APAC liquid feed market to register staggering gains over 2017-2024, heavily escalating livestock sector to fuel the regional demand

Publisher : Fractovia | Published Date : 2017-07-20Request Sample

The rising proportion of meat consumption across the globe, in all likeliness, will be one of the essential factors shaping Liquid Feed Market trends over the forthcoming years. This is evident from the fact that pork is the most widely favored livestock meat in the world, consecutively followed by poultry, beef, and mutton. As per estimates, global meat production increased by more than 18% in the last decade. The poultry sector alone has been deemed to be the fastest growing meat market, having exhibited a valuation of 98 million tons in 2010, in terms of volume. While meat production and consumption have undeniably depicted an exemplary rise, a simultaneous trend that has cropped up is that of using nutritious supplements for livestock, which has propelled liquid feed industry size in the last few years.

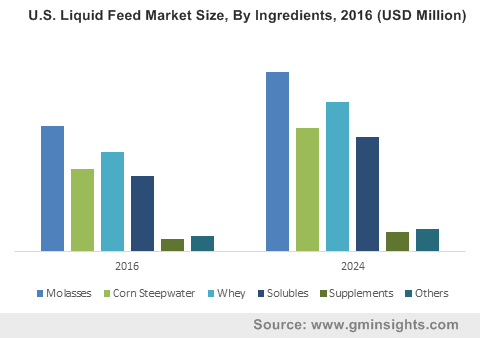

U.S. Liquid Feed Market Size, By Ingredients, 2016 (USD Million)

Research has indeed proved that consuming organically raised livestock can prove to be more environment-friendly and healthier. Attesting to this strong backdrop, liquid feed market share was worth USD 55 billion in 2016. Manufacturing liquid feed involves the indirect participation of two processes – milk processing and ethanol production. While products such as sugar syrup and brewer’s yeast are obtained from the latter, buttermilk, bakery waste, acid whey, and sweet whey are obtained from the former. The ample availability of these products enhances the manufacturing process of liquid feed and will heavily push the growth of the overall liquid feed industry, which, according to estimates, will cross USD 90 billion by 2024.

Nutritious feeds encompassing proteins and vitamins that are non-toxic, anti-allergic, and digestible make animals healthier and contribute toward increased meat production. Thus, driven by the increasing percentage of meat consumers across the globe and growing consumer spending on food, liquid feed market size has been forecast to surpass 155 million tons by 2024 in terms of volume. These feeds, encompassing ingredients such as whey, supplements, molasses, and solubles are used to enhance the metabolism and body health of pigs, aquatic animals, poultry, and ruminants.

A sizable chunk of global liquid feed market share is obtained poultry and ruminants. Given the unbelievable proportion of egg, meat, and dairy consumption, this comes as no surprise. Compound and liquid feed are supplied to livestock excessively to increase meat quality, egg hatchability, and swine livability. Strict norms by the EPA with regards to industrial livestock production will positively favor the regional liquid feed industry growth.

Liquid feed market outlook in the U.S.:

As per reliable statistics, the U.S. encompasses more than 500 pet food facilities, 6,000 feed mills, and 800 feed production facilities. The region has always proved to be a lucrative ground for the growth of liquid feed industry and will continue to remain so in the future as well.

Molasses, one of the vital ingredients of liquid feed, has been observed to register an exceptional growth rate in this region. Molasses integrated by protein meals, phosphorus, urea, salt, and rumen modifiers are considered to be one of most inexpensive and preferred supplements for cattle, since they help to improve feed taste and increase feed palatability. Molasses are heavily utilized to feed cattle in the U.S. to increase the quality of beef as well. Statistics depict that the cattle production sector in the U.S. alone was valued for more than USD 80 billion in 2016. On these grounds, it is forecast that U.S. molasses based liquid feed industry size may surpass USD 5.9 billion by 2024. Globally though, molasses based liquid feed market size is likely to exceed USD 25 billion by 2024.

Poultry is universally one of most preferred livestock. Liquid feed supplements help to increase the bodyweight of the animals in addition to optimizing egg production in poultry. On these grounds, liquid feed industry size from poultry is expected to surpass USD 15 billion in terms of revenue. Poultry applications have penetrated the livestock sector across numerous geographies, especially the Asia Pacific. As per estimates, APAC poultry meat consumption was more than 35 million tons in 2016, and the region held more than 65% of the total share. An exceptional increase in meat production coupled with rapid economic growth will help propel APAC liquid feed market, slated to experience a CAGR of 5% over 2017-2024.

China and India, two of the most emerging economies across the world, have been forecast by experts to be profitable growth avenues for APAC liquid feed industry. India liquid feed market from poultry applications, especially, is slated to record a CAGR of 5% over 2017-2024. This growth can be essentially attributed to the rise in livestock business supported by numerous government subsidies and private investments. The country has been experiencing a paradigm shift in cultural and religious barriers, which has led to a rise in meat production and consumption, ultimately stimulating India liquid feed industry share.

An insight into the competitive landscape of liquid feed market dynamics:

Global liquid feed industry involves the participation of major biggies such as Cargill, GrainCorp., Archer Daniels Midland, Ridley Corporation, Quality feeds, Westway Feed products, BASF SE, Performance Feeds, Land O’ Lakes, and Dallas Keith. The strategies of product innovation and alliances are rampant across the growth spectrum of liquid feed market. Most companies focus on improving the efficiency rate of the products and optimizing their usability.

The recent approval of GrainCorp’s range of liquid feeds by the cattle producers under the jurisdiction of the PastureFed Cattle Assurance Scheme (PCAS) is an instance of how deeply liquid feed industry giants are ingrained into efficient feed production. Even Cargill has been undertaking efforts to enhance sow diets for improving the survival rate of piglets, a program which is currently adopted by pig farms across European countries.

The fluctuating prices of key raw materials such as fish meal, maize, soybean, corn, and fish oil and their availability is likely to generate a demand-supply gap in the future, a factor which may affect the growth of liquid feed industry. However, efforts are being undertaken by feed manufacturers and raw material producers at the grassroot level to ensure ample availability of raw material and eliminate the supposed price trends.