APAC industrial floor coatings market to experience a sharp growth curve over 2018-2024, surging demand from the food processing sector to fuel the industry expansion

Publisher : Fractovia | Latest Update: 2018-11-22 | Published Date : 2017-08-03Request Sample

The global industrial floor coatings market has been thriving on the cusp of rapid urbanization and industrialization, as the importance for flooring has been depicting a rise across various industrial sectors. Most of the companies have been renovating their floors to install smooth and protective coatings, as unprotected flooring leads to regular wear and tear. Amidst harsh working conditions involving chemical spills, excessive heat, and heavy machineries, there is surging need to rework the flooring structure, which will boost industrial floor coatings industry size. As per a reliable research report, industrial floor coatings market held a revenue of USD 4.1 billion in 2017.

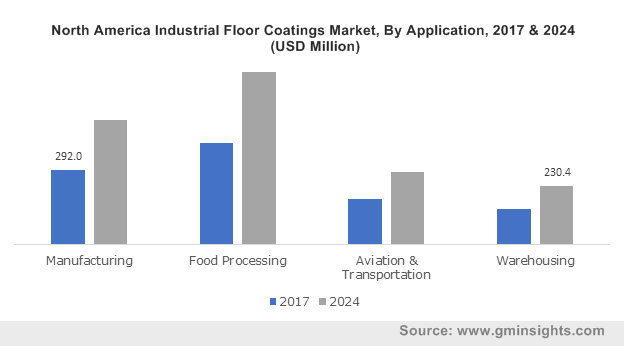

North America Industrial Floor Coatings Market, By Application, 2017 & 2024 (USD Million)

Industrial floor coatings market seemingly boasts of a long-standing history, and is on the verge of constant developments, with the latest trends depicting myriad innovations to enhance floor coatings. Bio-based floor coatings, in particular, have been gaining popularity among market players pertaining to the shifting trends toward the adoption of environment friendly and hygienic flooring. Moreover, increasing prices of conventional flooring raw materials may lead to the growing usage of bio-based floorings. The huge requirement of eco-friendly floorings across various industrial sectors is thus, likely to stimulate industrial floor coatings industry share.

The automotive sector has been growing substantially across the globe due to the rise in the demand for personal usage vehicles, owing to the improved lifestyle of the people along with rise in per capita income. Aesthetically pleasing, durable floors are bound to attract more consumers, subject to which vehicle dealers are largely investing in the development of well-maintained and attractive floorings. Attractive floor coatings also serve to create required ambiance, which will fuel industrial floor coatings industry. According to Global Market Insights, Inc., industrial floor coatings market is slated to collect a revenue of more than USD 7 billion by 2024.

The future of industrial floor coatings industry is expected to shift toward the adoption of epoxy materials, as the usage of artificial resins for flooring is increasing exponentially pertaining to the competitive prices, architectural design, and easy maintenance. In accordance, epoxy held 50% of industrial floor coatings market share in 2017 and will expand at a CAGR of 6% over 2018-2024, owing to the capability of the product to bear high impact and thermal shocks.

Renowned German chemical company, BASF has been planning to establish an automotive application center in China, as per the latest reports. As Asia Pacific is witnessing a strong growth in the automotive sector, BASF is trying to strengthen its R&D foot prints in APAC region. This investment in China, considered the world’s largest car producing region, is likely to improve BASF’s customer base for automotive coatings solutions, which will indirectly spur APAC industrial floor coatings market.

It had been touted that this investment is one of the long-term business strategies of the company which is aimed to strengthen its stance. Other key players in industrial floor coatings market are PPG Industries, Asian Paints, ArmorPoxy, BASF, Sherwin-Williams, Maris Polymers, Florock Polymer, Kansai Paint Co., Ltd., Roto Polymers, Axalta Coating Systems, RPM International Inc., Akzo Nobel, Nora System, Milliken & Company, 3M, Lubrizol Corporation, Ardex Endura, Dow Chemical, tambour.co., Pro-Maintenance Inc., Apurva India, and Grand Polycoats.

As per estimates, Asia Pacific industrial floor coatings industry will exhibit an annual growth rate of 8% over 2018-2024. Various manufacturing and food processing companies have also been giving preference to APAC, owing to its favorable regulatory landscape. India, China, Japan, Malaysia, and Vietnam are expected to come up as the prominent revenue contributors of the Asia Pacific, which has also established strong footprints in the manufacturing sector.

The Joint Secretary of the Union Ministry of Food Processing announced that India has received 43% foreign direct investment for the food processing industry in the year of 2016-17. To increase the employment rate and reduce food wastage, around INR 6000 crores have been allocated by the Government of India to establish 42 mega food parks across the country. On these lines, it is noteworthy to mention that industrial floor coatings market from food processing applications held a revenue of 1.5 billion in 2017.

Key players in industrial floor coatings market are investing significantly to develop new process catalysts via increased R&D activities, which is likely to favor the organizations wishing to expand their regional space. Scaling up the research and development activities is slated to strengthen strategic alliances amidst market players, which will subsequently propel global industrial floor coatings market space.