Microcrystalline cellulose market to amass remarkable proceeds from pharmaceutical applications, global valuation to exceed the billion-dollar mark by 2024

Publisher : Fractovia | Published Date : 2018-04-05Request Sample

The competitive spectrum of microcrystalline cellulose market is famed to be quite consolidated, with renowned firms like Asahi Kasei, FMC Corporation, and Mingtai Chemical covering half of the global share. The consolidation, in recent years, has been rather strengthened with companies feverishly inclining toward distribution network enhancement and production capacity expansion. Citing a relevant testimony to the declaration would be DFE Pharma GmbH & Co’s opening of a new MCC manufacturing facility in India couple of years back.

Sigachi Industrial, another leading name in microcrystalline cellulose market, started working on a new microcrystalline cellulose production plant in Dahej, Gujarat in the year 2013. Some of the pivotal firms are also undertaking mergers & acquisitions activities in a bid to extend their product portfolio. Say for instance, Mingtai Chemical Co. made it to the front page few years back, announcing the extension of its agreement with Danisco (DuPont Nutrition & Health) for the manufacturing of colloidal grade microcrystalline cellulose. These aforementioned instances depict only a fraction of the ongoing developments underlining microcrystalline cellulose industry space.

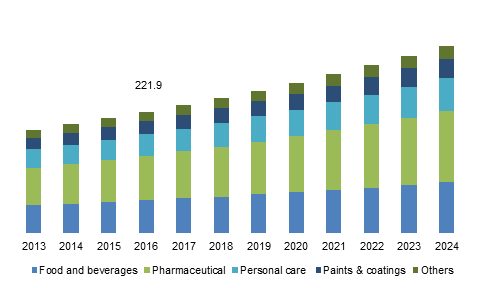

U.S. Microcrystalline Cellulose Market Size, By End-user, 2013 – 2024 (USD Million)

In terms of capitalization, the global microcrystalline cellulose market is estimated to enroll itself in the billion-dollar business fraternity by 2024. The ongoing expansion of the pharmaceutical domain undoubtedly is one of the pivotal forces driving the overall industry size, as the product is extensively utilized as an excipient in drug formulation. Ever since its inception, microcrystalline cellulose has made its presence felt in the pharma domain as an extremely important tableting agent pertaining to its compressibility properties. Reportedly, the product’s small bulk density and flow characteristics make it suitable for any kind of oral dosage.

It is imperative to mention that the extensive research investments in the pharma space over the recent years has undoubtedly widened the application scope of microcrystalline cellulose market. As per reliable estimates, global pharmaceutical industry spent more than USD 150 billion on research and development in the year 2016, a spike of almost USD 25 billion from what it recorded in 2008. It has also been speculated that the figure is likely to shoot up to almost USD 180 billion over the coming four years, another data backing microcrystalline cellulose market’s lucrative growth prospects from pharmaceutical sector.

Speaking along similar lines, North America stands as one of the major beneficiaries of the increased pharmaceutical spending trend, with the United States as the chief revenue pocket. According to International Federation of Pharmaceutical Manufacturers & Associations (IFPMA), overall R&D investments pertaining to pharmaceutical sector was more than USD 60 billion in 2016.

Elaborating further on the regional trends, the expanding obese population in the country is also substantially fueling the regional mcc demand. As per a latest projection by Organization for Economic Co-operation and Development (OECD), nearly 75% of the American population is likely to be obese or overweight by the end of 2020. As per CDC’s estimation (as of 2014) - around one third of U.S. adults of age group 20 and more, and 17% of adolescents and children were marred obese. Backed by the clinical studies that validate the role of insoluble dietary fibers in maintaining the body weight and other obesity induced disorders, North America microcrystalline cellulose industry is presumed to record a CAGR of 5.5% over 2017-2024.

Obesity is also acting as a major propeller for Asia Pacific industry. As per estimates, India and China collectively account for nearly 15% of the total obese populace. Add to it, the growing personal care industry in APAC is also substantially influencing the regional trends. According to India Brand Equity Foundation, India personal care industry is slated to exceed $20 billion by 2025 which is more than triple from what it recorded in the year 2016. Not to mention, the projection, in all plausibility, would leave a perpetual impact on the regional microcrystalline cellulose market share. Overall APAC microcrystalline cellulose market is forecast to witness a y-o-y growth of 6% over 2017-2024.

While the revenue graph of the global microcrystalline cellulose industry depicts high potential, there still exists a chain of constraints, high production cost being at the pinnacle. Perhaps driven by the fact that its manufacturing process requires the presence of prominent expertise, the production is rather cost intensive. Another challenge faced by the contenders in the business space is product substitute threat from carboxymethylcellulose, guar gum, and xanthan gum. Despite these deterring factors, the commercialization matrix of microcrystalline cellulose market is certain to escalate over the ensuing years, on ground of its extensive application across myriad verticals. One of the anticipated trends that remains to be seen is how mcc production using environmentally viable raw materials brings forth a slew of opportunities for the market in the years ahead.