Magnesium wheel market to generate heavy proceeds from the forged manufacturing methodology by 2024

Publisher : Fractovia | Latest Update: 2019-07-03 | Published Date : 2017-11-23Request Sample

Fuel efficiency enhancement seems to have emerged as a major goal for automotive behemoths lately, thereby impacting magnesium wheel market. In order to achieve higher fuel efficiency, automakers are using lightweight materials for manufacturing automotive parts, primarily for BIW and wheels. Technically, magnesium is 75% lighter than steel and 33% lighter than aluminum. Thus, the increasing preference for magnesium material over other available structural materials is likely to boost magnesium wheel industry share.

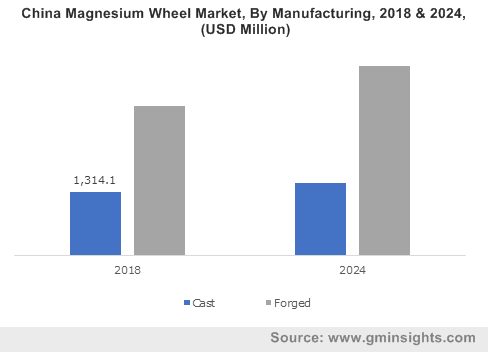

China Magnesium Wheel Market, By Manufacturing, 2018 & 2024, (USD Million)

Reportedly, material scientists and engineers have been conducting in-depth research studies to check the feasibility of magnesium for manufacturing automotive structural components. For instance, scientists at the Pacific Northwest National Laboratory (PNNL) of the Department of Energy have developed a new extrusion process to incorporate magnesium alloys into automotive components. The prevalence of research and development activities related to the advancement of magnesium material, such as the aforementioned, are certain to propel magnesium wheel market trends.

Automobiles are responsible for about 12% of the overall carbon emissions across Europe. As the weight of the vehicle increases, fuel consumption increases, releasing more CO2 per km. In this regard, to curb carbon footprints, the European Commission is planning to introduce regulatory norms for reducing the overall weight of the vehicle, which would impact the regional magnesium wheel market.

Vehicle weight reduction is among the more principal factors responsible for lowering the fuel consumption thereby minimizing exhaust emissions. This would help augment magnesium wheel market size, as magnesium alloys fulfill the lowest weight value set by automakers and giants in aeronautical sectors. The presence of a large automotive base across several European countries will also have a positive impact on the Europe magnesium wheel industry.

Since 2009, the usage of lightweight materials such as aluminum and magnesium has increased considerably. As stringent regulatory norms related to emissions are coming into the picture, magnesium material is going to be used on large scale for several parts of automobiles. Considering the excellent material characteristics such as light weight, high strength, and lower overheating, most of the superbike manufacturers are giving preference for mag wheels, which will apparently boost magnesium wheel market size.

Meanwhile, to increase the sturdiness and reduce the weight of the wheel, manufacturers of alloy wheels are primarily giving preference for forging technology. Companies involved in the design, manufacturing, and sales of lightweight alloy wheels for street and racing bikes have been producing wheels for racing and high-performance street bikes with the forging process. Currently, wheels manufactured with magnesium and aluminum alloys are being used prominently in motorcycle racing events such as Gran Premio motorbikes.

In 2015, more than 14 drivers of the MotoGP had used forged magnesium wheels. Thus, the growing use of forged magnesium wheels for racing motorcycles is slated to enhance magnesium wheel industry share over the years ahead. According to Global Market Insights, Inc., forged manufacturing is a dominant segment in magnesium wheel market, pertaining to the growing preference for lightweight, high durability, rigidity, and ease of maintenance.

Considering the efficiency of this product, most of the well-known automakers are replacing heavier steel material with magnesium alloys in order to boost its fuel economy by minimizing the weight of the vehicle. Over the coming years, the surging investment in magnesium for automotive applications is thus likely to stimulate magnesium wheel market share.

However, it is imperative to mention that lighter materials are more expensive, which may slightly impede magnesium wheel industry in the future. The basic cost of magnesium seems to be major restraint for many of the automakers. In order to deal with this issue, most of the auto suppliers and giants in magnesium wheel industry have been adopting tactics of joint ventures and partnerships with research institutes.

Heavy investments in R&D activities along with surging technological advancements in magnesium wheel industry are thus likely to fuel product demand over the years ahead, owing to which the overall magnesium wheel market will surpass a revenue collection of USD 28 billion by the end of 2024.