U.S. medical gas equipment market to earn significant revenue over 2016-2024, high demand for medical masks and regulators to spur the regional growth

Publisher : Fractovia | Published Date : 2017-05-30Request Sample

Growing demand for home-based healthcare services subject to domestic comfort and convenience will drive medical gas equipment market over the years to come. A recent survey depicted that more than 85% of the geriatric population in America prefers home healthcare. In fact, Medicare provides homecare to more than 3.5 million Medicare beneficiaries, as more than 90% of American seniors prefer the Medicare home health benefit. This will massively propel Medical gas equipment market, which is slated to cross a revenue of USD 7 billion by 2024, with a CAGR projection of 7.7% over 2016-2024.

The geriatric population across the globe has been soaring exponentially since the last few years. According to the World Health Organization, the elderly population above the age of 65 is forecast to increase from 7% in 200 up to 16% by the year 2050. The subsequent rise in chronic ailments will fuel the need for increased hospitalizations, point of care diagnostics, and home healthcare, which will propel the requirement of health equipment for 55% to 60% of patients, thereby impelling medical gas equipment industry.

U.S. Medical Gas Equipment Market Size, by Product, 2012- 2024 (USD Mn)

Renowned organizations such as the U.S. Food & Drug Administration (FDA), Gases and Welding Distributors Association (GAWDA), and Compressed Gas Association (CGA) have enforced favorable norms that will help augment medical gas equipment market size over the next few years. The U.S. Congress introduced the Food and Drug Safety and Innovation Act in July, 2012 to enable the termination of Drug User Fees for medical equipment manufacturers. These fees normally range between USD 98,000 to USD 1,840,000 for conventional drug companies, which is why their elimination is likely to further fuel medical gas equipment industry.

Medical masks are slated to be one of most lucrative product segments of medical gas equipment market, with a CAGR projection of 9.2% over 2016-2024. Reduced manufacturing costs coupled with surging demand for these products will stimulate medical gas equipment industry size. Gas outlets and medical regulators are also expected to observe a fairly healthy growth rate over the next few years.

Subject to the numerous supportive initiatives enforced by the European Medical Gas Association and the European Industrial Gases Association, Europe medical gas equipment market is anticipated to cross USD 1.9 billion by 2024, having held a valuation of USD 1 billion in 2015. Germany, Russia, Poland, and UK are slated to be the chief revenue contributors. While UK medical gas equipment industry will grow at a rate of 6.9% over 2016-2024, Germany market is forecast to cross a revenue of USD 533 million by 2024, having held a valuation of USD 296 million in 2015.

Vacuum systems held 31% of medical gas equipment industry share in 2015, and is slated to cross a revenue of USD 2.2 billion by the year 2024, with a target market size forecast to surpass USD 2.2 billion by 2024. On the other hand, manifolds were valued at USD 1.1 billion in 2015 and are expected to surpass a value of USD 2.2 billion by 2024, with a CAGR estimation of 7.8% over 2016-2024.

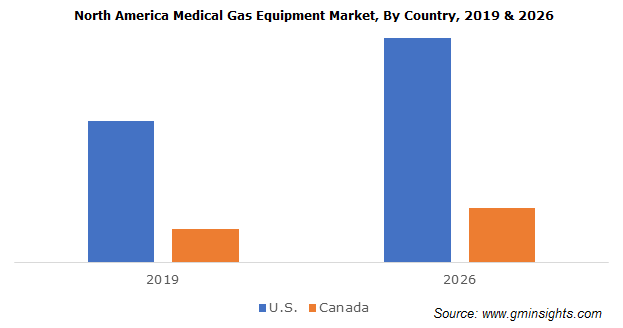

The U.S. has been witnessing a rapid surge in the healthcare infrastructure and other medical facilities. Having held more than 81% of the regional medical gas equipment industry share in 2015, it is forecast to expand rapidly over 2016-2024. The huge demand for invasive medical procedures, favorable government norms, and the improved healthcare facilities will impel U.S. medical gas equipment market size, which is slated to cross USD 2.4 billion by 2024.

China medical gas equipment industry will observe a CAGR of 10% over 2016-2024, subject to the presence of a huge elderly population base and the rising number of chronic and pulmonary disorders. In addition, the developing healthcare infrastructural growth across the region will lead China medical gas equipment market size to cross USD 472 million by 2024.

Worldwide medical gas equipment industry share was predominantly held by Linde Gas and Air Liquide in 2015, both of which cumulatively accounted for more than 38% of the revenue share in 2015. Other players include Air Products and Chemicals, Praxair, Matheson Tri-Gas, BeaconMedaes, and Air Gas.