LiDAR market to gain substantial proceeds from corridor mapping applications over 2019-2025, augmented use of UAVs to transform the industry dynamics

Publisher : Fractovia | Latest Update: 2019-05-24 | Published Date : 2017-02-22Request Sample

Rapid infrastructure development and increased spending on innovative mapping technologies has provided the global LiDAR market immense growth opportunities over the past decade. Continuous expansion of public utilities and transport routes as well as monitoring of environmental impact on the geography can be performed more efficiently using advanced 3D mapping systems. Light Detection and Ranging (LiDAR) technology enables the accumulation of reliable 3D measurements and is suited to investigate numerous man-made developments, including railway, road networks, power lines and buildings. Further, representing an extremely lucrative application area, the imminent deployment of this technique in connected cars and driverless vehicles is slated to tremendously propel the revenue graph of the LiDAR market.

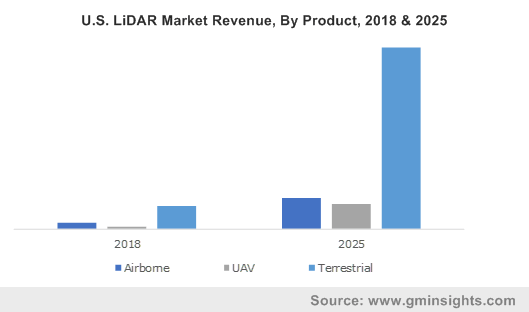

U.S. LiDAR Market Revenue, By Product, 2018 & 2025

Unveiling the scope of LiDAR industry from the augmented need for corridor mapping

Technically, corridor mapping involves conducting high resolution imaging of natural corridors and artificial infrastructures developed linearly, such as transmission lines, pipelines, rivers, coastal areas, roads and railways. The process helps in optimizing the lifecycle of a corridor and ensure regulatory compliance, in addition to tackling the possibility of disasters which can cause enormous losses. LiDAR mapping is ideal for detailed planning, analysis and design of utility transmission and pipeline corridors, or to help maintain and plan for railway routes and tunnels. The LiDAR market can be expected to draw considerable interest from governments and major infrastructure companies for the potential of the technology to improve project outcomes.

Elaborating on the consistent development of the railway sector, the £14.8 billion Crossrail project in Europe, which is expected to complete by December 2019, comprises of extensive railway networks. This includes the Elizabeth Line, a 118 Km long route in London, designed to lower the burden on the city’s critical underground central line. Separately, the Confederation Lines in Ottawa, Canada, saw the completion of its first phase in 2018, costing around US$1.6 billion, with the second construction phase to end by 2023. Similar railway expansion projects are being undertaken all over the world and warrant substantial demand for effective corridor mapping, reinforcing the LiDAR industry over the coming years. The market will also witness an increase in adoption across the globe with unprecedented growth of the renewable energy sector and extension of power transmission lines.

Unveiling the LiDAR market potential with regards to increasing deployment of UAVs

A LiDAR drone is considered to be an affordable and efficient way of 3D imaging and modeling of geological features, with the concept gaining momentum owing to proliferation of advanced drone mapping software solutions. UAVs allow for a more portable and flexible mapping system to gather valuable terrain data. Citing an instance, a LiDAR UAV from YellowScan was utilized for mapping a transmission line corridor, including the lines, poles and vegetation, to study the risk of a flashover and if the vegetation needs to be trimmed. Fast-paced development of new UAV platforms, cameras and sensors to provide the most comprehensive 3D maps and accurate measurements will underscore the massive scope of LiDAR applications.

Speaking further, the Teledyne Imaging group recently unveiled its new LiDAR for drones that can offer improved canopy penetration, highest quality LiDAR survey data, lowest noise and exceptional data accuracy. Many other companies from the LiDAR industry are involved in the production of UAV-based 3D mapping systems as well, developing specialized scanners for a variety of professional uses. Recently, Cepton Technologies had launched its latest long-ranged LiDAR scanner built particularly for UAVs, which enables prolonged flight time, high-resolution imaging and significantly high scan rate.

Evidently, persistent enhancements of LiDAR systems in the near future will help sustain the overall industry growth, supported by the increasing demand for corridor mapping solutions and the advent of reliable UAV technology. Comprised of key players such as Teledyne Optech, Beijing Surestar Technology, Yellowscan, Leica Geosystems, Innoviz Technologies and Geokno, the global LiDAR market is projected to reach a valuation of over US$10 billion by 2025.