Knee joint reconstruction devices market to witness robust growth over 2018-2024, U.S. to be a major regional contender

Publisher : Fractovia | Published Date : 2018-11-02Request Sample

Rising occurrence of orthopaedical disorders across the globe has tremendously contributed to the joint reconstruction devices market growth, as a large number of patients are finding the conventional treatments for damaged joints to be less effective. Many alternatives used to manage joint pains or injuries only provide a temporary relief, require supportive instruments like crutches, whereas the permanent solutions like weight loss from physical activities are not easily achieved by everyone. The joint reconstruction devices industry is critical in enabling faster deployment of treatments that have a longer lifespan. Advanced healthcare facilities in developed nations has made joint replacement surgeries more accessible and favorable health insurance policies have made them affordable. A major source of revenue for the joint reconstruction devices market is the growing geriatric population, of 60 years or older people, which WHO estimates will be about 2 billion by 2050.

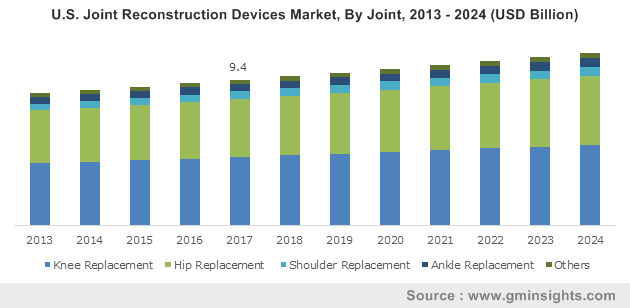

U.S. Joint Reconstruction Devices Market, By Joint, 2013 – 2024 (USD Billion)

Old age as a common factor influencing the upsurge in orthopedic diseases

Generally, older people tend to have weaker bones and are more susceptible to damage their joints due to overexertion or slips and falls, forming a sizable portion of the joint reconstruction devices market earnings. According to studies, almost half of the world’s population aging 65 years or above has osteoarthritis (OA), which is a prevalent disease that can cause disability among the older people. The joint reconstruction devices industry caters significantly to people suffering from OA, as the condition has degenerative effect on the body and eventually hampers one’s ability to perform daily tasks that require agility and flexibility.

It is projected that nearly 30 million adults in the U.S. are affected by OA, indicating the need for effective treatment options. With the rise in older population, cases of osteoporosis will also increase as the bones ability to absorb calcium decreases with age. In addition, the number of people aged 100 or more is estimated to cross the 4 million mark by 2050, which will certainly fuel the joint reconstruction devices market over the coming years.

Knee joint replacement to be a key industry driver in the imminent future

The global joint reconstruction devices market had amassed a remuneration of about USD 7.8 billion from knee joint replacements in 2017, as knee replacement surgeries are preferred by patients to counter unbearable pain and recover a better quality of life. Prevalence of obesity among a large percentage of the world population has aggravated the weakening of knee joints, since for every extra pound of weight a person’s knee needs to absorb extra 4 pounds of pressure while walking, running or climbing stairs. Knee problems are one of the most common disorders and a long term solution can be provided with strong and flexible joint reconstruction.

Rheumatic arthritis is a leading cause of painful swelling and joint deformity in adults and is a chronic inflammatory disorder and its onset is usually observed to be between the ages of 20 to 45. It is said to be the most crippling form or arthritis and almost 2.1 million Americans are affected by it, making rheumatic arthritis a prominent disability inducing issue in the U.S. Increased frequency of the disease will bolster the knee joint reconstruction devices industry as the development of joint deformity or bone erosion cannot be effectively halted.

Revision joint replacement surgeries to present additional growth avenues

Although joint replacement surgeries are considered to be one of the most successful medical procedures of all times, complications do arise in some cases and a negative outcome of a joint replacements can be corrected by revision surgery. The joint reconstruction devices industry facilitates revision joint replacements for patients that have suffered from loosening and wear of implants, bacterial infections, fracture, recurring dislocation or allergies to metal after a replacement procedure. The need for such a surgery also depends on a patient’s specific conditions, for example obese or diabetic people are more likely to experience implant failure or infection.

A medical institute has indicated that over the next decade, the demand for joint revision procedures could go up by 50%, mostly due to joint failures, bone loss and other reasons, further strengthening the joint reconstruction devices market. The continuous advancement of healthcare technologies, revision surgeries, which are more difficult to plant than the routine replacement procedure, could lead to an improved longevity of replaced joints.

Anticipated to witness a steady 3.7% CAGR from 2018 to 2024, the joint reconstruction devices market comprises of major players like Zimmer Biomet, Integra LifeSciences, Stryker, Medtronic Spinal, DePuy Synthes Companies, among others.