Lyocell Fiber Market to surpass the billion-dollar benchmark by 2024, driven by its high demand from apparel sector

Publisher : Fractovia | Published Date : 2017-08-01Request Sample

The textile industry that has been of late working high on its environmental profile is the key driver behind lyocell fiber market’s escalating commercialization. Emerging trend toward high tech comfortable clothing has led to an increased consumption of wood based fibers. Strong initiatives undertaken by the industry giants and governmental organizations regarding biobased polymer development and deployment, recirculation of textile waste, and advanced technological implementation in fiber production have catapulted lyocell fiber market trends. Renowned brands are also shifting their focus on fibers that can be recycled after the product’s due shelf life. Global apparel industry which is forecast to record a valuation of approximately around USD 1000 billion by 2021 is shedding a positive light on lyocell fiber market outlook as well.

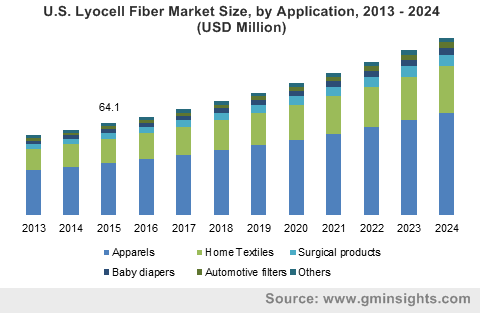

U.S. Lyocell Fiber Market Size, by Application, 2013 - 2024 (USD Million)

Lyocell fiber technology has completely revolutionized the concept of environmentally sustainable textiles. Involving a closed loop process, this man-made fiber is generally derived from wood pulp mostly from sources like bamboo, spruces, and eucalyptus. This eco-friendly manufacturing makes lyocell fiber market demand extremely high in the apparel sector. In fact, as per estimates, apparel sector dominated the global lyocell fiber industry share in yesteryear, covering almost 20% of the overall revenue. Other than the environmental sustainability assurance, there are some other improved functionalities that these fibers impart to the textiles including good moisture absorbance, excellent luster, and higher strength. These undoubtedly add an extra mark to its market value.

Another profound sector introducing latest trends in lyocell fiber market is the healthcare domain, given the increasing proliferation of IoT and technological advancements in surgical devices business space. Key companies involved in the market have been readily involved in research activities for novel product developments that are far more sterilized than the conventional one. Increasing deployment of biodegradable fibers in the manufacturing of these surgical devices is opening up new opportunities for lyocell fiber market commercialization. Subject to the growing government pressure on synthetic fiber manufacturing with regards to its environmental unfeasibility, a paradigm shift toward cellulose man-made fibers has been observed lately.

Despite myriad opportunities, there are some of the challenges that lyocell fiber market players have been rigorously facing, the primary being its expensive price trends in comparison to the market availability of its other cheaper counterparts like polyester. While this issue is not exactly a roadblock, it is certainly one of the major aspects deterring the lyocell fiber market penetration into small scale low budget business space. Another factor that can be considered as a downturn for the market growth is the requirement of an extra bit of care like hand wash, cold rinse, dry clean etc. for lyocell fiber based textiles, which consequently increases their maintenance cost. However, with the increasing deployment of technological innovations in the business space, the impact of these deterring factors is likely to reduce, favoring the growth of lyocell fiber industry.

Considering the consequential transformation in the textile industry trends in terms of preferred fiber deployment and the increasing international trade, lyocell fiber market is forecast to penetrate most of the geographies across the world. Nonetheless, since technology plays a pivotal role in the business proliferation, it is undeniable that overall industry will witness a vibrant landscape in the coming years.

Europe lyocell fiber market

Statistics claim that Europe will represent 12% of the overall lyocell fiber industry by 2024 in terms of revenue share. Clothing and textiles, the two most diversified domains in the European manufacturing sector have undergone a radical shift of late in their business models in terms of technological integration and competitiveness with a move toward more value-added fiber products. The projected proliferation of Europe lyocell fiber market can be majorly grounded to this fundamental aspect. Speaking of regulations, textile legislations (1007/2011) enforced by the European Union related to fiber names and labeling of fiber compositions in textile products is anticipated to pave new opportunities for the regional lyocell fiber market. U.K., Germany, being the developed hub of the continent are forecast to be the major revenue pockets. Besides textile and apparel sectors, automotive and medical applications are further forecast to add a remarkable value to lyocell fiber market expansion over the years ahead, subject to the growing demand for non-woven fabrics in the two aforementioned sectors.

Asia Pacific lyocell fiber market

Asia Pacific, in 2016, having registered its name in the largest regional lyocell fiber industry in terms of volume coverage is slated to carve rather an appreciable growth trajectory over the coming seven years. As depicted by market analysts, growth drivers of the regional market include expanding baby diapers business space, an affluence in middle-class population, and a significant development in medical space. Baby diapers market in some of the developing & developed economies of APAC belts have been gearing up at a fast pace, a factor profoundly driving the APAC lyocell fiber market dynamics. Comprising countries like India and China, where the disposable incomes of the middle-class population have substantially increased, consumers preference for baby diapers are not only limited to convenience but hygiene as well. Regional lyocell fiber market has been majorly driven by this changing preference over the past couple of years. Accounting almost USD 550 million in 2016, APAC is forecast to cover a sizable portion of the overall industry with a CAGR of 8% over 2017-2024.

Market Investors are highly optimistic toward the lyocell fiber market outlook and are betting big to exploit the untapped potential opportunities in the coming years. Bearing a testimony of this fact is the recent announcement of the Lenzing Group regarding the establishment of lyocell fiber production plant in Thailand. Lenzing Group is a world market leader in fiber innovation and technology, holding a portfolio that ranges from dissolving pulp to specialty cellulose fibers. Their planning of lyocell fiber production expansion is surely shedding a positive light on the overall lyocell fiber industry dynamics. Some of the other players actively participating in the market include Aditya Birla Group, Acegreen Eco-Material Technology Co., Smartfiber AG, Nien Foun Fiber, and Acelon Chemicals & Fiber Corporation.

As per a recent industry report put forward by Global Market insights Inc., Lyocell fiber market is forecast to register its name in the billion-dollar fraternity down the line of seven years, by exceeding a revenue of USD 1.5 billion by 2024 with a projected CAGR of 8% over 2017-2024.