Mobility on Demand market to double its revenue share by 2024, car sharing services to gain major traction

Publisher : Fractovia | Published Date : 2018-05-17Request Sample

With most of the world’s urban centers becoming more congested and polluted, Mobility on Demand market has emerged out to be one of the most opportunistic business verticals addressing the transportability challenge. As per estimates of 2015, roughly 335 million commercial cars and 947 million passenger cars were in operation worldwide. With the potential environmental deterioration of fuel usage and nearly 1.25 million road traffic casualties every year globally, mobility on demand industry has indeed experienced a commendable proliferation in recent times. Testament of the fact is the 100 billion dollar valuation pegged by the industry in 2017.

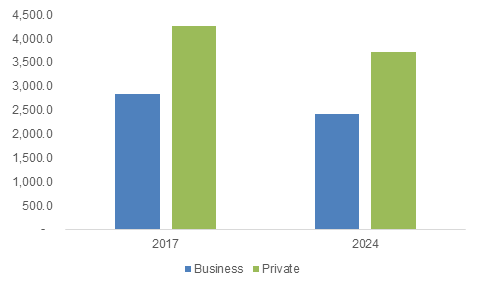

UK car rental market size, by application, 2017 & 2024 (USD Million)

The business space has evolved with extreme rapidity, as converging forces including the likes of powertrain technologies, widespread data connectivity, and connected & autonomous vehicles are making profound headways in the conventional mobility ecosystem. It is prudent to mention that the efforts undertaken by the regional governmental bodies to promote these services have been a key enabler in stimulating mobility on demand market growth. Say for instance, in the year before last, the Federal Transit Administration (FTA) selected 11 projects under its flagship Mobility on Demand Sandbox Program. The move has already left its mark in the regional mobility on demand industry as one of the breakthrough initiatives undertaken by the U.S. Department of Transportation in recent years. Reportedly, the USD 8 million funding program mainly aimed to harness the maximum potential of the on-demand mobility options in the country by bringing groundbreaking innovative projects in the field.

The mass popularity of car sharing services is allowing mobility on demand market to attain remarkable heights. While shared mobility is relatively a new trend, it has undeniably shifted consumer preference from car ownership to different modes of transportation. This is vividly coherent from the increasing global acceptance of Lyft, Uber, and the like as a viable mode of transport. As per estimates, overall mobility on demand market from car sharing services is slated to grow at a remarkable CAGR of 30% over 2018-2024. Car sharing economy, though draws a major attention from startups and venture capital investors, established automakers are also leaving no stone unturned to leverage maximum benefits from the lucrative business space.

Toward the end of last year, Singapore made its way to the headlines with the launch of its first large-scale electric car sharing program. Apparently, through this project, the land-scarce city intends to provide commuters more transport options, even without buying their own cars. If reports are to be relied on, the service will be made operational by a unit of France’s Bollore Group, BlueSG for the next decade. It is claimed to be a part of Singapore’s plan to augment the regional mobility on demand industry share, with a profound reduction in on-road vehicles. For the records, the regional government has also provided some funding for the program infrastructure.

The Chinese government is also acting in favor of car-sharing developments in the country both at local as well as central levels, which by extension is opening up a plethora of opportunities for the regional mobility on demand market players. The State Council, in the year 2015, encouraged regional automakers to bring forth innovative car sharing models. One year later, in March 2016, 10 national level ministers and commissions, under the National Development and Reform Commission, put forth some of the important guidelines with regards to shared economy and improved credit system. These initiatives speak volume and has undeniably contributed to China mobility on demand market share. In fact, with China, Singapore, and India at the growth front, entire Asia Pacific mobility on demand industry size is forecast to surpass the billion-dollar benchmark (USD 2 billion) by 2024.

Maximizing the core opportunities would likely require mobility on demand market players to venture into innovative solutions that are highly tech-driven. Thriving on the cusp of its gigantic growth prospect, many new firms are entering this business space by establishing subsidiaries or by forming a collaboration with already established giants. Just a few weeks back, renowned automaker General Motors made an official announcement of its car sharing service in Austin for ride-share app drivers and on-demand delivery app drivers. Another instance of similar line, leading automobile company Nissan recently launched its car sharing service, e-share mobi in Japan, in a quest to establish its stance in APAC mobility on demand market. In essence, it would be appropriate to state that, with newer breakthroughs and changing technologies in mobility ecosystem, the commercialization scale of mobility on demand industry is likely to witness a revolution of sorts, with an anticipated global share of USD 200 billion by 2024.