Monoethylene Glycol (MEG) Market to accumulate formidable proceeds from PET applications, MEA to emerge as a profitable growth ground for industry growth over 2017-2024

Publisher : Fractovia | Published Date : 2017-12-11Request Sample

A robust incline in the commercialization potential of monoethylene glycol market has been observed of late, an ascent that can be attributed to the increasing deployment of this organic compound across a plethora of end-use sectors such as textiles, automotive, and packaging. MEG industry has also been gaining prominence owing to the shifting global outlook of the oil & gas sphere, which has led to changing trends in ethylene production and processing. Primarily, MEG has been deployed since years for the manufacture of polyethylene terephthalate (PET) that finds applications in numerous end-use sectors. Also, PET manufacturing companies have been attempting to experiment with changes in production technology and commercialization, thus demanding MEG on a large scale, which would drive monoethylene glycol market share over the forthcoming seven years.

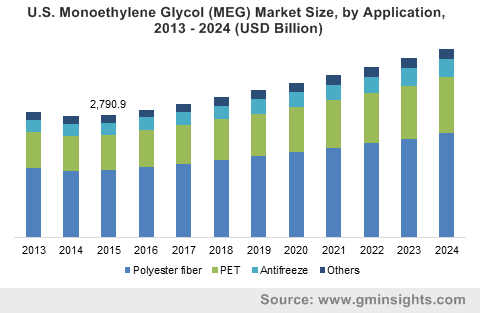

U.S. Monoethylene Glycol Market Size, by Application, 2013 – 2024 (USD Million)

Recently, Braskem, one of leading developers of thermoplastic resins, inked a technological cooperation contract with Haldor Topsoe, the Danish conglomerate in catalysts & surface science with an intention to pioneer a new methodology of producing monoethylene glycol (MEG) from sugar. As per the terms of the deal, a demonstration plant is slated to be constructed in Denmark, the operations of which may commence in the year 2019. This initiative is likely to gain traction in monoethylene glycol industry, since it combines leading-edge technology with deep expertise in industrial design and operations. As the concept amasses mass prominence across the overall MEG market, the competitive scenario of this business space is likely to witness a tremendous transformation, pushing renewable chemistry to an elevated level. In fact, Braskem is of the view that this technology would peg the title of being one of the most sustainable ones ever introduced in monoethylene glycol industry, which would substantially contribute toward the notion of the ‘go-green’ future.

Outlining MEG market trends from PET applications

The F&B, pharmaceuticals, and other sectors have been prime end-users of PET, as the product is massively used to make films, bottles, sheets, etc., for the aforementioned industries, driven by the properties of dimension stability, high barrier resistance, excellent chemical resistance, and ease of recyclability. Given that MEG is predominantly used for PET production, it goes without saying that the demand for PET will substantially boost MEG industry share. In 2016 alone, PET production amounted to around 25 million tons, and a major percentage of this valuation can be credited to the APAC belt.

Incidentally, Asia Pacific MEG market size has been forecast to increase at a CAGR of around 7% over 2017-2024, primarily on account of the rising demand for polyethylene terephthalate in the emerging economies such as China and India. China in fact, is one of the key PET producers, having held more than 25% of the overall APAC PET production in 2016.

The Middle East to emerge as a lucrative growth avenue for MEG market over 2017-2024

Once considered the potential hub for myriad end-use sectors, the Middle East has lately been depicting a change of market dynamics, owing to reduced ethane reserves and fluctuating oil prices. In fact, ethane-based chemical producers, back earlier, had experienced a period of low production costs, when the price of oil had been profoundly low in the country. Today however, on account of increased shale gas and oil exploration activities, North America has been experiencing a boom in cracker and derivative capacity, leading to a global shift in industry diversification. In consequence, this shift has also had a profound impact on niche verticals, not excluding monoethylene glycol (MEG) market.

Having recognized the pressures on the specialty chemicals domain worldwide, renowned players across numerous spheres have been coming together to brainstorm a unified approach to tackle chemical production, distribution, and sales. In this regard, it is noteworthy to mention that the Saudi Basic Industries Corp (SABIC) has had a massive role to play in the development of the regional MEG market. Recently, SABIC signed on an agreement with Exxon Mobil to construct a petrochemical complex in Texas. The project would involve the construction of two polyethylene units and one MEG unit, and the firm aims to penetrate developed markets such as the United States. The efforts of the petrochemical giant to diversify its portfolio by maintaining its presence across every sub-vertical – right from ethylene production to plastic manufacturing, has led to SABIC emerging as one of most prominent players of monoethylene glycol industry. In 2015 alone, SABIC apparently held around 10% of the MEG market share, consolidating its stance in the overall business space.

The ebb and flow in the growth graph of the O&G industry has been forecast to have a profound impact on monoethylene glycol market trends. Say for instance, in 2013, MEG prices across the globe were pegged at USD 1200 per kilo ton, when the costs of crude oil stood at around USD 100 per barrel. The very next year though, with the dip in oil prices, MEG was valued at USD 750 per kilo ton in the Asia Pacific. As the prices of crude oil observe periodic fluctuations, an ambiguity of sorts is observed across raw material manufacturers, thus affecting the outlook of niche verticals such as MEG industry. However, the robust demand for this compound across myriad end-use domains, especially packaging and textiles, is likely to catapult monoethylene glycol market size to greater heights. As per estimates compiled by Global Market Insights, Inc., MEG market share is anticipated to register a CAGR of close to 6% over 2017-2024.