distinct marketable products. The yield of the NGL products, especially that of ethane, can significantly vary depending on its prices and the ability to process and distribute them in markets.

Reportedly, prices of ethane in the U.S. began to rise in 2016 with increasing product demand which eventually led it to surpass natural gas prices in the country on a heat-content equivalent basis between 2016 and 2017. Citing reports, in the first-quarter of 2018, U.S. ethane production was 260,000 b/d higher than the first-quarter 2017 level.

While it is anticipated that the production of ethane will increase by another 440,000 b/d between the first quarter of 2018 and the fourth quarter of 2019, as per EIA’s Short-Term Energy Outlook, accounting for 52% of the growth in NGPL production. Additionally, with several petrochemical plants expected to come online in the U.S. between 2018 and 2019, the natural gas liquid market will amass strong growth potentials in the forecast period.

Propane natural gas liquid to account for a considerable share in the NGL industry revenue growth

Modern petrochemical industries effectively fulfill the demand for a wide range of products closely associated with industries like agriculture, automobiles, construction, health care, textile, pharmaceuticals and more. Propane natural gas liquid is one such product that has gained increased traction in various industries owing to its use as a high-end feedstock along with its growing application in transportation and space heating equipment.

Known for being a clean burning fuel, propane is used to drive low emission vehicles and is slated to be ideal for equipments like lift trucks and forklifts that operate in construction and warehouses sites that demand improved air quality. It is also suitable for operating equipment in underground mines and other enclosed spaces. Propane is also used as a fuel for vehicle fleets like buses and taxis that have access to centralized LPG fueling stations, especially in urban areas that are seeking to reduce tailpipe exhaust emissions.

Stringent emission norms will positively impact the industry landscape for both propane and subsequently for NGLs. Reports from Global Market Insights, Inc. suggest that the propane natural gas liquid market will witness a CAGR of over 7% over 2019-2025.

The natural gas liquids are components of gas that are separated from gas in the form of liquids. NGLs primarily include ethane, propane, butane, and pentanes which are increasingly used across commercial, residential and industrial spaces. With growing product adoption across diverse industries, the natural gas liquid market size is projected to surpass 14 mbl/day by 2025.