North America to lead low power network market over 2019-2025, asset tracking to augment the application landscape

Publisher : Fractovia | Published Date : 2019-04-30Request Sample

The global low power network (LPN) market is slated to register significant proceeds in the forthcoming years, irrefutably pertaining to the rapid advancements in IoT and smart technologies. Ever since its inception, LPN has stood tall, becoming the preferred technology of choice for IoT applications primarily owing to defined standards that help network operators meet specific cost, coverage and power consumption needs.

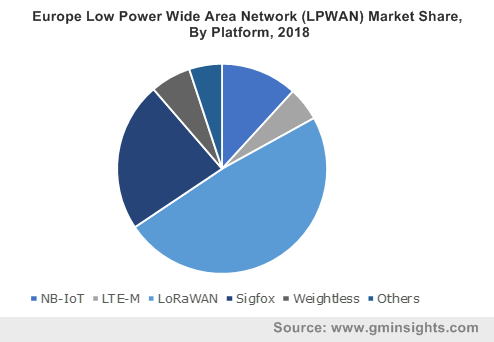

Europe Low Power Wide Area Network (LPWAN) Market Share, By Platform, 2018

In addition, the technology can effectively strengthen the business case for IoT solutions by offering a seemingly affordable and power efficient wireless solution that leverages existing networks and offers an improved built-in security & enhanced global business reach. As LPWA networks operate with greater power and bandwidth efficiency over a larger area, the need for greater infrastructure and hardware asset is lowered, translating to greater cost efficiency. This has undeniably helped forge a profitable growth path for low power network industry.

Also, aided by these benefits, LPN market has been able to expand its application scope, that is inclusive of smart metering, smart lighting, asset monitoring & tracking, access control, IT asset management, smart cities, livestock monitoring, precision agriculture, personnel tracking in rugged environments, energy management, manufacturing, and more. The technology is also anticipated to entice OEMs that need to track assets across supply chains and through multiple stakeholders, signifying added growth opportunities for the lead low power network industry in the coming years.

Lead low power network market| Impact on asset tracking

Due to their capacity to offer more affordable connectivity between objects spread over larger geographical areas, long-range, low power wireless platforms have gained increased momentum in real-time asset tracking applications lately. The technology can connect assets, objects and devices over much longer distances, including indoors and rugged environments, whilst offering key features like low power consumption, due to longer battery life between 5 to 10 years, and low cost, as systems are typically simpler and affordable to deploy, operate and maintain, and can even be plugged into existing infrastructures.

Additionally, with benefits like increased visibility, brand protection, loss prevention, streamlined inventory management, increased asset utilization and more, businesses have been able to enhance the efficiency of asset tracking using lead low power network. This in consequence, would have a major impact on the commercialization graph of LPN industry from asset tracking applications.

Lead low power network (LPN) market| Impact on smart buildings

Since a very long time, experts have anticipated IoT to emerge as the technology of choice for numerous applications. With the influx of recent advancements such as low-power wireless connectivity, cloud-based processing and data analytics, the anticipation seems to be on the verge of fulfillment. LPN, in the smart building space, is integrated in products such as smoke alarms, thermostats and door locks to remotely identify and monitor smart building operations in residential & commercial spaces. They are also used in building management applications, building energy management systems, electrical contractors based connected power solutions, critical power facilities, home automation, and also for digitally transforming the electricity, gas and water utility industries.

Furthermore, to support smart building IoT connectivity, wireless solution providers are developing LPN technologies that possess a higher ability to penetrate walls and cut potential interference compared to Wi-Fi, Bluetooth, and ZigBee. This has subsequently influenced the lead low power network industry from smart buildings.

For instance, LoRaWAN (also called as LoRa), a patented digital wireless data communication technology developed by Cycleo SAS, has emerged as a viable network technology for in-building wireless IoT connectivity that allows low-powered devices to communicate with Internet-connected applications over long range wireless connections. It has also been called as the next-gen wireless standard for IoT deployment and has attained extensive demand in recent years owing to its ease of deployment, lower cost of connectivity and scalability which make it an attractive option for property owners of large enterprise and commercial office spaces. This is undoubtedly an example of an advancement that lead low power network market will be characterized by in the future.

Speaking of the regional proliferation, the North America LPN market has been touted to witness substantial proceeds in the years to come, owing to the presence of renowned technology titans that are investing heavily in the IoT sector. In 2019, global tech giant Microsoft had announced the acquisition of Express Logic as part of its commitment made in 2018 of investing around $5 billion in IoT over the next four years.

According to Johnson Controls’ 2018 Energy Efficiency Indicator (EEI) survey, around 57% of organizations in the U.S. and 59% of global organizations plan to increase investments in energy efficiency and smart building technology. The prevalence of such initiatives will bring about renewed growth prospects for North America (LPN) lead low power network industry, that is expected to dominate the global market with a projected share of over 40% by 2025.

In a nutshell, the global low power network will continue to depict expansion trends in the forthcoming years, driven by the penetration of IoT, smartphones, and the rising demand for a widespread network coverage for enhanced connectivity. As per Global Market Insights, Inc., the overall lead low power network market is touted to exceed a valuation of $65 billion by 2025.