North America Marine Sealants Market to witness substantial gains over 2017-2024, shipbuilding sector to drive the end-use landscape

Publisher : Fractovia | Published Date : 2017-09-06Request Sample

Marine sealants market, one of the rapidly expanding business spaces of recent times, has witnessed a financial acclamation over the past few years pertaining to extensive research activities in the shipbuilding sector. Technological interventions along with key players’ significant R&D initiatives are primarily responsible for the renewed dynamism in the marine sealants industry space. The aforesaid factor can be demonstrated by the introduction of i-cure technology in the shipbuilding sector that enables producing next generation sealants. Synonymous with “intelligent cure” this patent protected advanced cross-linking technology is invented by Sika, a globally acclaimed player in the marine sealants market. Reportedly, this new generation I-Cure based sealants amalgamates both the properties of conventional polyurethane sealants and advanced adhesive technology which ultimately leads to improvements in durability, ecology, workability, and adhesion.

In addition to this, stringent regulatory compliances brought forth by the European Union with regards to chemical safety have restricted commercialization of several products containing methylene diphenyl diisocyanate (MDI). Reportedly, the i-Cure based sealants and adhesives are not unaffected by these legislative challenges and are labelling free. In fact, the overall marine sealants industry share from shipbuilding applications held a revenue of USD 140 million in 2016 and with the growth in shipbuilding of tankers, carriers, and LNG, the application scope is likely to expand in the coming years. As per a recent market speculation put forward by Global Market Insights, Inc. “Global marine sealants industry will exceed a revenue of USD 330 million by the end of 2024.”

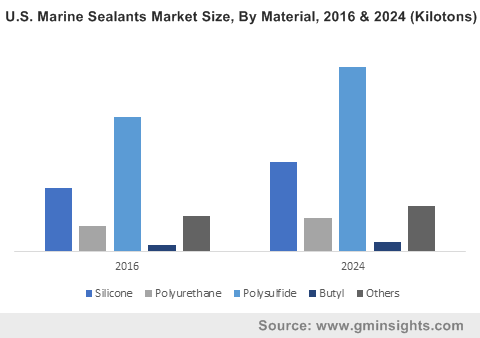

U.S. Marine Sealants Market Size, By Material, 2016 & 2024 (Kilotons)

Rise in global cargo trade with regards to coal, crude oil, and other resources along with rapid globalization have impelled marine sealants market proliferation. Accounting for 55% of the global industry share in 2016, cargo ships dominated the business landscape and is expected to witness a y-o-y growth of 6% over 2017-2024. In fact, global offshore vessel market is forecast to surpass a valuation of USD 20.13 billion by the end of 2024. These vital statistics depict the upswing in marine transport trends which is undeniably leaving a parallel impact on marine sealants market commercialization.

Economic recovery of the major geographies along with increasing GDP are some of the other critical indirect factors that have enhanced the business outlook. For instance, the escalating food demand curve has led to an increase in the grain trade across the globe. In this regard, U.S. witnesses an upper hand, given the increasing number of grain exports in the country. Estimates claim U.S. to represent almost 40% of the overall grain exports by 2030, a statistic that is in other way translating the growth prospect of regional marine sealants market as well. Overall North America marine sealants industry is slated to grow at a CAGR of 3.8% over 2017-2024.

With a regional market valuation of USD 95 billion in 2016, Europe proves to be another potential belt in the global industry. Robust growth in yacht building sector along with increasing cargo trade are the major two factors driving Europe marine sealants market. Stringent emission control regulations enforced by the international regulatory bodies like REACH, EU have shifted the product focus toward sustainability notion. However, some of the European countries are subject to economic uncertainties which might downturn the regional marine sealants market outlook. Taking into account the recent investments by the APAC countries in ship maintenance, it goes without saying that Asia Pacific will turn out to be one of the most outpacing regions partaking in the global marine sealants industry, with a target value of USD 100 million by 2024.

Marine sealants industry can be catalogued under the category of a fiercely competitive landscape with the extensive presence of SMBs and large enterprises at a global level. Some of the prominent names in the business space include Bostik, 3M, Sika AG, Dow Corning, Henkel AG, and SABA. Product innovations with a sound environmental profile and mergers & acquisitions are few of the profound strategic moves by these industry players, to combat the entry of new companies and sustain in the competitive scenario. Over the forthcoming years, assert analysts, marine sealants industry, driven by a plethora of sustainability trends and development in shipbuilding sector across major topographies, is expected to carve a steady growth, with a projected volume capacity of 65 kilotons in the next seven years.