Multi Pad Drilling market to earn lucrative revenue via onshore applications over 2016-2024, global share to double by 2024

Publisher : Fractovia | Published Date : 2017-04-21Request Sample

The exponential rise in oil and gas exploration activities across the various regions of the globe will drive multi pad drilling market significantly. Growing awareness to reduce environmental problems such as lesser land disruption will considerably stimulate multi pad drilling industry size over the years ahead. The demand for crude oil has exponentially increased across the globe, and extensive excavation projects are required to be carried out to fulfill this demand. This, in turn, will augment the multi pad drilling market share. As per the report by Global Market Insights, Inc., “Worldwide Multi Pad Drilling market was worth USD 90 billion in 2015 and will register a noticeable annual growth rate of more than 15% over the coming years of 2016 to 2024.

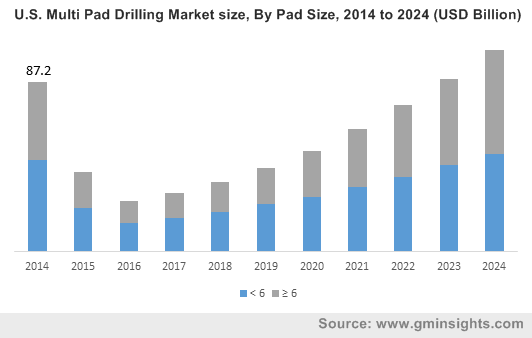

Surging technological advancements to enhance productivity, reduce overall operation cost, and to minimize carbon footprints in the environment will favor the growing product demand across the globe. U.S is investing heavily into oil & gas projects to explore more fuel resources. Increasing shale gas production and exploration across the region will also contribute significantly to boost North America multi pad drilling market revenue over the coming timeframe. Antero Resources Corporation, one of the major leaders in global multi pad drilling market, has decided to invest USD 1.3 billion for drilling projects across Marcellus and Utica shale in 2017. In addition, this firm is willing to drill about 6 wells per pad in Utica shale. < 6 size is one of the notable pad segment of multi pad drilling industry and is predicted to register a CAGR of more than 13% over the period of 2016 to 2024. The drilling machine pertaining to < 6 pad size can be operated with minimal manual skills and technical support, which will contribute significantly to the industry growth.

;U.S. Multi Pad Drilling Market size, By Pad Size, 2014 to 2024 (USD Billion)

Russia multi pad drilling market is prominently dependent on the escalating drilling that occurs across the offshore area. Russia is investing heavily in gas field development plans, which will substantially generate remarkable revenue over the coming timeframe. Offshore multi pad drilling in one of the prominent application segments, which collected a revenue of more than USD 850 million in 2015 and is projected to record a flourishing growth rate over the coming seven years. The attributing factor toward the industry growth is the presence of a vast number of resources across offshore locations.

Onshore multi pad drilling industry generated a revenue of USD 90 billion and will exhibit an annual growth rate of more than 15% over the period of 2016 to 2024, owing to the availability of conventional and non-conventional resources. The rising investments in onshore plants will also notably augment the industry growth. For instance, Nobale Energy is going to invest USD 1.8 billion and USD 625 million in the development of onshore & offshore plants respectively across the U.S. in 2017. As per statistics, China has 130 BCM recoverable shale gas reserves and 5.19 TCM conventional gas reserves, which will favorably influence China multi pad drilling market share.

The Middle East region is one of the largest oil and gas producers. Middle east multi pad drilling market will register a CAGR of more than 7% over the coming years of 2016 to 2024. The escalating investments in infrastructure development to expand the production as well as storage capacity landscape will push the product demand in this region.

Multi pad drilling industry giants such as Chevron, BP, Dow, Total, and YPF have invested nearly USD 5 billion to explore shale reserves in Argentina. This will stimulate Argentina multi pad drilling industry, which will cross a revenue of USD 2 billion by 2024. Favorable government initiatives to promote natural gas production will enhance the market growth over the coming timeframe.

Mergers and acquisitions is one of the key business strategies of the market players to gain more profit. The noteworthy participants in multi pad drilling market are Devon Energy, ExxonMobil, Chevron Corporation, Cairn India, Trinidad Drilling Ltd., Nabors Industries Ltd., Marathon Oil Corporation, Encana Corporation, Hess Corporation, Chesapeake Energy, Nostra Terra Oil & Gas, Continental Resources, Pioneer Natural Resources, Consol Energy, and Earthstone Energy, Inc.